DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Banks play model field

Source: Adobe Firefly

29 May 2025

TODAYS BRIEF

Welcome back!

Some news on the homefront: Evident is expanding its coverage of AI and business. On June 18, we unveil the inaugural Evident AI Insurance Index. Thirty insurers will be ranked on their AI maturity. Look for a special edition of The Brief focused on the insurance industry. Want to know more about our new vertical? Get in touch.

In today’s Brief, banks are playing the field with models, someone new and tempting has their eyes on quants and we get the inside story on two interesting use cases.

People mentioned in this edition: Jeremy Barnum, Marianne Lake, Jared Kaplan, Aritra Chakravarty, Lindsay Patrick, Joop Vahl, Davide Corbelletto, Andrew McMullan and others.

Plus these banks: JPMorganChase, Bank of America, Wells Fargo, DBS, ING, Intesa Sanpaolo, RBC, CommBank and others.

The Brief is 2,195 words, a 7 minute read. Check out this Brief online. If you were forwarded this newsletter, please subscribe here.

– Alexandra Mousavizadeh & Annabel Ayles

TREND LINES

AGE OF PROMISCUITY

Banks are sending a message to AI vendors: We’re just not ready for commitment.

“Model agnosticism” is everywhere. It was virtually the first thing JPMorganChase’s CFO Jeremy Barnum said about the bank’s AI strategy and its new flagship platform, LLM Suite, at its investor day last week. Since April, Bank of America, Wells Fargo and DBS executives have all talked up the benefits of keeping their options open.

“Different models will be good for different things,” Derek Waldron, JPMC’s chief analytics officer, said recently. “We don't want to architect ourselves around one particular model.”

It’s a good time to play the field. AI models claiming to be the “world’s best” are seemingly born every minute – Anthropic just launched Claude 4, Google I/O this month brought us Deep Think, a "reasoning mode" for Gemini 2.5, and Mistral released Devstral, its new coding model. Banks want to bet on every horse to avoid vendor lock-in and keep costs down.

But there is something else going on: Banks are going agnostic to best capitalize on agentic AI. The more flexible with models they can be, the easier (and cheaper) it becomes to chain them together and let them take autonomous actions the way agentic systems require.

Wells Fargo is, for example, designing systems that can determine which model is right for each task. DBS has a monitoring system that lets them see real time performance to decide when it’s right to swap in a new model.

Bottom line: Banks are changing the way they think about AI’s value (See: “Death of the Use Case,” The Brief, May 15). Finding ways to squeeze value out of each model gets more important as the ways they deploy AI get more complex.

WHAT'S ON AT EVIDENT

Banks have rapidly progressed from GenAI experimentation to enterprise-wide adoption — but delivering real value at scale remains a challenge.

In this virtual roundtable, we’ll examine the use cases that are moving the needle. Fuelled by data from the Evident AI Use Case Tracker, we’ll discuss: Where are leading banks seeing tangible business impact? How are they defining and measuring ROI? And what strategic choices are enabling them to move beyond isolated wins to delivering value at scale? Join the roundtable.

IN THE NEWS

FOUR STORIES TO DRIVE AI CONVERSATION

JPMC is cashing in its investment in emerging tech. On stage at its investor day last week, Marianne Lake, the CEO of consumer and community banking, said AI advancements would let the bank cut 10% of operations and account services jobs in the next five years. “AI is not just a tool, it’s reimagining workflows and it’s changing the loading capacities for thousands of people,” Mary Callahan Erdoes, CEO of asset and wealth management, later added. (See “AI Remakes the Workforce,” The Brief, April 3)

Christmas for software engineers – or the coming apocalypse. Depends how you look at it. In rapid-fire succession, OpenAI, Anthropic, Microsoft, Google and Mistral debuted more advanced AI models that write code. AI vendors are increasingly moving from models that know things to models that do things. For Anthropic, that’s meant stopping investment in chatbots to focus on more complex tasks “so that people can really delegate a lot of work at once to our models,” said Jared Kaplan, chief science officer at Anthropic.

Your AI agent will buy that for you. Google is the latest to let AI complete purchases for its users, the company announced at its I/O conference last week. It follows a trend: Earlier this month, PayPal and Perplexity teamed up to let users make purchases directly from the chat. Mastercard (Agent Pay) and Visa (Intelligent Commerce) last month announced they were also developing tools that could enable these kinds of agentic payments.

Inside Donald Trump’s “One, Big, Beautiful Bill” is a short clause with big implications: A 10-year moratorium on state-level AI regulation. States have been grappling with the right way to regulate AI – most publicly in California, where Gavin Newsom vetoed an AI safety bill at the end of last year. Republicans backing the bill cite the large number of AI bills nationwide and say the moratorium would help innovation by not allowing states to create a patchwork of conflicting regulation. Opponents – which are growing and now include some prominent Republicans – say the moratorium would leave consumers unprotected and be damaging to online safety. As the bill heads to the Senate, the Trump administration hasn’t tipped its hand on this clause, though the president did say that he was “not happy about certain aspects” of the broad spending bill.

FROM THE EVIDENT AI INDEX

MANY HAPPY RETURNS

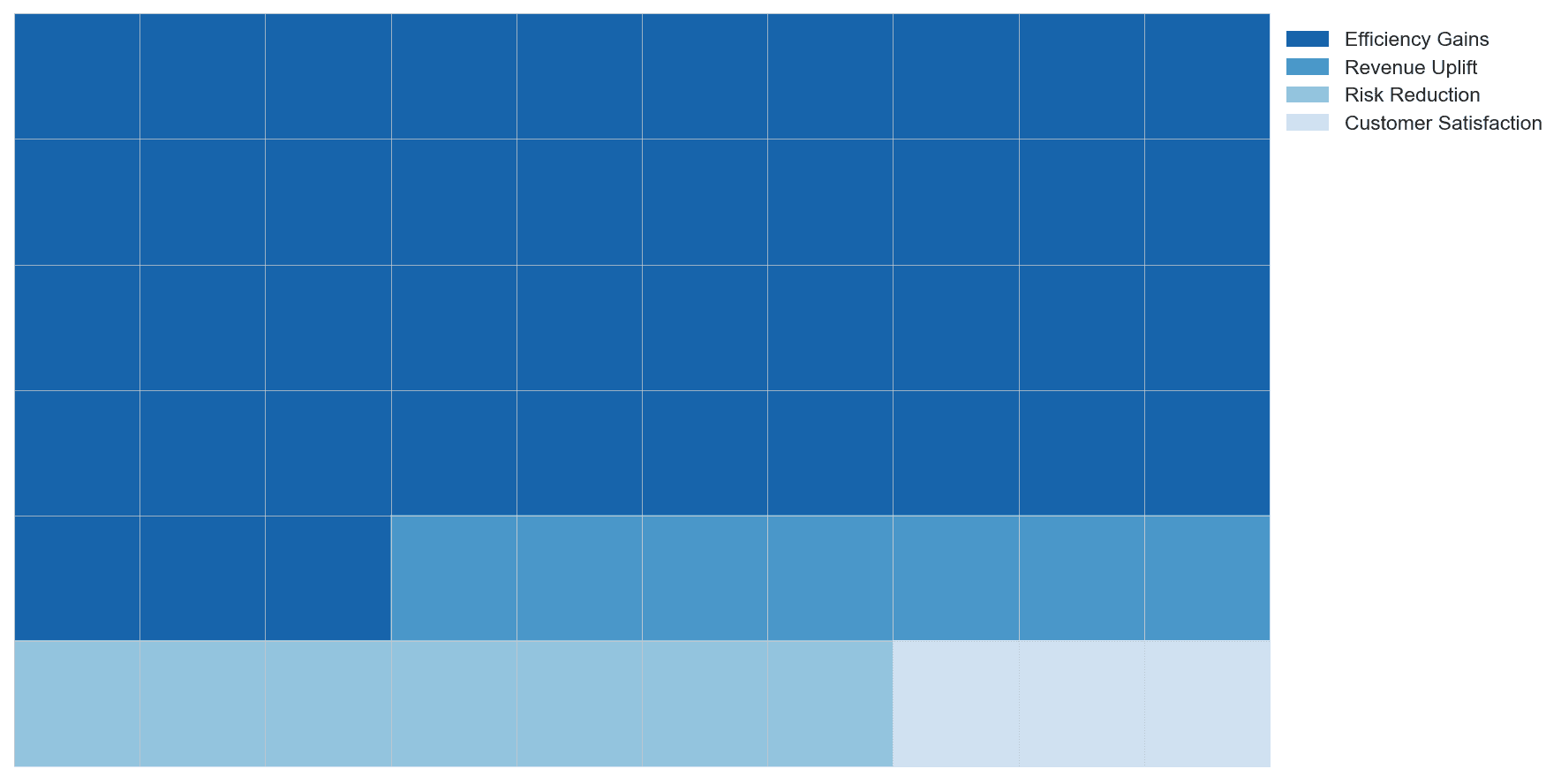

Efficiency gains were the main benefit cited in use cases rolled out by 50 of the world’s largest banks

This is a preview of our next use case trends update, available to Evident members next week. Want to know more about the specific ways banks are rolling out AI? Check out our Use Case Tracker – the inventory of all the AI use cases announced by the world’s largest banks available to members.

USE CASE CORNER

DON'T TRUST THE PROCESS

We sat down this week with Joop Vahl, chief product officer at ING wholesale banking advanced analytics and AI, and Davide Corbelletto, distinguished quantum specialist at Intesa Sanpaolo, to talk about how they reengineered archaic processes at their institutions. Vahl described a tool that helps get new customers through compliance checks faster. Corbelletto helped his team use quantum computing to find a better way to top up his bank’s cash machines.

#1 What’s Up Doc(ument)?

Use Case: Customer due diligence Line of Business: Wholesale bankingVendor: GoogleBank: ING

The problem: When bringing on new customers, bank staff often reach out to clients multiple times to get documents to satisfy compliance requirements – and then read them.

What ING did: The bank turned to Gen AI to build a tool that could summarize documents and pull out the relevant details for compliance. To build its AI tools, the bank uses nine to 12-person squads of product managers, UX analysts, data engineers and data scientists. Priority number one for this use case was in data pre-processing – making sure the tool was able to understand the structure of all the types of documents it ingested so it returned the right answers. The bank thinks this tech can be readapted elsewhere. “The scalability is the actual business case we’re relying on,” Vahl said.

By the numbers: With its Gen AI tool, ING was 90% accurate (about on par with its staff) and cut the average handling time by half.

Uptake: As the bank piloted the tool, Vahl found that analysts were double-checking its answers manually, which clawed back some of the efficiency gains. The team has since rolled out features that explain why and how the tool arrived at an answer to help analysts trust it. Vahl said the tool eventually will cut handling time by 75% to 80%. “Ultimately ROI comes from usage,” he said. “If users don’t trust or adopt it, the value’s not realized.”

#2 Cashing in on Quantum

Use Case: Quantum-inspired ATM recharging algorithmVendor: n/aBank: Intesa Sanpaolo

The problem: Each morning, the bank has about two hours from when it receives ATM data to when it needs to determine the best way for a carrier to top up its cash machines. The algorithm it was using could take “one hour and 15, one hour and 30, one hour and 40 minutes” to figure that out, Corbelletto said.

The opportunity: Quantum computers can run simulations faster and take in more data. “It's not just a matter of doing things faster,” Corbelletto said. “It’s a matter of doing more things in the same time frame.”

What Intesa did: The bank developed a “quantum-inspired algorithm,” a type of middle ground that gets a traditional computer to act more like a quantum computer. Corbelletto’s team first tried to crack the ATM optimization problem on a quantum annealer (a type of quantum computer) before discovering they could squeeze value out more immediately on traditional hardware with a “quantum-inspired” approach.

By the numbers: The quantum-inspired algorithm can save the company 10% on the cost of recharging on average each month, Corbelletto said, “but the really important thing is we’re more accurate.”

Looking ahead: If the bank were to run its algorithm on a quantum computer instead of using a quantum-inspired algorithm, it could achieve a “quadratic speedup,” Corbelletto said – meaning it would one day be done in a fraction of the time.

COMING SOON

After three years of benchmarking AI maturity in banking, we’re turning our attention to the insurance sector.

For the first time, insurers will be able to see how they compare to peers in terms of AI investment, deployment, and outcomes.Find out more

TALENT IN THE NEWS

WANTED QUANTS

OpenAI and Anthropic are raiding Wall Street for quants.

In recent weeks, both Bay Area firms announced recruiting events in New York in June targeting quantitative analysts. OpenAI CEO Sam Altman has publicly encouraged high-frequency traders to avoid the “existential dread” that comes with work in the field and join OpenAI instead. The firm’s chief people officer even comes from a quant fund.

Following the success of DeepSeek – which grew out of quant hedge fund High Flyer – the push for quant talent by top AI research firms makes sense. Quants’ expertise in mathematical modeling and algorithmic optimization is immensely valuable for AI development. One thing’s for sure: Having AI labs sniffing around Wall Street is only going to make the competition for top talent stiffer for banks.

TALENT MATTERS

NEW LEADS

Lloyds hired Aritra Chakravarty as its new head of agentic AI. Chakravarty spent 12 years at HSBC and was most recently chief product and technology officer at Jiffy.ai, a financial services AI firm. He’ll report to Rohit Dhawan.

Bobby Grubert was appointed head of AI and digital innovation at RBC Capital Markets. The new AI team Grubert will lead reports into chief strategy and innovation officer Lindsay Patrick and will have hubs in New York, Toronto and London.

Barclays hired Victor Daniel Casas Hernandez to be its head of data and generative AI platforms. He joins from MAS Global Consulting where he headed up the engineering, AI and data practices.

Westpac poached CommBank’s chief data and analytics officer Andrew McMullan to be its chief data, digital and AI officer. McMullan spent nine years at CommBank and held a number of roles at RBS before that.

USAA hired Raquel Ettrick Thompson as chief technology risk officer from BNY, where she was global head of AI governance and control. Thompson recently spoke with Evident at our Responsible AI Roundtable.

NOTABLY QUOTABLE

"I think of agents as a new powerful format. I do think it’ll happen in enterprises faster than in consumer. In the context of an enterprise, you have a CIO who’s able to go and say, 'I really don’t know why these two things don’t talk to each other. I am not going to buy more of this unless you interoperate with this.'"

— Sundar Pichai, CEO at Google, in an interview with The Verge, May 27

CODA

MAL-AI-SE?

Business considers AI good for productivity. Happy workers are also more productive workers. But what if AI makes workers less happy?

A couple new studies raised this apparent problem. One published in Harvard Business Review found that while generative AI can boost performance on one task, it undermines motivation to do other work. Another from Duke found that workers feared being judged for using Gen AI in their day-to-day – and that colleagues did, in fact, view them less favorably for it.

But is this really a problem? In the sector we track closely, we don’t really buy it. Sure, firing off a few emails with ChatGPT may not spark joy or impress your deskmate. But saving your company millions of dollars is a tried and true way to rise fast and command respect at the water cooler. If anything, AI has opened the door for more workers to create that kind of outsized return.

Still, anything that impacts worker morale is something any business keeps front of mind. Amazon coders complained this week that the AI push was making their roles feel more like warehouse jobs. As banks quickly democratize AI – 200,000 LLM Suite users at JPMC, 30,000 coders with AI tools at Citi, 11,000 ChatGPT licenses at BBVA – there’s a good chance that bank managers will hear the same.

WHAT'S ON

COMING UP

Sun 1 - Weds 4 June

Digital Banking, Boca Raton, FL

Tues 3 - Thurs 5 June

Money 20/20 Europe, Amsterdam

Mon 9 - Thurs 12 June

Databricks Data + AI Summit, San Francisco

Tues 10 June

Evident AI Outcomes Roundtable, Virtual

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]