DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Death of the use case

Source: Adobe Firefly

15 May 2025

TODAYS BRIEF

Welcome back!

In today’s edition, why banks are rethinking their approach to use cases and how Discover fits into Capital One’s tech strategy. The five news items that are driving the AI conversation for business. Plus, our regular Use Case Corner.

People mentioned in this edition: Jamie Dimon, Jason Strle, Keith Toney, Richard Fairbank, Ricardo García Martín, Sumee Seetharaman, Chintan Mehta and others.

Plus these banks: HSBC, BNY, Capital One, JPMorganChase, Wells Fargo, Bank of America, UBS, NatWest and others.

The Brief is 2,153 words, a 7 minute read. Check out this Brief online.If you were forwarded this newsletter, please subscribe here.

– Alexandra Mousavizadeh & Annabel Ayles

TREND LINES

SCALING AWAY

The use case is dead. Long live the use case.

You can’t miss it. Banks are talking less about use cases – and certainly not touting numbers as some kind of flex.

In back-to-back shareholder letters, Jamie Dimon mentioned hundreds in development. In last month’s letter? Not a word about use cases. HSBC went from discussing 500 AI solutions last July to talking about “robust prioritization” this year. BNY unveiled 700 use cases a year ago; this spring it talked up the 90% of AI applications proposed by employees that the bank isn’t pursuing.

This isn't a pullback. Leaders are reorienting their approach to AI implementation. There’s not much use, so to speak, celebrating one-off AI tools anymore. That’s so 2024. The bigger prize is to figure out how to deploy AI at scale – to build AI tools without starting from scratch every time and make sure they work together seamlessly.

The “complicated thing that CEOs are wrestling with is how the technology can be deployed to significantly change operational processes,” Goldman Sachs CEO David Solomon said at the Cisco AI Summit this year. “To do that, you have to fundamentally change your processes.”

Over the coming weeks and months, expect to hear a lot more about this shift. We’ll go in depth in our coming Outcomes Report. As JPMorganChase CIO Lori Beer said earlier this winter, “the next phase is really, really making AI scale.”

COMING SOON: Our next Outcomes report (out this summer) will focus on all things use cases – where and how banks are deploying them at scale, which ones are at the frontier and what new application areas are emerging. Want to be the first to read the report? Learn about membership here.

M&AI

WILL MARRIAGE KILL CAPITAL ONE'S AI MOJO?

Once Capital One closes its $35 billion acquisition of Discover Financial Services Sunday, one of the things that will determine the merger’s success is its ability to bring the two together technologically without much friction.

In any coupling, integration can be a bear – and in this one, the stakes are particularly high. You’ve got the sector’s AI standout (#2 in the Evident AI Index) trying to digest 21,000 employees and a whole new business line. Will it be a distraction or a boon for Capital One’s AI game?

STACKED WITH TALENT

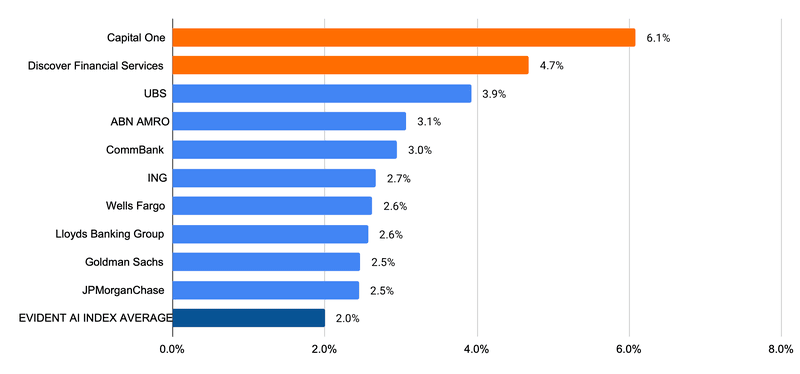

AI-focused employees as share of overall headcount

As the chart above shows, both companies lean far into AI. Capital One’s AI talent makes up the largest share of its overall headcount of any of the 50 banks we track, and absorbing Discover wouldn’t change that. Had Discover been included in the Index last year, it would have trailed only Capital One in this “density” metric.

Discover’s healthy AI investment suggests that Capital One CEO Richard Fairbank may be able to find synergies – and cost savings – more easily than we saw in the last big merger in the industry. After UBS swallowed Credit Suisse in 2023, UBS CEO Sergio Ermotti had to ditch 90% of Credit Suisse’s applications during tech integration.

There are other reasons for optimism. Like Capital One, Discover brought AI into call centers. Discover also gave data scientists a self-service solution automation tool. Even as Discover has expanded its AI footprint, executives like Jason Strle and Keith Toney have both discussed the importance of keeping a human in the loop, much like Capital One does.

Bottom line: Capital One won’t reveal much about its plans for Discover for a while, but – if they combine the right way – the new entity has a good shot to be even stronger technologically.

MEMBERSHIP MESSAGE

ABOUT EVIDENT

Evident is the intelligence platform for AI adoption in financial services. We help leaders stay ahead of change with trusted insights, benchmarking, and real-time data through our flagship Index, Insights across Talent, Innovation, Leadership, Transparency and Responsible AI pillars, a real-time Use Case Tracker, community and events. Get in touch to hear more about how Evident can help your business adopt AI faster.

IN THE NEWS

FIVE STORIES TO DRIVE AI CONVERSATION

Klarna, it turns out, can’t quit humans. For years, the buy-now, pay-later company has been the brash loud poster child of AI adoption in finance. Fire away, declaimed the group’s CEO Sebastian Siemiatkowski, AI can do the work of many (including 700 of his staffers). Not so fast. Klarna’s chatbot-only approach to customer service led to “lower quality,” Siematkowski announced last week, saying the company henceforth will be “really investing in the quality of human support.” A case of overpromising, underdelivering. But Klarna likely won’t be the last word on automation in finance. With less hype, PayPal recently told the Information that it will save $200 million annually from automating 80% of its customer service operations.

Capital One has applied for 33 agentic AI patents, the eighth most of any U.S. company, data from IFI Claims out today shows. Google, which tops the ranking of patents filed between Feb. 2024 and April 2025, has 86 agentic AI applications. The bank plans to use its same agentic framework that powered Chat Concierge to build other agentic tools around the bank. (See “Banks go agentic,” The Brief, April 17)

Big win for build over buy: Stripe turned heads with its big new foundation model for payments. It shows how data-rich financial companies don’t have to turn to the likes of OpenAI to create a sort of LLM tailored for their own needs, in this case to shore up cyber defenses. Open source models and decent tech teams are enough. Get ready for more announcements like this.

China banks rising: New data on AI use from the China Innovation Watch paints a dynamic picture. ICBC has more than 200 AI use cases, China Construction Bank has 168. Bank of China meanwhile generated 13 million lines of code in a month after equipping 3,600 developers with DeepSeek R1. (See “China AI Rising,” The Brief, Feb. 6)

UniCredit signed a 10-year deal with Google Cloud to migrate its core applications up to the sky. The Italian bank is playing catch-up on AI, and looking ahead. As UniCredit eyes the potential takeover of Commerzbank, it’ll now share a common back-end infrastructure partner with the German company. (See “Unicredit’s German Payoff”, The Brief, Oct. 3).

TALENT ROUNDTABLE

ARE YOU AGENT-READY?

At the Evident talent roundtable last week, Ricardo García Martín, BBVA’s global head of GRM data & analytics, and Sumee Seetharaman, TD Bank’s vice president of its AI/ML practice & center of excellence, offered revealingly diverging approaches to staffing for agentic AI.

- Specialize now: García Martín said “the composition [of talent] is changing” as BBVA focuses on hiring engineering specialists to develop AI agents. Of the 10 banks with the biggest AI talent pools, BBVA has had the highest growth rate of AI talent in the last six months, data from our 2025 Talent Report showed.

- Stay the course: TD Bank’s Seetharaman didn’t see the talent mix for agentic AI use cases any different to what’s already in place. For her, it’s “an evolution of the automation work that’s been underway at the bank for many years.” In particular, she highlighted putting in place an “AI Practice” team to work on the “most advanced use cases” across lines of business – including agentic ones.

The hourlong conversation covered best practices for how to use talent to scale AI and mesh company strategy with hiring practices. Watch the full event here.

USE CASE CORNER

CONFIDENCE BOTS

Banks with chatbots are seeing even more traction with customers – and singing about the results. This week, we dig into three of the customer-facing chatbots with the most eye-catching figures.

#1 10X Talker

Use case: Fargo

Vendor: Google

Bank: Wells Fargo

Why it’s interesting: Customers can speak or write to Wells Fargo’s virtual assistant and pay bills, transfer funds or retrieve account details. It uses what the bank calls a “privacy-first pipeline” – a layer of separation between the customer and the model that powers the bot – to reduce the risk of sensitive data leaking.How it works: The multi-step process starts with a locally-hosted speech-to-text model that transcribes a customer’s question. Then a small language model scrubs personally identifiable information that users input – names, account numbers, addresses – and isolates the customer’s question and intent. Only after that process does the question get passed to the Gemini Flash 2.0 model which generates the response.By the numbers: The chatbot had 245 million interactions in 2024, up from 21.3 million in 2023 and double its initial projection for the year, the bank’s CIO Chintan Mehta shared in an interview.

#2 There's Something About Erica

Use case: Erica

Vendor: N/A

Bank: Bank of America

Why it’s interesting: Bank of America’s tool was considered “by far the most advanced chatbot” by The Financial Brand, a retail banking news outlet, last year. The bank says nearly 20 million people now use it – nearly half of the bank’s mobile customers.

How it works: About 40% of Erica’s interactions are customer questions, but the rest are outbound messages – notes flagging unusual activity or preemptive messages. Erica can respond to questions on about 700 topics, which the bank says it refines constantly to stay timely – for example, about a natural disaster in the news. Every answer to a user still passes through a human.

By the numbers: Bank of America customers interacted with Erica 676 million times in 2024, the bank’s Hari Gopalkrishnan said last month.

#3 More Cora

Use Case: Cora+

Vendor: OpenAI, IBM

Bank: NatWest

Why it’s interesting: Working with IBM, the bank gave its Cora+ chatbot a Gen AI upgrade in 2024, allowing users to have a conversation about requesting a new card, changing account details or taking other actions. After inking a deal with OpenAI in March, NatWest has its sights on adding more capabilities to Cora+ – like reporting and resolving fraud claims. How it works: Cora+ is powered by ChatGPT 3.5 and a separate unnamed model that assesses the answers for clarity, Wendy Redshaw, chief digital information officer, retail at NatWest said in February. When the bank first built out the chatbot’s generative AI capabilities, it limited the amount of data the tool could access in hopes that narrow (but accurate) responses would bolster the customer experience, Mark Wolden, strategy and innovation lead for Cora, said in March. By the numbers: The bank reported a 150% increase in customer satisfaction following the launch of Cora+, and the Net Promoter Score (a way of measuring satisfaction) of its retail business increased two points in 2024.

Want to know more about the specific ways banks are rolling out AI? Check out our Use Case Tracker – the inventory of all the AI use cases announced by the world’s largest banks available to Evident members.

NOTABLY QUOTABLE

"If you’re not getting a hype cycle or funding cycle — or you could call it a bubble, you could call it a lot of things — you’re not going to end up with the incredible outcome on the other side."

— Marc Benioff, Salesforce CEO, in an interview, May 14

TALENT MATTERS

JOIN THE CLUB

The Bank of England launched an ‘AI Consortium’ on AI use in financial services to advise British regulators. Among the group are Lloyds’ Rohit Dhawan, JPMC’s Daniele Magazzeni, HSBC’s Jeffrey Valane and Goldman Sachs’ David Wade.

AI 2030, an initiative aimed at “mainstreaming Responsible AI,” announced its new class of senior fellows. Among them: CIBC’s Jimmy Yang and JPMC’s Shanthi Gudavalli.

Sham Arora joins Tech Mahindra as its CTO. Arora spent two decades at Standard Chartered, and served as the bank’s CIO until the end of last year.

ABN AMRO says Yorick Naeff will take over as head of innovation in early 2026, focusing on generative AI and digital assets. He’s CEO of Dutch neobroker BUX, which ABN AMRO acquired last July, and will stay with BUX through the integration.

WHAT'S ON

COMING UP

Sun 1 - Weds 4 June

Digital Banking, Boca Raton, FL

Tues 3 - Thurs 5 June

Money 20/20 Europe, Amsterdam

Mon 9 - Thurs 12 June

Databricks Data + AI Summit, San Francisco

Weds 11 - Thurs 12 June

The AI Summit, London

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]