DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Special Edition | New Evident AI Insurance Index

Source: Adobe Firefly

18 June 2025

TODAYS BRIEF

Welcome to this Special Edition of the Brief. Today, we’re unveiling our first-ever ranking of the 30 largest insurers in North America and Europe. The Evident AI Insurance Index and accompanying Key Findings Report look at an industry adopting a new technology to its business needs. As with our work on banking, the Index and research offer a window for anyone interested in how AI will change the working world.

This sector shows age isn’t tech destiny. The average firm in this ranking was founded more than 140 years ago. Insurers played it safe on digital transformation and took their time with the cloud. But they’re not standing by now, as you’ll see from the ranking itself, the use cases we highlight and the way that executives are positioning their companies on AI. Interested in finding out more about the results? Get in touch.

People mentioned in this edition: Marcin Detyniecki, Barbara Karuth-Zelle, Ramnik Bajaj, Isabelle Girard, Jodie Wallis, Isabelle Kokoschka and others.

Plus these insurers: AXA, Manulife, Allianz, USAA, Intact Financial, Liberty Mutual, Allstate, State Farm, MassMutual, Progressive and others.

The Special Edition of the Brief is 2,310 words, a 7 minute read. Check it out online or share the Index. If you were forwarded the newsletter, please subscribe here. We want to hear from you: [email protected].

– Alexandra Mousavizadeh & Annabel Ayles

TALE OF THE TAPE

AND THE WINNERS ARE…

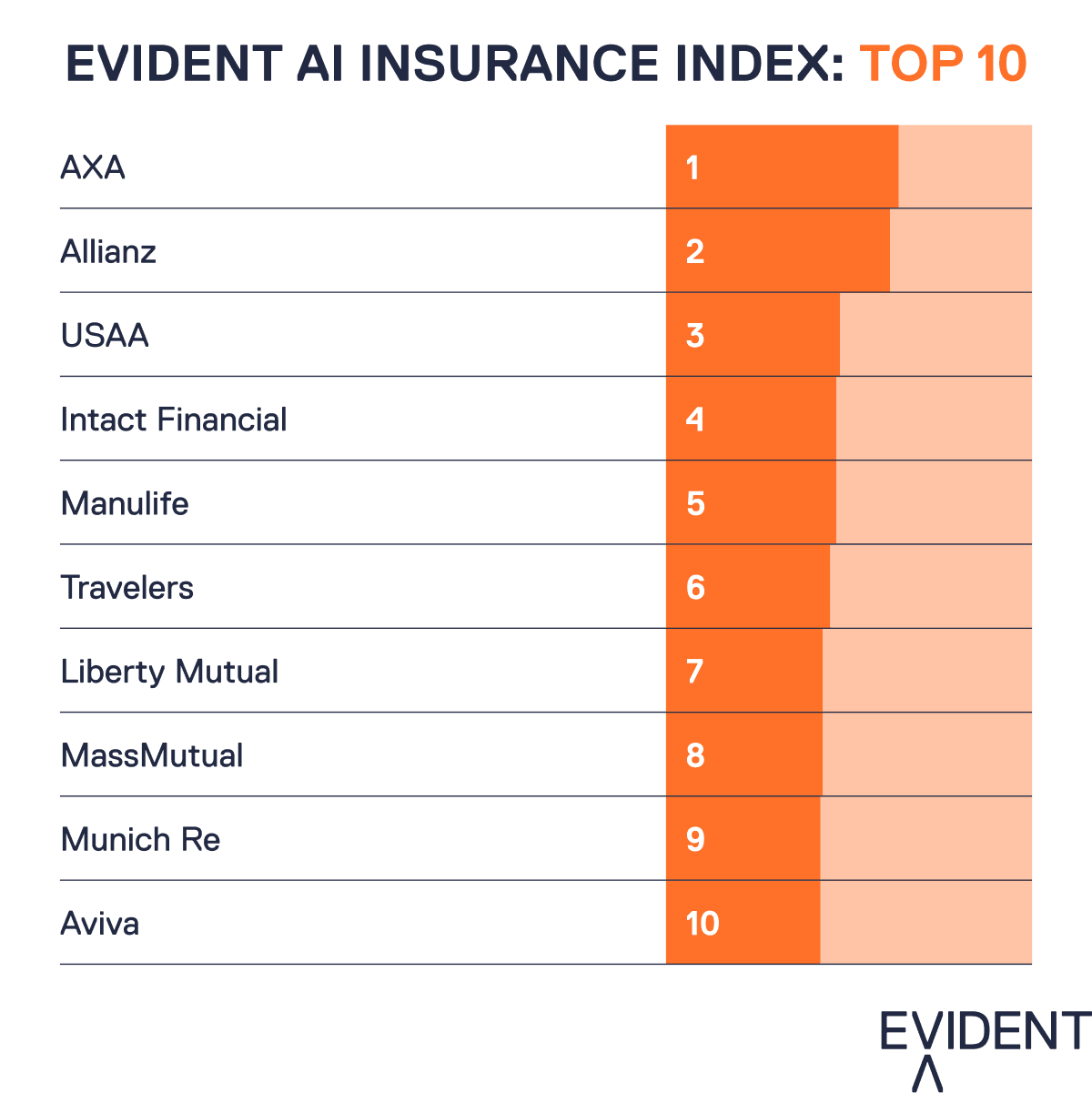

What makes an insurance company great at AI? To answer that, we scoured publicly-available data about 30 of the insurers that write the most premiums and hold the most assets – on things like who they hired, what they’ve published, the startups they’ve invested in and the safety guardrails they put in place. In all, we look at 76 different indicators and break them out into four pillars. An insurer’s performance on Talent makes up 45% of their final Index score, Innovation 30%, Leadership 15% and Transparency 10%.

Now, envelopes please…

AXA (#1) and Allianz (#2) came out on top, by far. These European powerhouses ranked among the top four in each of the pillars of the Index.

- 🥇VIVE LA FRANCE: AXA’s research team (which powers its top Innovation ranking) stood out. In the last three years, the firm published nearly a quarter of all the AI research papers put out by the 30 insurers and its body of work received 42% of all citations on those papers – an indicator of how useful that research is. On top of that, AXA was involved in nearly 10% of all the venture activity by the insurers over that time period.

- 🥈UBER TALENTED: Allianz’s approach to talent sets the German insurer apart. It has the largest AI headcount in the Index and invested early in AI-specific training programs that help the firm cut the time to production on its AI tools: “AI and data upskilling at Allianz began in 2020,” said Isabelle Kokoschka, the firm’s global head of learning and skills management. “Implementing AI is one thing, but transforming how we work with AI is just as crucial.”

- 📚TREND LINES: Composite carriers like AXA and Allianz that offer multiple types of insurance outscored property & casualty specialists, life insurers and reinsurance companies. In turn, P&C insurers like USAA (#3) and Intact Financial (#4) scored almost a third better than life insurers on average – in part because their frequent customer interactions allow them to create new data for AI tools quicker. But life insurers Manulife (#5) and MassMutual (#8) overcame that to rank among the top 10 overall.

Why leading matters: the bottom line. In insurance, a firm’s expense ratio – the cost of underwriting relative to premiums it earns – shows how likely it is to turn a profit. As our analysis shows, firms that lean into AI have pushed that ratio down.

Explore the Index and download the full Key Findings Report for a breakdown of why the leaders ended up on top

RSVP NOW

Next Tuesday, we’re hosting a special roundtable discussion to dive deep into the findings of the ranking and discuss how insurance companies are approaching AI. On the agenda:

- Where is the insurance sector when it comes to AI maturity?

- Which insurers are surging ahead in what areas of investment?

- And how are established leaders maximizing ROI from recent AI deployment?

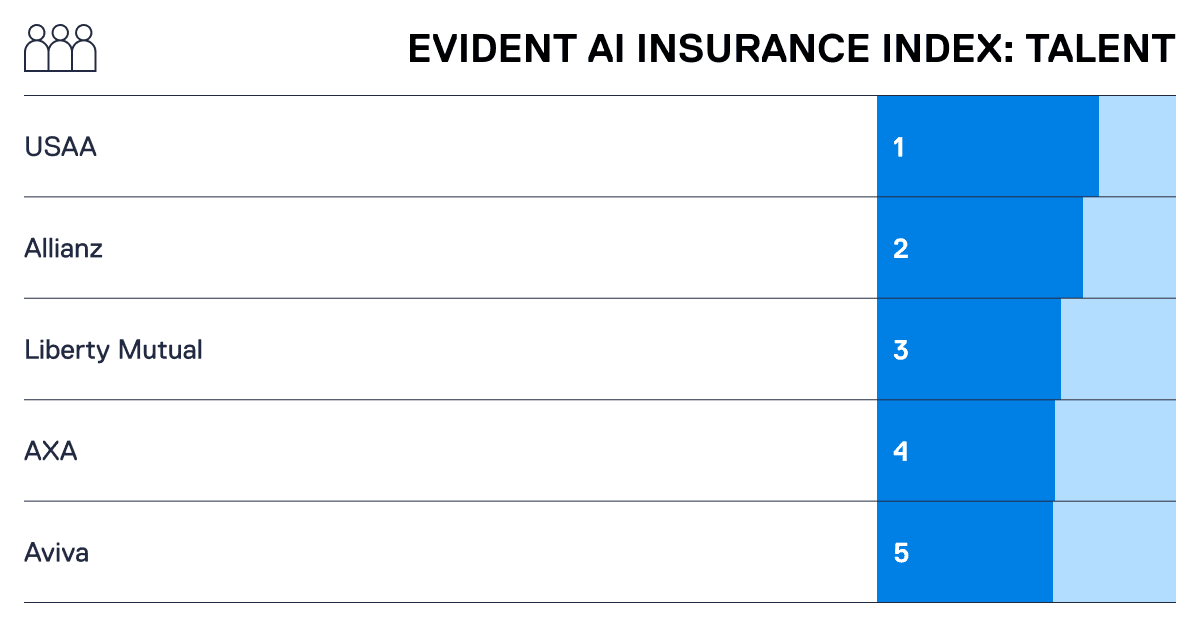

INSIDE THE INDEX: TALENT

USAA’S SECRET AMERICAN SAUCE

USAA (#3 overall) is the U.S.’s top insurer, beating out Travelers and Liberty Mutual – in large part because of its top billing on Talent. Nearly one of 20 employees at USAA works in AI, about triple the average at the other 29 ranked insurers.

- FAR FROM FLIGHTLESS: Famous stateside for the emu in its ads, Liberty Mutual, which ranks seventh overall, flew up the talent leaderboard in part because of its push to bring in AI product managers – people who help AI tools get from development to implementation. The firm trails only Allianz and AXA for the most in the Index.

Bottom line: The Index’s overall top 10 employ nearly 60% of the sector’s AI talent. As we’ve seen with banks, it’s not possible to scale AI without the right people in place, so the demand for talent will most likely only grow.

ACCELERATE YOUR AI TRANSFORMATION

Evident is the intelligence platform for AI adoption in financial services. We help banks and insurance companies accelerate enterprise-wide AI deployment with trusted insights, benchmarking services and access to a global community of peers.

Evident members can now access the Index Dashboard to explore the underlying data – and schedule their customized Index Diagnostic Report. The report provides a bespoke analysis of your organization’s Index performance versus peers.

Already a member? Log in here. Or get in touch to learn more about how Evident can help your business adopt AI faster.

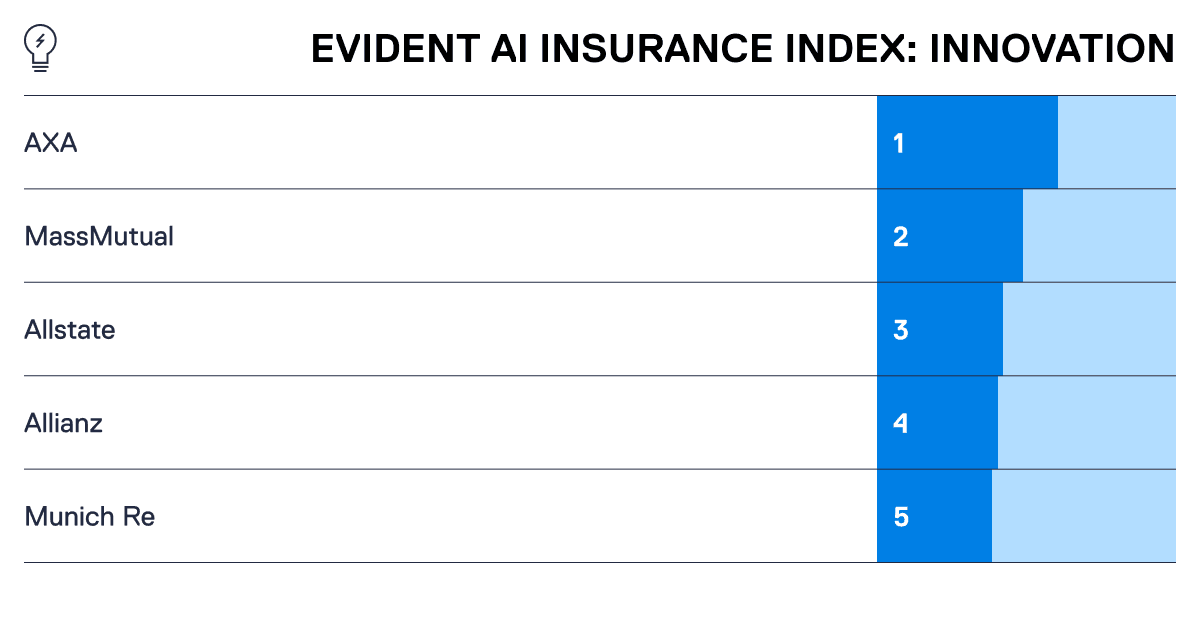

INSIDE THE INDEX: INNOVATION

AXA CRACKS IT

AXA has a commanding lead on Innovation, the Index category capturing AI investments and R&D. But MassMutual’s active venture arm and Allstate and State Farm’s patent activity pushed the American firms up this ranking.

- MASS APPEAL: Only about half of the insurers in the Index have invested in any AI companies; MassMutual Ventures has backed 13. The insurer tends to pursue AI companies focused on improving underwriting precision, like Gradient AI, which it funded in July 2024. Munich Re has invested in nine AI companies, trailing only MassMutual.

- IP VIPS: Allstate drives innovation with its IP strategy. The firm holds 17% of all AI patents filed by the 30 ranked insurers and is one of three carriers to hold more than 100. State Farm (#6 in Innovation) is one of the most active patent-holders globally, and the insurer’s gusto for R&D extends into AI. It filed the first AI patent of any insurer in the Index back in 2015 and now holds nearly 300.

Download the Key Findings Report to read more about how leading insurers have tackled Innovation.

WHO’S WHO

5 PEOPLE TO WATCH

🎓 Academic: Marcin Detyniecki

Head of Research and Development & Group Chief Data Scientist at AXA

Leads AXA’s research team and co-founded the Trustworthy and Responsible Artificial Intelligence Lab, in partnership with the Sorbonne. “Fast and rigorous – this is the approach I recommend when it comes to Generative AI,” he wrote on LinkedIn. “As new frameworks and models emerge on a weekly basis, working fast is the only way to keep up and move forward.”

🔗 Operator: Barbara Karuth-Zelle

Chief Operating Officer at Allianz

Served as the head of Allianz Technology before becoming COO. Championed AI training at Allianz. “Digital and AI transformations are not mainly about the technology but rather the mindset, the people, and the organization,” she said. “We need to constantly adapt and readapt as technologies and practices change.”

📐 Architect: Ramnik Bajaj

Chief Data Analytics & Artificial Intelligence Officer at USAA

Leads the insurer’s AI council, which assesses the viability of AI use cases across the firm. Spent three years creating a “unified data environment” at USAA – a way to make data more accessible so it’s easier to build AI tools. “With a technology like Gen AI, it’s important to also learn our way into the right architectural patterns that can give us not just speed to market, but also reliability [and] accuracy, preserving trust and … privacy,” he said in May.

🏗️ Builder: Isabelle Girard

Chief Data & Digital Officer at Intact Financial

Leads the Intact Data Lab, the insurer’s innovation team, and has pushed for top-down leadership on AI. “What works for us is our centralized approach, expertise in-house and then working closely with the business units to understand how to apply artificial intelligence solutions within their reality,” she said. “You need to ensure that your management team is a good partner for artificial intelligence projects.”

📊 Data Enthusiast: Jodie Wallis

Global Chief Analytics Officer at Manulife

Pushed the firm to democratize access to AI tools to generate use case ideas – and ways to scale them. “AI is transformative, and it is creating efficiencies for how we work, create, and interact with one another,” she said. “By equipping our teams with GenAI tools, we’re enabling them to work smarter, move faster, and make a bigger impact.”

NOTABLY QUOTABLE

OTHER BRIGHT SPOTS

- AIG (#22 overall) ranks sixth on Leadership, propelled by its vocal executive team. During the firm’s investor day – which featured Anthropic's Dario Amodei and Palantir's Alex Karp – CEO Peter Zaffino described how AIG was bringing AI closer to its core business. “We’re focusing on this as an end-to-end process,” he said. “Not on the fringes, [and] not just for expense savings.”

- Italian-based Generali (#13 overall) ranks third on Transparency, the pillar of the Index that captures how insurers approach responsible AI. “From the start, we have ensured that AI values our people, by guaranteeing human oversight on digital technologies and implementing sound governance,” Alessandro Bonaita, group AI governance program director, said.

- Zurich Insurance Group (#13 overall) tied with Travelers (#6 overall) atop the RAI leadership category. “Safe and responsible AI is a must for a data driven and scaled organization like Zurich Insurance Group,” said Ericson Chan, the firm’s chief information & digital officer.

Explore the full ranking of 30 insurers and download the Key Findings Report here.

USE CASE CORNER

THREE TOP TOOLS

We pulled out three examples of novel ways insurers are deploying AI – and seeing the benefits.

#1 WHAT’S THE DAMAGE?

Use Case: Computer Vision for Auto Claims

Vendor: n/a

Insurer: Progressive

Why it’s interesting: Progressive uses computer-vision models to analyze photos of damaged vehicles its customers upload. The tool identifies the type and location of the damage and estimates the cost of the repair.

How they did it: The estimation tool improves as more people use it. After the tool labels the vehicle’s parts and classifies the damage, it becomes part of training material to improve the tool’s accuracy. Progressive has also fine-tuned its model to account for the quirks of individual makes and models.

Impact: With the computer-vision model, adjusters now complete 2.5-times more claims, and the number of customers using photo-based estimates has risen 82% per year on average since 2016 while maintaining accuracy, the firm said.

#2 HOLD FIRE

Use Case: Wildfire risk-prevention tool

Vendor: Kayrros

Insurer: AXA

Why it’s interesting: AXA XL – the company’s P&C subsidiary – uses satellite images to predict fire risk, taking into account factors like the type of terrain in an area, how dry it appears and the routes of power lines. It gives clients live risk maps which lets them plan ahead to clear brush or relocate stock and cut down how much damage a fire could inflict.

How they did it: Working with satellite company Kayrros, the firm trained its model to turn 20 variables into a wildfire risk score. The data is regularly refreshed, ensuring risk managers get near real-time updates when a score changes. After launching the tool in France in 2024, the firm says it will expand across Europe.

Impact: With the tool, underwriters get a better overview of potential losses, which the firm says allows them to allocate money better and improve their pricing.

#3 LEASE AND DESIST

Use Case: Lease Summarization Tool

Vendor: n/a

Insurer: Manulife

Why it’s interesting: Reading a 100-page commercial lease used to burn between six and 10 lawyer hours at Manulife. An AI tool now summarizes them in ten minutes.

How they did it: Manulife’s Advanced Analytics group used existing leases to train an LLM that can summarize an agreement, pull out key clauses and flag anomalies for the firm’s legal team. The tool gets periodically retrained, and an accompanying data visualization tool is on the way, the insurer said. Down the line, the insurer says it plans to reuse the model powering the tool to summarize other kinds of contracts.

Impact: Using the tool saves two hours per lease, the firm reports, and is on track to save four by the end of this year – which adds up to hundreds of saved hours firmwide.

CODA

ON THE HO-ROI-ZON

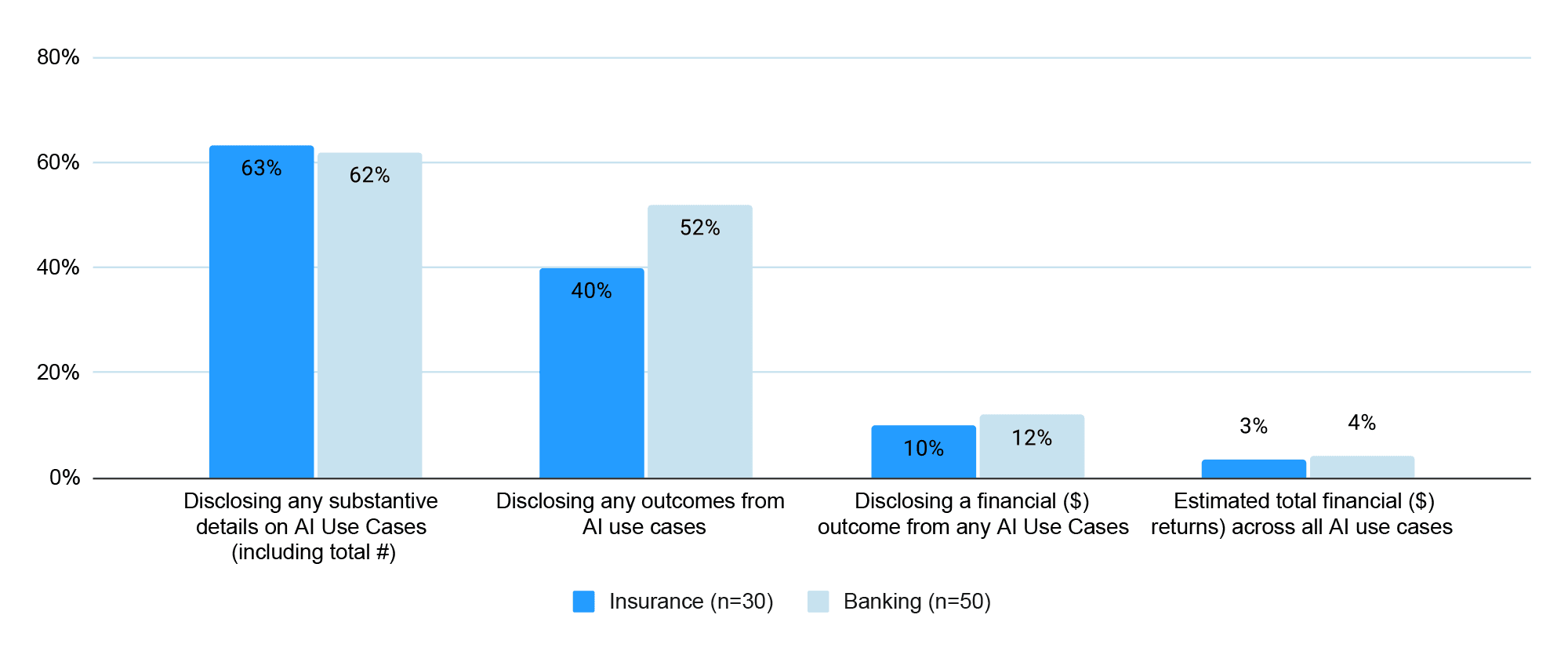

INSURANCE VS. BANKING: WE'RE NOT SO DIFFERENT, YOU AND I

How banks and insurers discuss AI use cases is broadly similar, but insurers' ROI reporting lags

AI use cases are spreading in insurance. Returns are, so far, hard to come by. If our three years benchmarking banks on these same AI maturity indicators have taught us anything: It won’t stay that way for long.

Right now, the majority of insurers aren’t reporting outcomes when they talk about using the technology. But as they bring AI closer to their core operations the way banks now are, demonstrating ROI will become an imperative. In our experience, it’s the only way for a company to shift AI from an experimental cost to a driver of measurable growth.

That growth is already happening, especially within claims automation, customer service, knowledge retrieval and underwriting & pricing business lines.

Claims automation tools (like Allianz’s Insurance Copilot) free agents up from the manual and repeatable parts of assessing claims. Customer service tools (like Manulife’s call summarization tool) cut the handling time for call center employees. Knowledge retrieval tools (like Intact Financial’s Gen AI chatbot) help agents gather policy information quicker. And underwriting tools (like Travelers’ BOP 2.0) help customers select the right policies.

What’s next: ROI reporting will only become more common and get more detailed. Not every insurer will follow Intact Financial (or RBC and DBS in the banking sector) in reporting firmwide AI value. But more firms will report something as AI grows across the business.

WHAT'S ON

COMING UP

Weds 18 June

Evident AI Insurance Index Launch, Everywhere

Tues 24 June

The Evident AI Insurance Roundtable, Virtual

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]