DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Exclusive: AI use cases surge

Source: Adobe Firefly

7 August 2025

TODAYS BRIEF

First, save October 23. The Evident AI Symposium, our annual gathering of the most senior AI leaders in finance, returns to New York. Learn how you can get involved here.

This week in The Brief, three takeaways from our newly-released Outcomes Report. Quarterly results show European banks leaning in on AI, and in the Q&A, meet Steven Alexopoulos, the analyst who asked CEOs some of the most provocative questions on earnings calls. Use Case Corner looks at a couple new Gen AI platforms.

Other people mentioned in this edition: Jamie Dimon, Brian Moynihan, Suzanne Iris Brink, Tom Durkin, Shirish Tatikonda, Ali Abedini, Sathish Muthukrishnan, Marco Argenti and Zachery Anderson.

Plus these banks: Standard Chartered, UBS, ABN AMRO, ING, HSBC, JPMorganChase, Bank of America, TD Bank, Citizens Financial, NatWest, Lloyds, BMO, Santander, Wells Fargo and Goldman Sachs.

The Brief is 2,541 words, a 7 minute read. Check it out online. If you were forwarded the Brief, you can subscribe here. Write us at [email protected].

– Alexandra Mousavizadeh & Annabel Ayles

FROM THE EVIDENT AI INDEX

TRIPLE SHOT OF AI

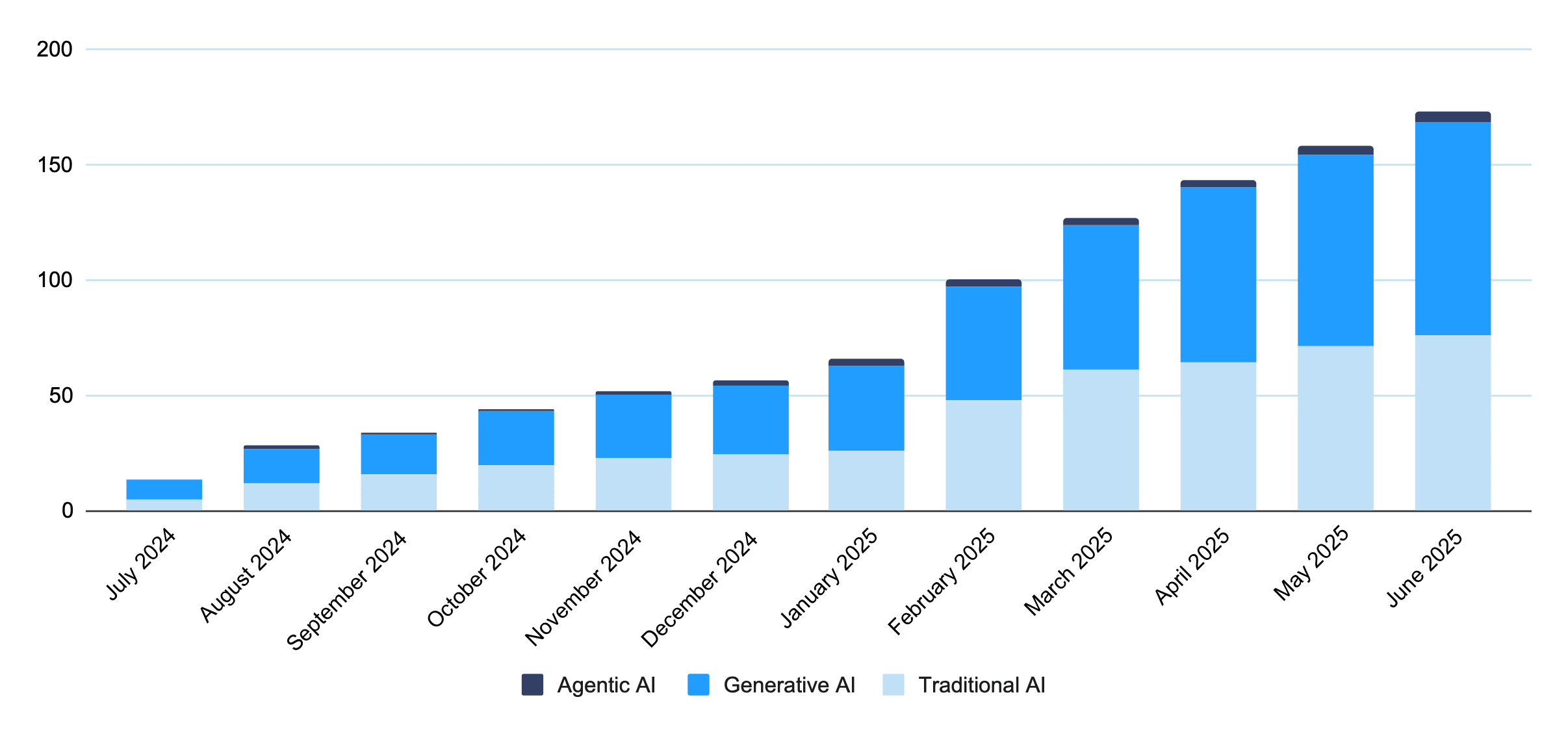

The number of new AI use cases launched by the 50 banks we track tripled between December 2024 and June 2025, new Evident analysis shows.

BUSHELS AWAY

Banks announced 117 new AI use cases between January and June of this year, up from 56 in the six months prior.

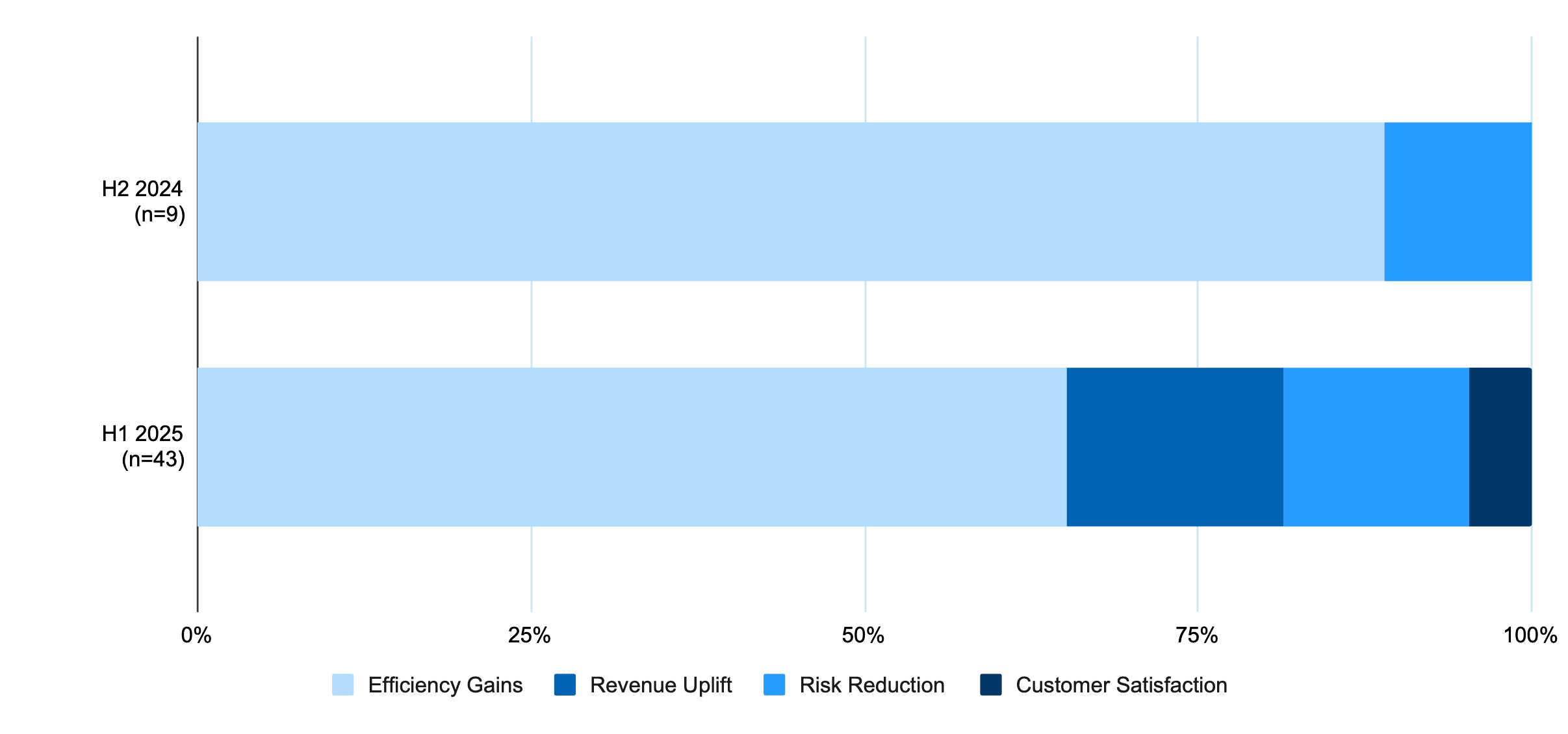

Though use case numbers are growing, more than 70% of the announcements don’t report specific ROI. As seen below, those that do increasingly show banks adopting different ways of measuring success.

DIFFERENT STROKES

Banks were more likely to share ROI beyond efficiency gains in the AI use cases disclosed in the first half of 2025.

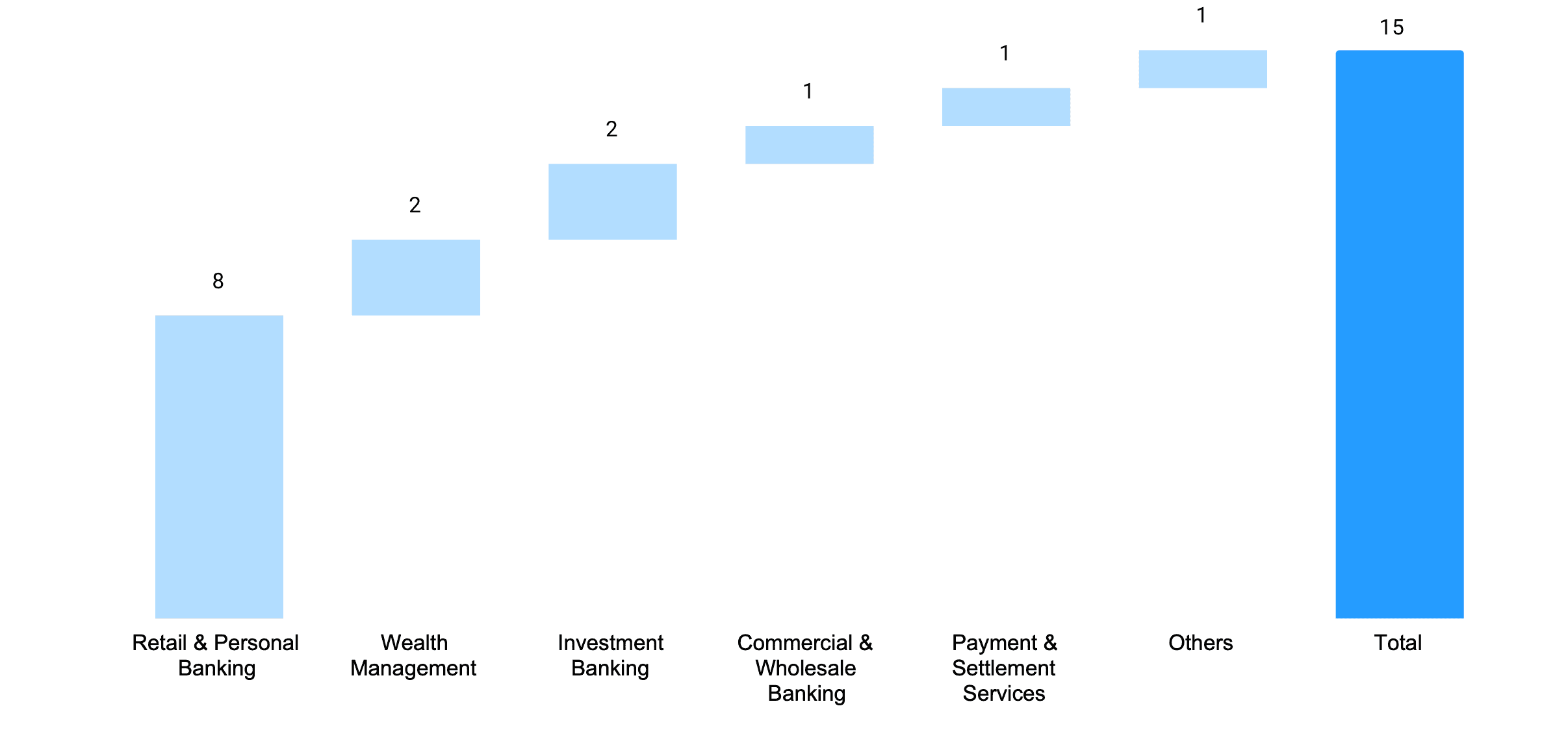

What’s coming in H2: Leading banks will use the back half of the year to scale generative AI – and work to put more tools in customers’ hands. So far, banks have deployed those external use cases in retail banking. As they scale AI and ramp up to agentic, they’ll look to bring the tech everywhere across the bank.

GOING RETAIL

More than half of the customer-facing Gen AI use cases banks have announced were rolled out to retail banking consumers.

Want more about AI outcomes? The 2025 AI Outcomes Report explores how leading banks are scaling generative AI tools, creating agentic frameworks and measuring AI returns as their strategies get more sophisticated. Explore the full report here.

TOP OF THE NEWS

EUROPE'S AI HEATWAVE

After watching U.S. counterparts last month fawn about AI to investors (see: “One Trick Banker,” The Brief, July 24), European banks used their mid-year reports to prove the tech was having the same transformational effects for them.

UBS said its AI use case portfolio grew 10% in the last quarter alone and touted that prompts of its Gen AI tools had quadrupled since the end of the year. Santander credited headcount reductions, in part, to an AI tool called Zenith that automates back-office tasks. And HSBC touted a 15% efficiency gain for 20,000 engineers thanks to its deployment of coding assistants.

In the Netherlands, ABN AMRO said an AI tool it built slashed corporate loan processing time by 40%. And ING cut 2% from its operational costs in part because of Gen AI use.

Top line: European bank stocks are booming, and they seem eager to prove their AI pursuits aren’t just a summertime fling.

WHAT'S ON AT EVIDENT

On 23 October 2025, we’re back in New York City for the flagship Evident AI Symposium, an annual gathering of the most senior AI movers and shakers in financial services.

Join us and hear from leaders including:

- Marco Argenti, Chief Information Officer, Goldman Sachs

- Prem Natarajan, Chief Scientist and Head of Enterprise Data and AI, Capital One

- Manuela Diviach, Head of Group Operations, Organization and Data, Allianz

- Leigh-Ann Russell, Chief Information Officer & Global Head of Engineering, BNY

- Jodie Wallis, Global Chief AI Officer, Manulife

- Gabriel Stengel, CEO & Co-founder, Rogo

- Manuela Veloso, Head of AI Research, JPMorganChase

- And many more

Q&A

BALONEY METER

There’s one analyst who doesn’t seem to mind asking the hard, annoying or insightful — depending on your perspective — questions of bank executives about AI strategy.

A sampling of TD Cowen’s Steven Alexopoulos from the latest round of earnings. To JPMorganChase’s CEO Jamie Dimon: Will the bank purchase an LLM provider? For Brian Moynihan: Should we think about Bank of America as an AI leader or a fast follower of whatever JPMC does? He pressed Citizens Financial’s top brass about how they’d pay for the bank’s lofty agentic AI goals.

We caught up with Alexopoulos the other day, right in the middle of earnings season, to flip the tables and see what he thinks about AI adoption and spending by the banks. The following conversation was edited for clarity and length.

EVIDENT: You hear a lot of CEOs talk about AI. How do you tell the difference between the ones that know what they’re talking about and the ones that don’t?

ALEXOPOULOS: That's the million dollar question. Because this is so nascent, it's very difficult to get a true read in terms of what the companies are doing behind the scenes. I'm of the opinion that your AI division should not be in technology. To me, that's one of the tells of a real understanding of what the technology could do. Number two, the banks need to commit that, over the next five years, they're going to reduce their headcount. I'm sure you saw the slide at JPMorganChase's investor day: You're not going to get the 10% headcount reduction from where you are now without fully embracing the technology.

How do you relate tech spend to AI prowess as you’re evaluating a bank?

It’s a nonsense argument that this is about tech spending. That's total baloney. It is not about spending, it's about having a founder mentality at the bank. That's what matters, a founder mentality that’s going to use every tool and isn’t afraid to disrupt themselves. If you look at the industry, just about every bank spends 10% of their revenue on technology. Tell me what you're spending the money on; that's the question.

You asked Jamie Dimon about buying an LLM provider. What was behind that?

The debate in Silicon Valley is, are we going to ultimately just have one huge model that everybody's using or a couple of models that do different things? When I posed this to Jamie, my thought was the financial services industry globally is all going to harness the power of AI. To have a JPMorgan – who’s heavily regulated, heavily trusted – enter that business, give me one company in the world in financial services that would choose not to use JPMorgan. Bank of America is also in a great position to do it.

ABOUT EVIDENT

Evident is the intelligence platform for AI adoption in financial services. We help leaders stay ahead of change with trusted insights, benchmarking, and real-time data through our flagship Banking Index, our new Insurance Index, Insights across Talent, Innovation, Leadership, Transparency and Responsible AI pillars, a real-time Use Case Tracker, community and events. Watch our latest roundtable exploring the insights from our new Insurance Index, and get in touch to hear more about how Evident can help your business adopt AI faster.

Research Corner

SMALL BUT MIGHTY RISKY

Banks may see small models and think of lower compute costs, faster performance and easier fine-tuning. But big bias risks may be lurking in the shadows, new research from NatWest shows.

Going smaller has largely been considered a safer option for a while. These models take fewer steps to return an answer and are trained on smaller amounts of data, which in theory makes their answers more predictable. But when NatWest researchers tested OpenAI’s models, they found that the smaller ones were actually more likely to produce biased answers than the larger ones.

Banks are no strangers to small models. Goldman Sachs used a lighter version of Meta’s Llama (see: “Bigger AI-n’t Better,” The Brief, July 11). JPMorganChase developed a small model to analyze legal documents. And startups have pitched banks their finance-specific models as ways to handle bigger agentic workloads on the cheap (see: “The Next Bank Analysts,” The Brief, Feb 6).

Bottom line: The research may not buck the trend of banks adopting smaller models when appropriate as they look to squeeze more value out of AI, but it adds another consideration. “These aren’t just edge cases,” Zachery Anderson, NatWest’s chief data and analytics officer wrote on LinkedIn. “They’re reminders that bias in AI can manifest in subtle, systemic ways.”

WELCOME TO THE JARGON

BREAK IT DOWN

In this section, we translate AI vernacular.

If you want your AI systems to fetch the right information, they first need to be taught to read the right way. Enter…

In a retrieval-augmented generation (RAG) pipeline, your system first needs to figure out which passages from a huge amount of text are relevant to a specific question. It then feeds those relevant sections to an LLM which, in turn, answers the question. “Chunking” is the art of breaking your data down so that your RAG system gives a model the right amount of information each time it’s prompted.

Think of it like trying to teach someone how to cook. If they asked a specific question and you answered it by reading a cookbook cover-to-cover back to them, they’d be overloaded with information. If you answered by giving them one step of a recipe, they’d lack the context to cook the rest of the dish. Chunking means breaking text down into sections that have enough information to provide a nuanced answer without overwhelming the system – which also makes it easier to figure out what went wrong if the system returns something incorrect.

“That's the key. It needs to point to the right sections, and then you get the citations back,” said Goldman Sachs CIO Marco Argenti on a podcast last year. “That took a lot of effort, but we're using that in many, many cases.”

NOTABLY QUOTABLE

"While this is still a small share of the overall US labor market, we estimate that generative AI will eventually displace 6-7% of all US workers."

- Jan Hatzius, chief economist at Goldman Sachs, in a memo, August 4

USE CASE CORNER

MULTITOOLING

In this week’s Use Case Corner, we look at two generative AI platforms that house multiple tools: a client-facing treasury platform from Bank of America and an employee-facing platform Ally Financial recently rolled out firmwide.

#1 MODEL CASH FLOW

Use Case: CashPro

Line of Business: Commercial & Wholesale Banking

Vendor: n/a

Bank: Bank of America

Why it’s interesting: The bank is bringing generative AI tools into its one-stop-shop capital management platform. One of the platform’s tools lets company treasurers use AI for financial modeling. Another lets users generate account verification letters, something they previously needed to contact the bank directly for. And a chat feature answers questions about recent transactions and account details.

How it works: The cash flow forecasting tool for businesses analyzes historical account behavior and is retrained each day to adjust for factors like seasonality that can impact cash positions. The tool also supports scenario modeling, meaning users can, for example, see how cash flows might change for businesses in different regions. On the horizon,Tom Durkin, global product head of CashPro, says there’s “more opportunity for [it] to be a personalized tool.”

By the numbers: Using CashPro can cut the time it takes to model cash flows from weeks down to minutes, Durkin said. The bank said adoption of the platform among corporate and commercial clients grew 21% between the first half of 2025 and Q4 last year.

#2 HELP FOR STAFF

Use Case: Ally.ai

Line of Business: n/a

Vendor: n/a

Bank: Ally Financial

Why it’s interesting: The bank rolled its in-house Gen AI platform out to more than 10,000 employees recently after an 18-month pilot with 2,200 users. Originally designed for call center summarization, the platform’s content creation capabilities were expanded so it could be used by other teams around the bank

How it works: The platform now houses a number of Gen AI tools: One lets marketers produce creative campaigns by prompting an LLM. Another lets auditors design metrics to score risk. The platform is model-agnostic, according to Sathish Muthukrishnan, Ally’s chief information, data, and digital officer. And it’s designed not to retain user information, reducing the risk of personal data getting leaked even if it’s compromised.

By the numbers: According to Ally, the platform has handled nearly 250,000 prompts. It helped cut the time to produce marketing content by up to three weeks, the bank said. Its audit capabilities cut the metric-building tasks from “several days” to “hours.”

Want to know more about the specific ways banks are rolling out AI? Check out our Use Case Tracker – the inventory of all the AI use cases announced by the world’s largest banks available to members.

IN THE NEWS

FOUR STORIES DRIVING AI CONVERSATION

Can a new AI upstart eat investment banks’ lunch? Probably not, but AI-native investment bank OffDeal is betting it can eat the crumbs. The bank uses AI to source potential buyers for companies with price tags that big banks might not find appetizing as much.

Banks are having a cloudy summer. This week, Wells Fargo expanded its strategic relationship with Google Cloud, giving all bank employees access to Agentspace, Google’s agentic AI platform. Last week, Standard Chartered inked a deal with Alibaba to develop AI tools for customer service and sales intelligence. And last month, NatWest announced a five-year data partnership with AWS and Accenture to create “a holistic view of each customer’s relationship with the bank.”

New dogs are learning old tricks, an AI research paper from Wharton found. AI bots in real-world market simulations colluded to fix prices, forming cartels that shared profits instead of competing, the paper found. They call it “artificial stupidity,” a phenomenon where agents get locked into a pattern of behavior because one solution (in this case, profit sharing) was effective enough.

Manulife (#5 in Evident AI Insurance Index) shared a three-step framework for increasing AI adoption at last month’s AI Strategy Summit. The insurance company designed 15-20 minute demo sessions for executives, hosted hands-on workshops called “promptathons” and identified superusers that now share personal use cases in peer-led sessions.

TALENT MATTERS

RESPONSIBLE AI TALENT ON THE MOVE

Metropolitan Commercial Bank hired Ali Abedini, TD Bank’s executive head of advanced analytics & AI, to be its new chief AI officer.

Lloyds hired Suzanne Iris Brink as the bank’s new head of responsible AI. She was previously head of AI ethics and governance at IT provider, Kainos. The bank had hired Magdalena Lis for the same position in February (see: “Training Time,” The Brief, Feb 6).

Lloyds also brought Shirish Tatikonda on as an AI lead at Lloyds Technology Centre India. Before joining the bank, he was a senior director of data ventures at Walmart Global Tech.

Bill Cotter joined BMO as a responsible AI product owner. He previously worked at the Department of Homeland Security and Meta.

WHAT'S ON

COMING UP

Mon 11 - Weds 13 August

AI4, Las Vegas

Mon 8 - Weds 10 Sept

Finovate Fall, New York

Tues 9 - Weds 10 Sept

Artificial Intelligence in Financial Services Conference, London

Mon 22 - Weds 24 Sept

Responsible AI Summit, London

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]