DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

JPMorgan sends AI to meet the client

16 May 2024

TODAYS BRIEF

Welcome back.

Today we share fresh analysis on which banks are building up their AI teams and in what roles. We’re seeing businesses move from AI buzz (so 2023) to implementation, detailed use cases and searching to find return on their not small investments. While the banks leading on AI continue to move fastest on hiring, look out for a couple surprising European risers.

We also unpack a headline-worthy use case released by JPMorgan Chase. And looking at our own data and some recent research we ask if Chinese banks are well ahead of everyone else on AI? Plus the Evident Trivia is back by popular demand...

The Brief is 1940 words, a 6-7 minute read.

Was this newsletter forwarded to you? Sign up here. Send tips and feedback to [email protected].

LATEST FROM THE EVIDENT AI INDEX

WINNER TAKES ALL (THE TALENT)

How to tell if a bank takes AI seriously by turning strategy into action?

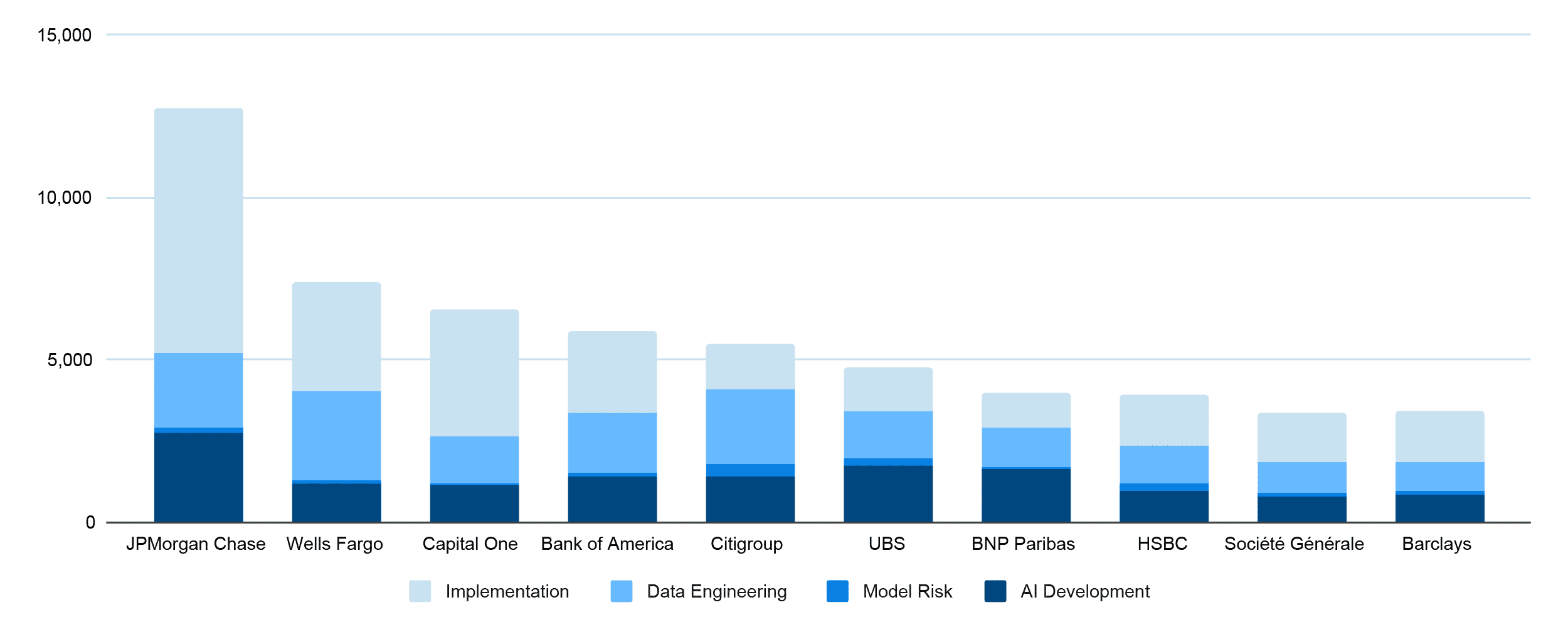

A good measuring stick is their talent stack – the people working in roles related to AI development, model risk, data engineering, and implementation in the banks. Here are the current leaders, according to the latest Evident research.

Top 10 Banks: Total Volume of AI Talent, by Capability Area

March 2024

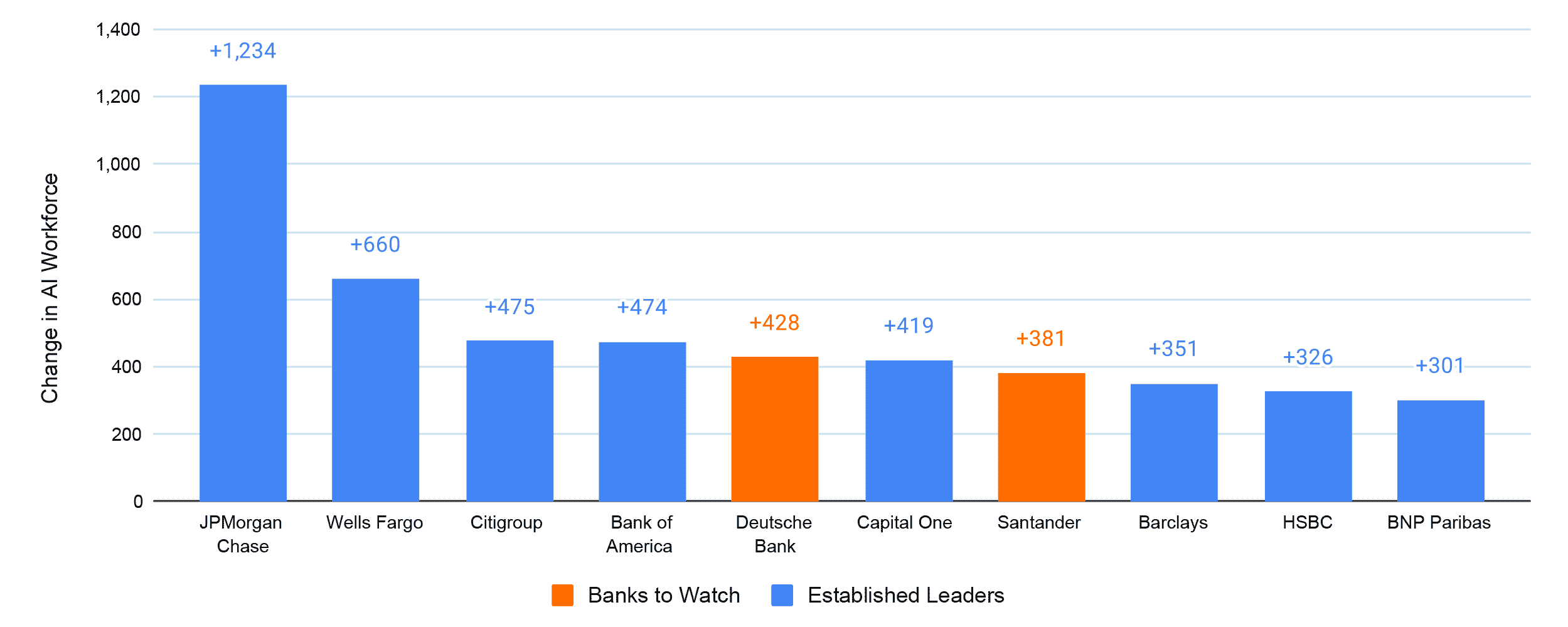

Big keeps winning. The largest banks have gained the most AI talent over the past six months, and we’re seeing JPMC, Wells Fargo and Citi accelerate away from the pack.

Top 10 Banks: 6-Month Change in AI Talent Volume

March 2024 vs. September 2023

Notable movers. Deutsche Bank and Santander sped up hiring in recent months, albeit from a lower starting point. They both feature in the top-10 for AI talent growth, slowly moving up the ranking in terms of overall AI talent by sheer number (now #20 and #19, respectively).

Backstory? Santander is focused on data engineering and implementation roles, accounting for 87% of their new AI hires. The bank is entering the final stretch of deploying its proprietary cloud platform (Gravity) and accelerating promising AI use cases (60 and counting). Deutsche Bank meanwhile is expanding quickly in India.

Read more about the latest talent trends across banks in The Dispatch: Talent Capability. Evident members have exclusive access to the full report. Find out more about membership here.

TALENT MATTERS

NOTABLE MOVES AND OPENINGS

DBS appointed Eugene Huang as group Chief Information Officer. Previously at HSBC and Citi, Huang brings both business and technology expertise, a combination that CEO Piyush Gupta says will be crucial to address the bank’s ongoing digital resiliency challenges.

Capital One’s David Weekly is advertising multiple roles, including product leadership on the bank’s generative AI team, within “The Lab”, the bank’s innovation unit.

Veteran Wall Street technologist Marinela Tudoran, the CIO of Credit Suisse’s investment arm, is leaving the bank amid layoffs after its acquisition by UBS. (See Speed Reads below.)

Meta hired JPMorgan Chase’s head of machine learning engineering (Asset Management), Onur Guzey, as a manager in their core ads team.

Simon Bannister, the former global head of emerging technologies at Deutsche Bank, is joining quant fund Qube.

EVIDENT TRIVIA

AND THE QUESTION IS…

What was the first video game to incorporate artificial intelligence?

The question comes from Rhett Edwards, winner of our inaugural trivia round.

Last time, we asked “What early chatbot, created by Joseph Weizenbaum in the 1960s, inadvertently caused its creator's secretary to form an emotional bond and ask for privacy during their interactions?” It’s Eliza. Long before language technology boomed, MIT researchers created a natural language processing program that simulated conversations between psychotherapists and their patients.

Email us your answer to Rhett’s question (no Googling please): [email protected]. The winner gets to run the next trivia round.

QUARTERLY RESULTS WRAP

AI HYPE DOWN

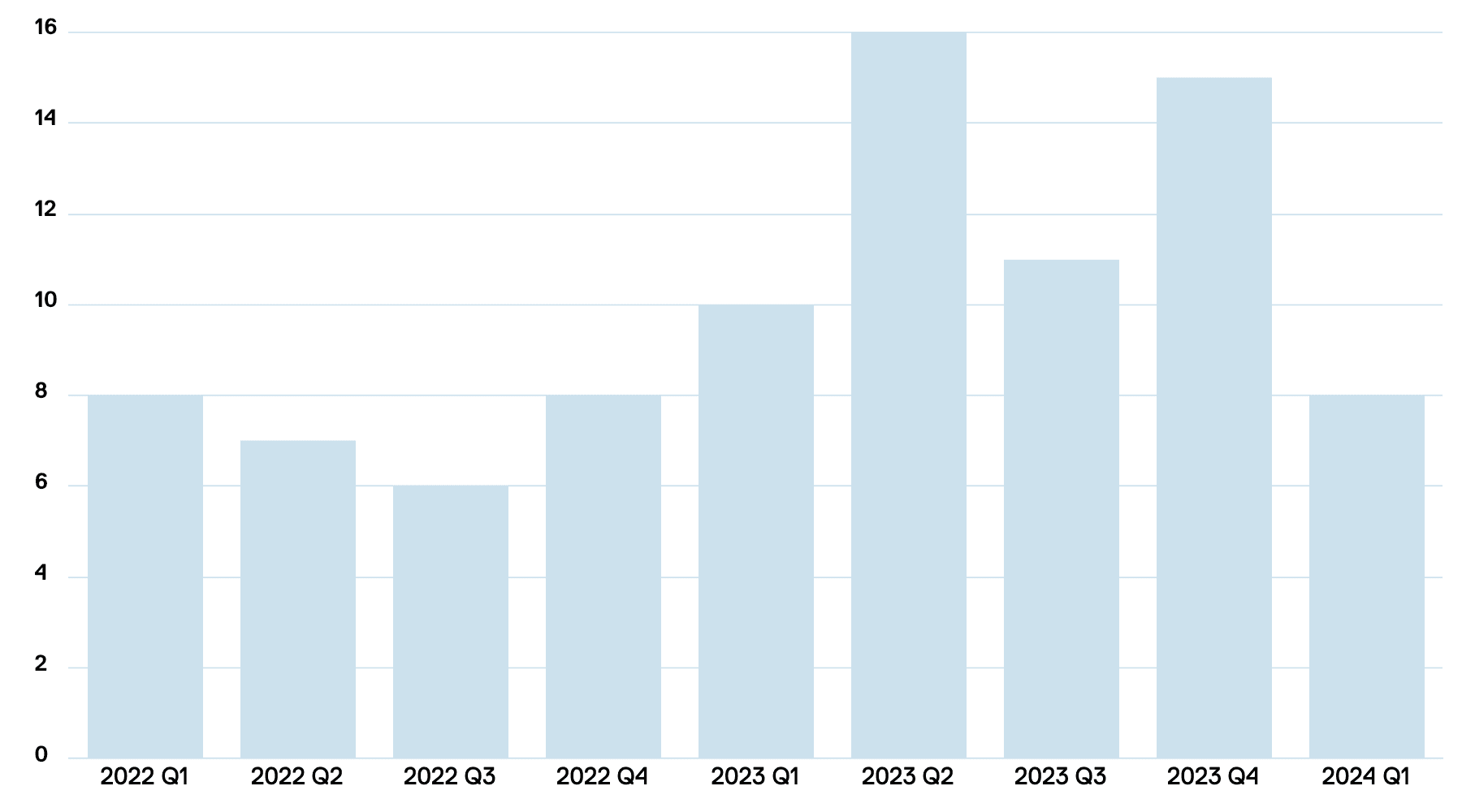

We ran the numbers, and it’s official: In this past earnings season, AI wasn’t the “It” topic. Eight of the 50 Evident AI Index banks mentioned AI in their Q1 calls, compared with the peak of 16 in the second quarter of last year.

Number of Banks Mentioning AI in Earnings Calls

n=50

But but but…What’s interesting is how they are talking about it. Bank CEOs are moving away from promises of investment and AI’s bright future to details on the current efforts with their use cases and ROI. Last year, earnings calls that touched on AI included two specific mentions of AI per call on average, according to our analysis. This year that number more than doubled to five mentions per call, as CEOs got into detail about how their banks use the tech. So while fewer banks mention AI, the ones who do are talking about it a lot more.

Illustrative example. Two years ago, ANZ CEO Shayne Elliot touted an investment in the cloud that he’s “really excited about,” predicting it will “streamline business processes that leverage automation and machine-learning” without offering detail.

Last week, Elliot came armed with details for the bank’s Q2 earnings call about:

- An AI transaction scoring system that “can identify customers at risk of distress around 40 days earlier than usual.”

- A pilot generative AI tool built to speed up the integration of the insurer Suncorp following its $3.3 billion acquisition by “radically” reducing the time it would normally take to go through thousands of procedures, policies and contracts.

- 3,000 engineers use generative AI coding tools to rewrite bank software to boost productivity – offering up specifics rarely heard on a bank earnings call.

NOTABLY QUOTABLE

"There is a world where your [AI] dating concierge could go and date for you with another dating concierge, and then you don’t have to talk to 600 people… it will say these are the 3 people you really ought to meet."

— Bumble founder Whitney Wolfe Herd, on the future of dating at Bloomberg’s tech conference last week

Our thought bubble. When might AI play a similar role in early stages of client interactions? The unreliability of current models makes it implausible for now to hand over critical client relationships to a machine. But a lot of research and focus is going into so-called agentic AI that takes the human out of the loop, so Herd’s vision might be realized in banking one day too.

EVIDENT SPEED READS (AND A LISTEN)

FIVE THINGS THAT CAUGHT OUR ATTENTION

UBS CEO Sergio Ermotti opened up about the bank's IT integration with Credit Suisse following their takeover. He said UBS will bring only 300 of the 3,000 Credit Suisse IT applications into his firm to minimize risk, and offered reassurance that while the focus on integration may slow down their work on AI, they are “on top of it.”

Citi’s co-CIO Shadam Zafar in an interview with Business Insider spoke about the “four phases” of the bank’s AI strategy. As with other banks, the immediate focus is productivity and back office use cases. Citi has about 30,000 employees using AI for software engineering and to modernize its older back-end platforms to process loans and open accounts.

The European Central Bank published a paper on the benefits and risks of AI for financial stability. Amongst known AI risks for individual firms, such as bias and inaccuracy, the report flagged a potential risk for the wider financial system and suggested new regulatory measures may have to be considered.

Microsoft’s annual Responsible AI Transparency report lays out how the company uses generative AI, oversees the deployment of those applications and supports customers with RAI. What stands out: Microsoft’s AI partners get access to a package of 30 tools tailored to help companies be safe and transparent in their AI development.

NYT’s Hard Fork podcast on how workers in various sectors are using AI to boost productivity and creativity — often in unexpected ways. It’s a reminder that AI strategy setters shouldn’t forget about how people use the tools.

WHAT’S ON AT EVIDENT

EVIDENT AI SYMPOSIUM

Join us at the Evident AI Symposium in London, where we will bring senior AI leaders from across the banking sector together to cut through the hype and drive forward a global conversation around the realities of AI adoption.

At our first European gathering, we’re zeroing in on the theme of: Accelerating Outcomes: How are banks delivering value from AI now?

Speakers include: David Schwimmer, CEO, LSEG; Clare Barclay, CEO, Microsoft, UK; Manuela Veloso, Head of AI Research, JPMorgan Chase; and Sameer Gupta, Chief Analytics Officer, DBS.

USE CASE CORNER

ON THEME

JPMorgan Chase’s announcement of its IndexGPT got a lot of attention. In this week’s Use Case Corner, we decided to peer more closely under the hood.

Bank: JPMorgan Chase

Use Case: IndexGPT

Vendor: Leverages GPT-4 (OpenAI)

Finance 101. Thematic Investing is an approach that allows investors to put their money in buckets that are based on emerging trends and themes.

How IndexGPT works. Users provide criteria for a particular investment theme – for example, e-sports or cybersecurity. The tool would then create a list of relevant keywords and use it to scan media and identify emerging trends. The output is a basket of companies that investors might want to look at.

How new is this? Goldman Sachs, Charles Schwab and Blackrock have launched products that use natural language processing to scan news and company releases to identify key trends for investors.

But… the generative bit matters. Using OpenAIs LLM lets IndexGPT create a more comprehensive list of keywords faster than a human research analyst can. The application of generative AI to thematic investing is new – that’s why JPMC filed a trademark for IndexGPT last year.

Other banks will be watching closely. IndexGPT is one of the first generative AI tools that a major bank is – with supervision – willing to put directly before institutional clients.

Potential ROI → improved – and faster – stock selection methodology for investors

Reported ROI → n/a

CODA

CHINESE BANKS SURGE AHEAD

There’s a lot of chatter about China’s AI gains. The country leads the way on research in the top AI fields, according to the latest data from Georgetown’s Center for Security and Emerging Technology. Other reports show China’s surging ahead, including our own data dive on bank AI patents.

Some skepticism is warranted. American export controls on advanced GPU chips hurt China’s ability to develop the most advanced AI tools. The Biden Administration is now moving to limit access to core AI software as well, according to Reuters. China just isn’t part of the premier league AI ecosystem now.

Yes, but. That doesn’t mean that China isn’t making big moves forward – above all in banking. They have a clear advantage: Scale and vast amounts of data. Nearly a billion Chinese smartphone users (943 million to be exact) use AliPay, WeChat Pay, and Union Pay to conduct mobile payments. In China, 38% of all point-of-sale transactions are cashless, double the proportion in the U.S. and the U.K. And each of China’s major banks has developed significant mobile banking infrastructure: Industrial and Commercial Bank of China has the most popular app with 66 million monthly active users, followed by China Construction Bank (54 million) and China Merchants Bank (46 million).

Chinese consumers are accustomed to online banking and expect a high level of AI integration. Banks are moving fast to implement the tools. Baidu’s version of ChatGPT (“Ernie Bot”) recently passed the 200 million user milestone - only eight months after launch. Both China CITIC Bank and Postal Savings Bank announced plans to partner up with Baidu on generative AI applications.

Based on their spend, sophistication and speed, we’re no longer asking: “Is the Chinese banking sector pulling ahead ?” The better question is, how far?

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]