DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Our AI banking ETF is back

Source: Google Gemini

21 August 2025

TODAYS BRIEF

Welcome back! In today's edition, European bank stocks surge just as they start to get more serious about AI. Coincidence? We discuss. The finance world digests GPT-5. Three AI trends from beyond the Western bubble. Also this week, an AI talent shuffle at NatWest, and we explore two new Gen AI tools.

People mentioned in this edition: Bettina Orlopp, Oliver Dörler, Ricardo Martín Manjón, Ana Botín, Brad Lightcap, Sam Altman, Subash Sharma, Suvendu Pati, Matt Comyn, Alan Docherty, Dan Bosman, Karen Dewar, Zachery Anderson, Allison Horn and Tan Su Shan.

Plus these banks: Commerzbank, Santander, BBVA, Deutsche Bank, UBS, CommBank, Wells Fargo, Morgan Stanley, NatWest, TD Bank, CaixaBank, JPMorganChase, and DBS.

The Brief is 2,320 words, a 6 minute read. Check it out online. If you were forwarded the Brief, you can subscribe here. Write us at [email protected].

– Alexandra Mousavizadeh & Annabel Ayles

EVIDENT ETF

EUROPE AWAKES

UNLIKELY WINNERS

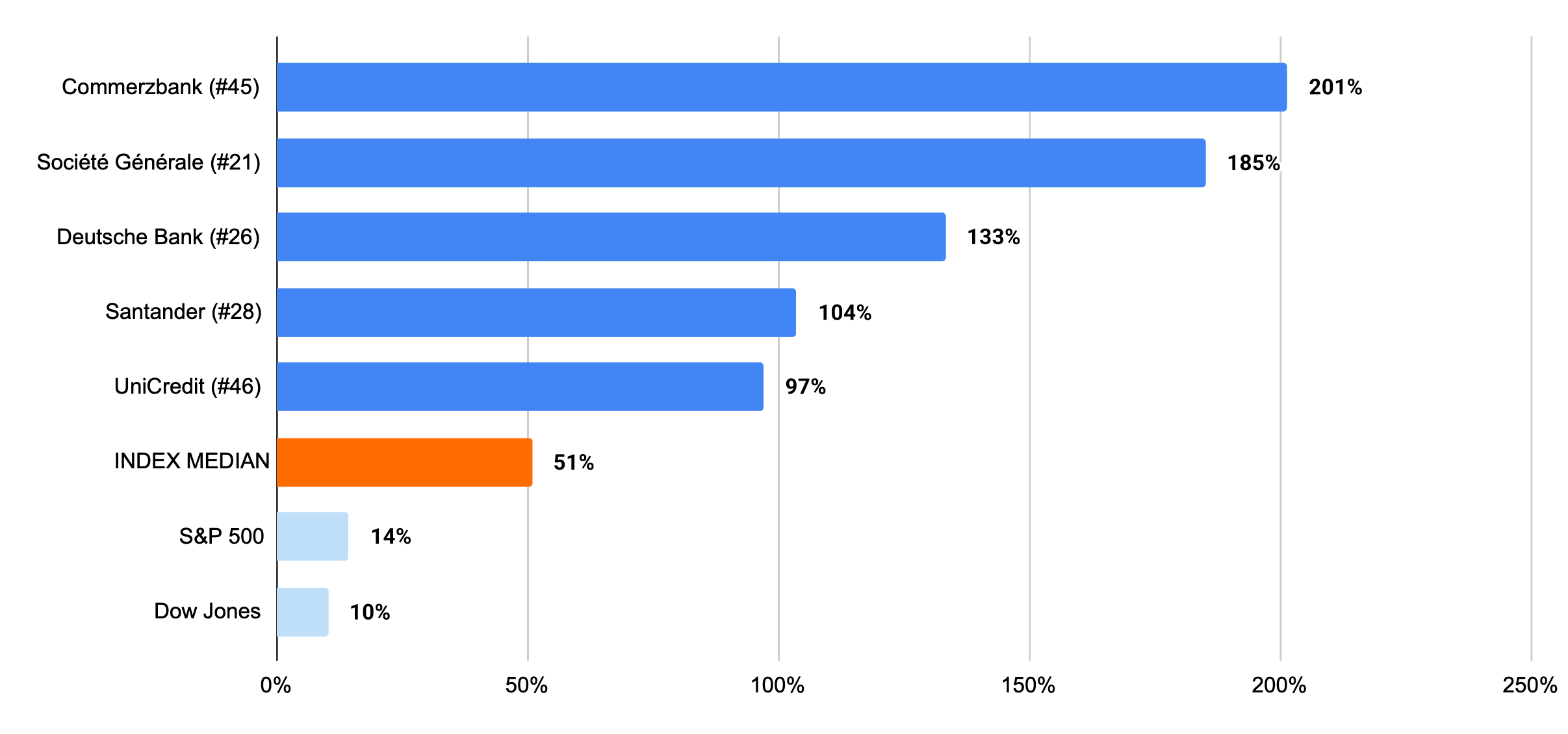

Over the last 12 months, several of the banks lagging on AI in Evident’s ranking of 50 major banks have seen significant growth in share price.

The “Evident ETF” is back. It’s a way to test whether the market rewards the Evident AI Index leaders. In other words, has being good on AI helped make you a great business – or at least been good for your share price?

Last October, when we took stock (so to speak), we found that AI leaders handily outperformed their peers by beating analyst forecasts on reported earnings. We expect this strong financial performance to continue for the top AI banks, as the return on this investment in technology pays off in 2026 and 2027.

Yet when we took a fresh look at the numbers this month, we also found another story playing out — at least for now.

Starting in 2025, the performance of U.S. versus European equities has begun to diverge (sharply). This has muddied the waters. In fact, if we review bank stock performance over the past 12 months, several banks trailing in the Index are now delivering shareholder gains that double or triple the Index's median bank (see chart above).

What’s really going on here? To date, these outsized, mainly-European gains have had a lot more to do with record earnings, aggressive capital returns and takeover speculations than AI. But these AI-trailing banks – now flush with cash – are turning to tech and could be poised to see the same kind of upward trajectory in our ranking.

Take Germany’s Commerzbank (#45 in the Evident AI Index): In her first year as CEO, Bettina Orlopp has prioritized AI-driven efficiency through AI infrastructure partnerships, organizational restructuring and a focus on Gen AI. Since March, the bank inked cloud deals with both Google and Microsoft, consolidated its data and AI teams under Oliver Dörler and rolled out its first customer-facing Gen AI tool – something less than a quarter of the 50 banks we track have done.

Something similar is happening at Santander (#28 in the Index). This year, the bank completed its cloud migration and established a new AI unit under Ricardo Martín Manjón, who reports directly to Executive Chair Ana Botín. Last week, the bank partnered with OpenAI to roll out ChatGPT licenses to employees, a key part of its plan to scale agentic AI in 2026 and 2027.

Looking ahead: The AI landscape in banking is changing as fast as the tech gets rolled out. Is this “second mover advantage” enough to shake up the rankings? Mark your calendars: On October 8, we’ll release the new Evident AI Index and you’ll find out.

Programming note: Starting with this edition, we’ll be making the Evident ETF a regular quarterly feature of The Brief. Any suggestions or comments? Please write us directly at [email protected].

WHAT'S ON AT EVIDENT

On 23 October 2025, we’re back in New York City for the flagship Evident AI Symposium, an annual gathering of the most senior AI movers and shakers in financial services.

Join us and hear from leaders including:

- David Walker, CTO, Westpac

- Foteini Agrafioti, Senior Vice President, Data and AI and Chief Science Officer, RBC

- David Wu, Head of Firmwide AI Product & Architecture Strategy, Morgan Stanley

- Manuela Diviach, Head of Group Operations, Organization and Data, Allianz

- Jason Dreoge, CEO, Scale

- Jodie Wallis, Global Chief AI Officer, Manulife

- Edward Achtner, Vice President, Head of Applied AI, BMO

- Manuela Veloso, Head of AI Research, JPMorganChase

- And many more

MODEL CORNER

SPLIT DECISION

Billed as a game-changer, OpenAI’s newly-released GPT-5 has largely fallen flat with consumers. For banks balancing cost-consciousness with agentic aspirations, it’s not a total disappointment – even if it’s not exactly superintelligence.

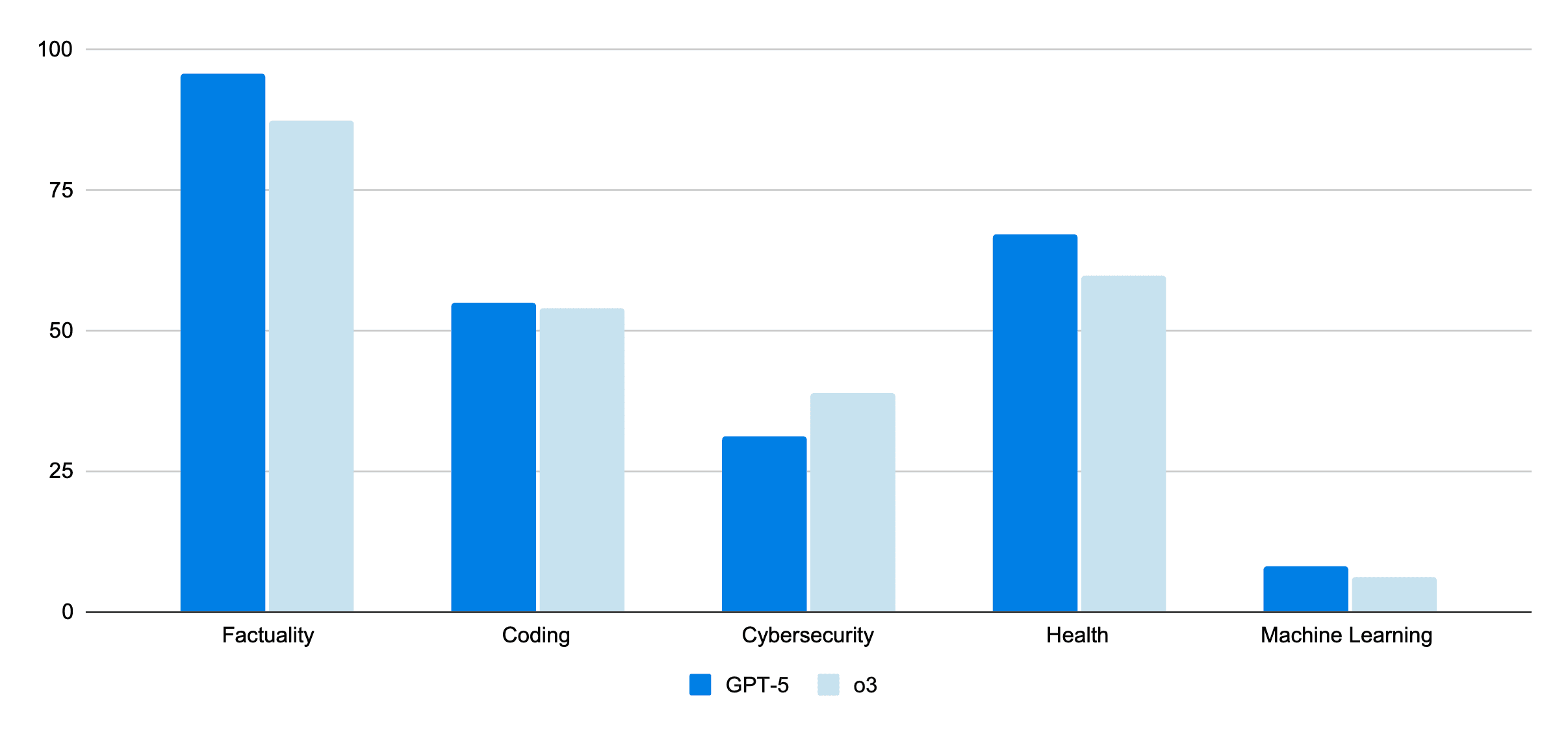

The performance increase may not be much to write home about (see the chart below). But GPT-5’s input cost – how much it runs you to prompt the model – is half the price of its predecessor o3 and one-twelfth the price of Anthropic’s top model Opus 4.1. That means it’s well-suited to run agentic applications on the cheap.

HIT AND MISS

In many widely-used benchmarks for model performance, GPT-5 showed little or no improvement.

BBVA, which received early access to test the model on financial analysis tasks, says it delivers. “GPT-5 marks a significant leap forward for us…in advancing our aspirations toward multi-step agent automation” said Elena Alfaro, the Spanish bank’s head of AI adoption.

Other banks were more underwhelmed, but stopped short of echoing claims that the new series of models (and their rollout) were a disaster. Deutsche Bank’s research arm mused whether “GPT should stand for ‘Gradually Progressing Tech’” in a new report, saying the new models were an improvement but not “superintelligent.” UBS called it “more evolutionary than revolutionary,” mirroring complaints from users who found the new release to be incremental.

Bottom Line: As OpenAI pushes further into enterprise, banks are firmly in its sights. “Financial services is a very interesting area, heavy on data analysis, heavy on research, heavy on planning,” said COO Brad Lightcap in an interview with Alex Kantrowitz of the Big Technology Substack. “As we continue to kind of see GPT-5 permeate the market, we'll get more and more of that feedback and can continue to improve on those use cases.”

NOTABLY QUOTABLE

"Whatever polish you put on top of your product, it has to allow for the engine under the hood to be unplugged and plugged back in with a more advanced system that's coming out every three to six months."

- Demis Hassabis, CEO of Google DeepMind, on Google for Developers, Aug 11

REST OF WORLD AI

ALL KINDS OF NU STUFF

In this new segment, we explore trends in AI development and adoption outside the West.

1. SÃO PAULO: Banks and fintechs are building AI tools directly into apps customers and employees already use rather than trying to force them onto other platforms.

- IN PRACTICE: Fresh from a $27 million raise, Gen Z-focused NG.CASH lets users pay, split bills or send money by texting or uploading an image to WhatsApp. It also offers an AI financial advisor customers can text. Nubank also recently built an internal AI assistant directly into Slack, slashing the time it was spending on ticketing.

- COMING NEXT: Itaú Unibanco, Brazil’s largest bank, is hosting an investor day focused on user experience on Sept. 2. Expect a heavy dose of AI from a bank that already employs more than 500 AI developers (see: “Copacabanka,” The Brief, June 26).

2. JOHANNESBURG: South Africa is one of the only places in Africa that has the cloud “infrastructure necessary to support Gen AI solutions,” a McKinsey report said in May. Banks are using that structural advantage to push into agentic AI.

- IN PRACTICE: Absa’s virtual banker, Abby, is moving from chatbot to agent. Built on Salesforce’s Agentforce, the tool can recommend products and make decisions autonomously – which the bank says is a first in Africa. “We can’t merely focus on efficiency gains,” said Subash Sharma, Absa’s chief digital officer, during this month’s Digital AI Conference. “How do we create new revenue streams, new value propositions” to improve customer lives?

- COMING NEXT: The financial sector will play a key role in Africa’s AI market growing to $16.5 billion by 2030, a new report from Mastercard found. More than 400 million people are financially underserved in Sub-Saharan Africa; the report suggests banks use AI to boost financial inclusion.

3. DELHI: The Indian government is arming banks with AI tools to lift all boats as it vies for regional dominance in finance and R&D.

- IN PRACTICE: RBI, India’s central bank, is rolling out MuleHunter, an AI fraud detection tool it developed, to at least 15 banks nationally. The tool had a 95% accuracy rate in identifying money laundering accounts during a pilot, RBI’s chief general manager Suvendu Pati said at a conference this month.

- COMING NEXT: An EY report earlier this year estimated that Gen AI could improve banking operations in India by 46%. As adoption grows, RBI is focusing on responsible AI, advocating for new financial AI sandboxes and the development of “indigenous financial sector-specific AI models” in a report published last week.

WHAT'S NEW AT EVIDENT

The 2025 AI Outcomes Report explores how leading banks are scaling generative AI tools, creating agentic frameworks and measuring AI returns as their strategies get more sophisticated. Download the full report here.

IN THE NEWS

AI DOWN UNDER

CommBank is betting on multiple AI horses. The Australian bank signed a multi-year deal with OpenAI last week, which gives employees ChatGPT Enterprise licenses and focuses on fraud detection and personalization. In March, the Australian bank expanded a partnership with Anthropic – also focused on “fraud prevention and customer service enhancement.”

Real AI returns will take time, CommBank CEO Matt Comyn and CFO Alan Docherty told investors during earnings. So far, the bank was seeing it pay off through the “quality of retail deposits, improvements in NPS, the improvements that we see in business lending market share growth, the automation of a number of credit origination processes and annual review processes,” Docherty said. But the larger benefits “will take many years,” Comyn added.

Buyer beware: Running AI models through top cloud providers is hurting performance, new research by Artificial Analysis shows. OpenAI’s gpt-oss model loses up to 15% of benchmark performance, depending on who hosts it – with Google Vertex and AWS some of the worst offenders.

Two patents granted this month show banks aren’t as behind on voice authentication as Sam Altman suggested last month (see: “Sam Altman’s Fraud Pitch,” The Brief, July 24). Wells Fargo unveiled a way for AI to detect when fraudsters are using synthetically-created voices to trick identity verification systems. And Morgan Stanley built a model that can detect when fraudsters are using “voiceprints” to circumvent authentication processes.

USE CASE CORNER

CHATTERBOXES

Banks are increasing the speed at which they roll out new generative AI tools (see: “Triple shot of AI,” The Brief, Aug 7). In Use Case Corner this week, we profile two launched this summer.

#1 TRADER’S RIGHT HAND

Use Case: TD Securities AI Virtual Assistant

Line of Business: Investment banking

Vendor: OpenAI

Bank: TD Bank

Why it’s interesting: The bank is putting a generative AI chatbot in the hands of front office traders and research professionals. The tool is “capital markets native,” meaning it was built to understand the specific language and context a front-office banker might prompt it with.

How it works: The tool uses a RAG system to search the bank’s internal research documents and can turn questions into SQL queries that return data or charts when a user’s question requires it. “It’s really about accessing that equity research data that our analysts put out and bringing it to the hands of the sales team in a way that’s sales-friendly,” said Dan Bosman, CIO at TD Securities.

How they did it: The idea for the tool came through TD Invent, a platform akin to an employee suggestion box. The bank’s research arm, Layer 6, then used OpenAI’s models to build and train the tool, giving it access to historical equity data and the bank’s internal documents. Bosman says the bank's tool used new prompt engineering techniques to avoid fine-tuning the underlying model.

By the numbers: The tool is currently in a pilot stage, but the bank says it expects it to improve efficiency and quality of client interactions as it gets rolled out more broadly.

#2 CARD COMPARISON

Use Case: AI agent for product exploration

Line of Business: Retail & personal banking

Vendor: Google Cloud

Bank: CaixaBank

Why it’s interesting: The bank’s Gen AI chatbot can recommend credit and debit cards to customers based on needs they lay out and questions they ask it. Once the customer selects which card is right for them, the tool then directs them to fill out an application for the card.

How it works: The bank was originally using the underlying tech to answer cardholder questions about specific transactions. It then adapted it to respond to questions about its financial products – part of its focus on using AI to create a “more fluid user experience.”

By the numbers: The bank rolled it out to 200,000 of the bank’s customers last month and says it aims to expand its usage beyond card products.

Want to know more about the specific ways banks are rolling out AI? Check out our Use Case Tracker – the inventory of all the AI use cases announced by the world’s largest banks available to members. Also read our newest case study on ING’s Gen AI KYC tool.

TALENT MATTERS

NATWEST AI HEAD MOVES ON

Zachery Anderson is leaving NatWest next month to “pursue an opportunity outside the bank,” the firm said. Anderson held the role of chief data and analytics officer for more than five years. Karen Dewar, the bank’s head of data transformation, will serve as interim CDAO.

JPMorganChase hired Allison Horn as its new head of talent transformation. Horn spent more than two decades in talent roles at Accenture and spoke earlier this year about the importance of training employees to use AI responsibly and ethically.

Cohere – the Canadian AI lab working on Gen AI with RBC – hired Joelle Pineau as its chief AI officer. Pineau comes from Meta, where she served as VP of AI research and worked alongside Yann LeCun to develop Llama.

CODA

PERSONALITY CRISIS

Whenever an SMBC employee wants a one-on-one conversation with CEO Toru Nakashima, they need only ask; his response will be near-instantaneous. There’s one catch: He’s an AI.

The Japanese bank is piloting a chatbot and AI avatar that responds to bankers’ questions with responses modeled off the past statements of its chief executive. As Jurassic Park’s Ian Malcolm might say, “Your scientists were so preoccupied with whether or not they could, they didn’t stop to think if they should.”

The bank’s tool comes right as OpenAI rolls back some of the “personality” it had built into previous ChatGPT models following reports of LLM-fueled psychosis. Are we absolutely sure bankers need an AI version of their boss to whisper sweet nothings to? How long will it be before someone is let go on the same day a sycophantic AI version of their CEO lauds their work?

This use case may be more kitsch than knavish, but after DBS’s board told CEO Tan Su Shan that she, too, could be replaced by AI, the idea of a machine actually running a company feels less far-fetched than it did just months ago. Before we hand over the keys, maybe we should make absolutely sure AI is a good personality fit.

WHAT'S ON

COMING UP

Mon 8 - Weds 10 Sept

Finovate Fall, New York

Tues 9 - Weds 10 Sept

Artificial Intelligence in Financial Services Conference, London

Weds 17 Sept

AI + DC, Washington, D.C.

Mon 22 - Weds 24 Sept

Responsible AI Summit, London

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]