DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Here’s the 2024 Evident AI Index

17 October 2024

TODAYS BRIEF

Welcome to our Oscars.

Today we release the 2024 edition of the Evident AI Index, the industry benchmark of AI maturity in the banking sector.

We set up Evident back in 2022 to build the global standard of AI adoption, and to radically increase transparency around AI deployment in business.

The Index – now in its 3rd year – tells you who’s up and down and by how much when it comes to AI adoption. It’s also a window into where we all are with this transformative technology.

In this special edition of the Brief, we’ll highlight the striking moves on the leaderboard. Then we'll get into the most important trends in Talent, Innovation, Leadership and Transparency of responsible AI activity – the four pillars of the Index.

To unpack the full results, read our Key Findings Report. We sat down with several of our colleagues in a rapid-fire debrief that you can read here. And please join us virtually next Thursday for a special Roundtable where we’ll be discussing the results, or in-person next month in New York for our AI Symposium. What do you think? Write to us [email protected].

And now, the envelope, please…

– Alexandra Mousavizadeh & Annabel Ayles

RED CARPET

“EVERYTHING EVERYWHERE ALL AT ONCE”

The Evident AI Index depicts rapid acceleration with AI over the last year.

The data speaks for itself: over 300 individual use cases announced publicly, 17% year-over-year increase in AI talent, a 59% increase in AI references across bank communications.

Forty-one out of 50 banks improved their score. Twenty-one of those banks also advanced in rank position. And all six regional groups improved their performance (albeit in different ways).

⭐And the winner is… ⭐

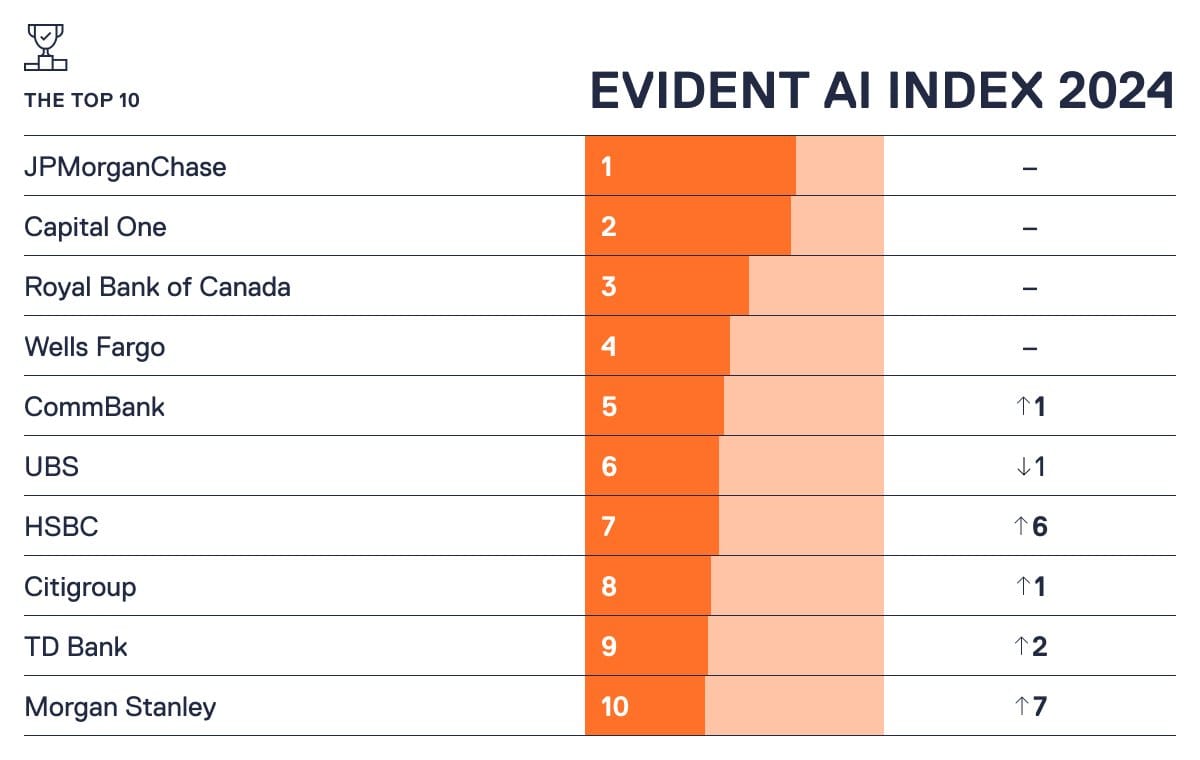

JPMorganChase leads the ranking for the third year running, followed by Capital One (#2), Royal Bank of Canada (#3), and Wells Fargo (#4). The top-4 banks ranks remain unchanged year-on-year and the North American banks continue to dominate the top-10.

Why are the leaders still leading? Firstly, they invested early – whether that be in talent, partnerships, or innovation. They built the capabilities that take time to build. Secondly, they’re continuing to accelerate. The top-10 this year increased their scores at twice the rate of the average Index bank.

It takes time for other banks to catch-up when the goalposts keep advancing.

While North America continues to dominate, new breakaways emerge. Banks from Europe (UBS, HSBC) and APAC (CommBank) are catching-up to the North American leaders. This corresponds with a shift in mindset across these banks from one of “bottom-up" experimentation to a "top-down" strategy in which patterns of use cases are prioritized and coordinated across the lines of business.

Closing In...

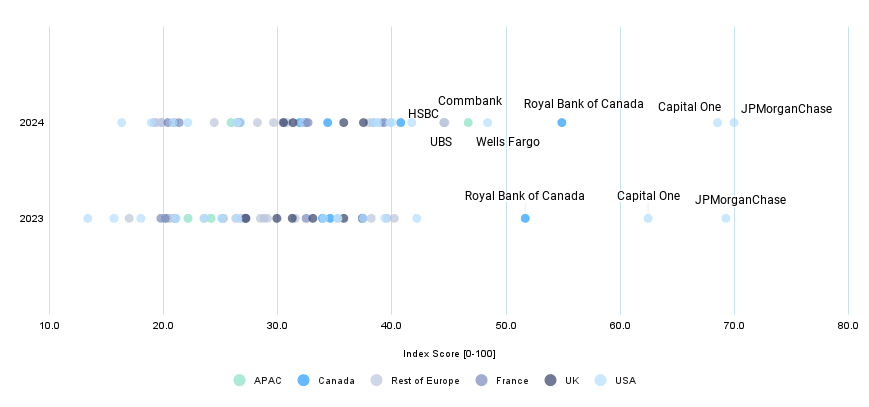

2024 vs. 2023: Evident AI Index scores for 50 of the world's largest banks

To explore the full 2024 ranking, download the Key Findings Report here.

🌎“Around the World in 80 Days”… or make that with 50 banks 🌎

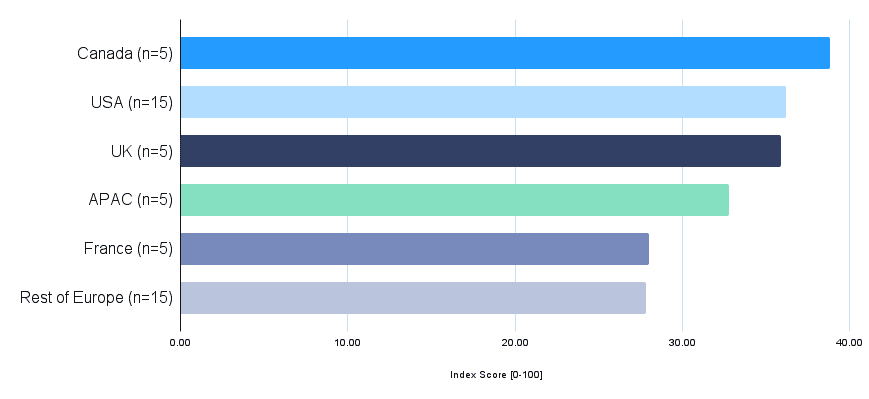

In each region, the incumbent leader held the top spot, and in the U.K., France and Asia-Pacific, the top banks also improved their score the most from last year (HSBC, BNP Paribas and CommBank, respectively). When you break down the results by geography, however, a clear story emerges: The Anglo-Saxon banks outpace the Continentals.

Continental Drift

Average Evident AI Index score, by region (n=bank count)

THE LEADERS

🏆#1: JPMorganChase leads for the third consecutive year🏆

JPMC is the only institution to place in the top-3 across all four pillars of the Index, reflecting the breadth and consistency of the bank’s AI investments. It has by far the largest volume of AI talent; has increased its AI headcount by 16% in the last 12 months; and boasts more AI researchers than the next seven largest contenders combined. Additionally, it is one of only two banks to report realized return on AI use cases – approaching nearly $2 billion.

🏆#2: Capital One hot on their heels 🏆

Capital One ranks #1 overall in Talent and has been steadily closing the gap with JPMC – primarily by extending its lead in this pillar. It has hired AI developers 1.6x faster than JPMC and, while it still lags JPMC in terms of its total volume of AI talent, it leads on the “density” of its AI talent relative to overall headcount. In simplest terms, Capital One’s “traditional” workforce is evolving faster into an AI workforce.

EVIDENT DIAGNOSTIC REPORTS

Evident members can now access the Index Dashboard to explore the data underpinning the rankings – and schedule their customized Index Diagnostic Report. The Diagnostic Report provides a bespoke analysis of a bank’s Index performance versus select peers, clearly identifying strengths and opportunities. Together, these resources help our customers identify opportunities, accelerate initiatives, review progress, and prepare for the next Index update.

Already a member? Log in here. Or contact us to join Evident today.

THE LEADERS (CONT.)

📈“A Star is Born”: HSBC & Morgan Stanley join top-10 📈

HSBC is one of the standouts of the past 12 months. In the Leadership pillar, the bank made major gains in its overall AI Narrative and the “AI focus” of its Executive leadership team, exemplified by the hiring and recent elevation of CIO Stuart Riley to the bank’s Executive Committee. HSBC also made significant headway in Innovation, investing through its ventures arm in Fano Labs in May and Contextual AI in August, and ramping up AI research output.

Morgan Stanley also made gains on Innovation, increasing its research output (up 2.3x vs. 2023) and joining the top 5 banks in AI venture activity. The bank is seeing the upside of its longstanding partnership with OpenAI. Following the launch of AI @ Morgan Stanley Assistant in September of last year, it expanded its AI suite of tools for internal financial advisors with the rollout of AI @ Morgan Stanley Debrief in June 2024. “The AI @ Morgan Stanley Assistant is just the first chapter of what we’re going to do across the financial advisor platform,” its CEO Ted Pick said yesterday when the bank released its stellar Q3 earnings, “[that’s] where we think we’re going to have some real edge.”

🧑📚“The King’s Speech”: Two most improved 🧑📚

BBVA and CIBC saw the biggest year-on-year gains in the Index, taking different paths to get there.

BBVA (up a lucky 13 ranks to #13) went big on Talent, overtaking HSBC and Société Générale in terms of the bank’s overall AI headcount. While Canada’s CIBC (up 19 to #22) focused on increasing transparency of the bank’s responsible AI activities, creating dedicated RAI roles, and publishing RAI principles.

Moving On Up

Change in Evident AI Index score, by pillar

📉Banks that fell out of the top-10 📉

Three did but even these achieved some notable results this past year:

- Goldman Sachs (now #11) earned the top score in our Open Source sub-pillar, and continues to lead the way on Ventures, but remains less forthcoming on its AI strategy, use cases, and return on investment.

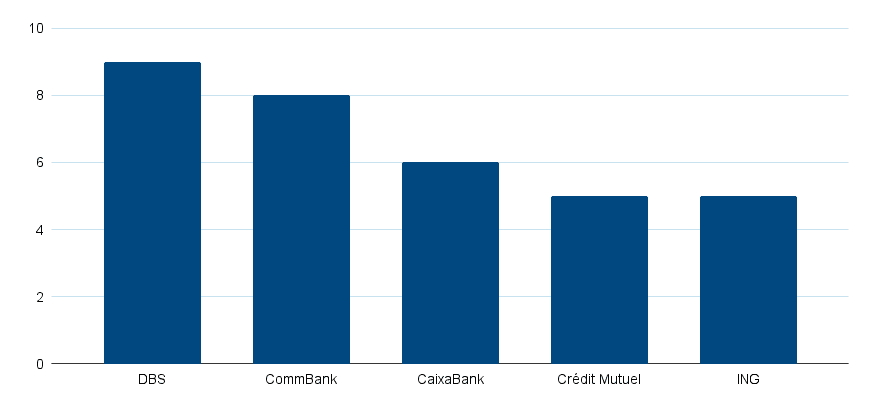

- DBS (#16) remains the #1 bank in Leadership and was one of only two banks (alongside JPMC) to publish a total realized value from their AI investments. The bank’s ranking was dragged down by Innovation, where the bank lacks the research, patents, and partnerships seen at the other leading banks.

- ING (at #17) joined the top-10 performing banks in the Leadership pillar, but lagged behind peers on Talent.

LEADERSHIP

🗞️ “A Few Good Men”: LOTS of AI use cases, too little detail 🗞️

Within the Leadership pillar, for the first time we tracked AI use case announcements.

Over the past year, we’ve gone from a handful to over 300 AI applications reported by the 50 Index banks. That’s a big jump and a testament to the banks starting to push use cases into production. But less than a quarter of those include crucial data on realized outcomes – whether in cost savings, efficiency gains, enhanced customer satisfaction, or revenue uplift.

Five banks stood out, sharing concrete outcomes about five or more use cases. (For the full list, check out pages 34-35 in the Key Findings Report).

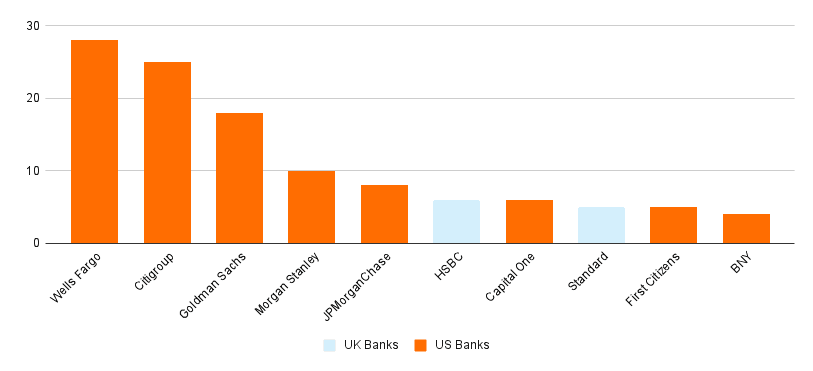

Show Me the Money

Index banks reporting the most AI use cases attached to outcomes

While nearly all 50 banks share AI use cases, only 26 banks shared any outcomes. Of those, six provided financial outcomes. The good news: Banks want to talk about ROI. The bad: As many banks avoid the conversation.

🎥 GET YOUR (WEB)CAMERAS READY 🎥

Join us virtually at our upcoming Evident AI Index Roundtable on Thursday October 24 at 15.00 BST (10.00 EDT).

We will dive into the October 2024 Evident AI Index ranking to discuss:

- Where are banks in their journey to AI maturity?

- How has this changed in the past year?

- Which banks are surging ahead and which are falling behind?

INNOVATION

💰“Moneyball”: Who’s placing bets where 💰

Ventures is one of six key areas tracked within the Innovation pillar. Here, North American banks dominate venture activity focused on AI start-ups, representing eight of the top-10 banks by levels of deal flow over the past three years. Europeans are getting in the game – with HSBC cracking the top-10 list (see below) for the first time by sneaking past ING, Barclays, and UBS.

The Great Race

Here are the three, in our view, most notable investments this year:

- BNP Paribas signed a comprehensive partnership deal in July with Mistral AI, taking part in the French startup’s $640M fundraising round.

- Citi Ventures in April invested in Glean, an AI-powered work assistant that specializes in retrieval-augmented generation (RAG).

- Goldman Sachs joined market intelligence platform Alphasense’s Series F round in June, which valued the company at $4 billion. The bank had previously led the Series D funding round for the company.

TALENT

🧑💼Where the jobs are 🧑💼

Within Talent, we’re talking Talent Capability (“how much talent do you have”) and Talent Development (“how do you get – and keep – it”).

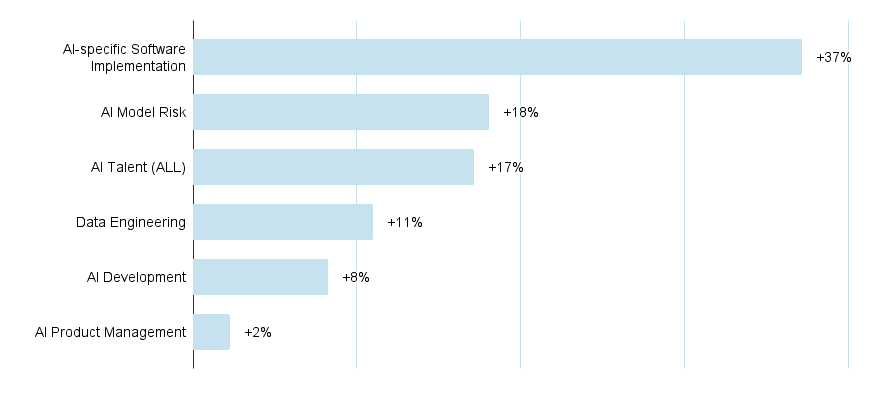

In rifling through banks’ personnel files (metaphorically speaking), we identified 70,000 employees in 200 AI-related roles – still a relatively modest share of the overall 3.7 million employee workforce. We grouped those roles into five capability areas – AI Development, Data Engineering, AI Model Risk, AI-specific Software Implementation, and AI Product Management – to get a picture of where banks are deploying their people.

The Index banks’ AI workforce grew 17% in the last year, and the fastest growth, up 37%, was in AI-specific software implementation. That tells us banks are hiring to adapt and scale AI use cases.

AI Talent Stack

LEADERSHIP

🧠 “A Beautiful Mind”: Thought leaders 🧠

We track and, naturally, rank banks broadly on their Leadership on AI (props to Singapore’s DBS for retaining its top spot). In doing so, we read the thought leadership research – whether on productivity, sustainability, returns or workforce impacts – produced by the banks. Here are the five that really caught our eye.

- Goldman Sachs: “AI could drive a 7% (or almost $7 trillion) increase in global GDP and lift productivity growth by 1.5 percentage points over a 10-year period,” calling the impact “profound.” But the bank tempered its enthusiasm compared to last year, saying there needs to be better “actual uptake.”

- KBC: The risks of mass unemployment are overstated, especially in the current macro context of a tight labor market.

- Citi: Total profits in the banking industry are set to hit $2 trillion by the end of 2028. Plus, while AI adoption may eventually create jobs in finance, the war for AI talent will continue.

- Morgan Stanley: The electricity needed to power the demand for Generative AI is set to increase 70% annually. By 2027, that’ll be on par with Spain's total energy consumption.

- ANZ Bank: Engineers using Github Copilot were 42.6% quicker to complete coding tasks and less likely to have faulty code versus those not using the tool, according to findings from the bank’s pilot.

AFTER PARTY

So there you have it. The Evident Oscars are over. Now for the nightcap (of sorts) we’d invite you to join Alexandra and Annabel, and their colleagues Colin Gilbert, Sam Meeson and Mike Silverman, for an extended conversation about what we found in putting together this year’s Index. And don’t forget to register for next week’s live virtual roundtable with special guests where we’ll take your questions and discuss these results.

COMING UP

Mon 21 Oct - Thu 24 Oct

Sibos, Beijing

Tue 22 Oct

Data and the Future of Financial Services Summit, London

Wed 23 Oct

FTLive: AI for Business Transformation, Singapore

Thu 24 Oct

Evident AI Index Roundtable, Virtual

Sun 27 Oct - Wed 30 Oct

Money 20/20, Las Vegas

Thu 21 Nov

Evident AI Symposium, New York

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]

- Mike Silverman|Director of Research|[email protected]