DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Special Edition | 167 ways banks use AI

Source: Adobe Firefly

20 February 2025

TODAYS BRIEF

Welcome back!

Some home news: Today Evident launched the Use Case Tracker. Evident members can now access a comprehensive database that includes and analyzes all the AI use cases unveiled by banks. There’s no better way to understand a bank’s strategy and its maturity on AI than to look at what they’re building. Reach out to us to learn more about the Tracker.

So for The Brief this week, we decided to stay single-minded and focus on use cases. Crunching data from the Tracker, we see three clear trendlines for banks’ adoption of AI in the year ahead. This sector has been the bellwether for how businesses take advantage of this technology, and that's truer than ever. You’ll also hear directly from leaders of three banks about their most innovative recent use cases.

The Brief is 2,024 words, a 6 minute read. You can read this Brief online and subscribe here. Our email is [email protected].

Dive Deeper: Explore the Use Case Tracker

TRENDING NOW

WHAT USE CASES TELL US

In the early days – oh, a year or two ago – the banking industry started to get its head around Gen AI and roll out some use cases.

Today, no major bank isn’t building out tech platforms, setting up governance rules and hiring the sharpest people they can find to help them integrate AI into their business. The use cases are more varied and sophisticated.

Now fast forward a few months, and you’ll see banks come under ever greater pressure to show how these billions in investments are paying off.

In looking closely at the 167 AI use cases announced by 50 of the world’s largest banks in the past year, we see this all play out in granular detail. Here are the three most important trends that jumped out to us:

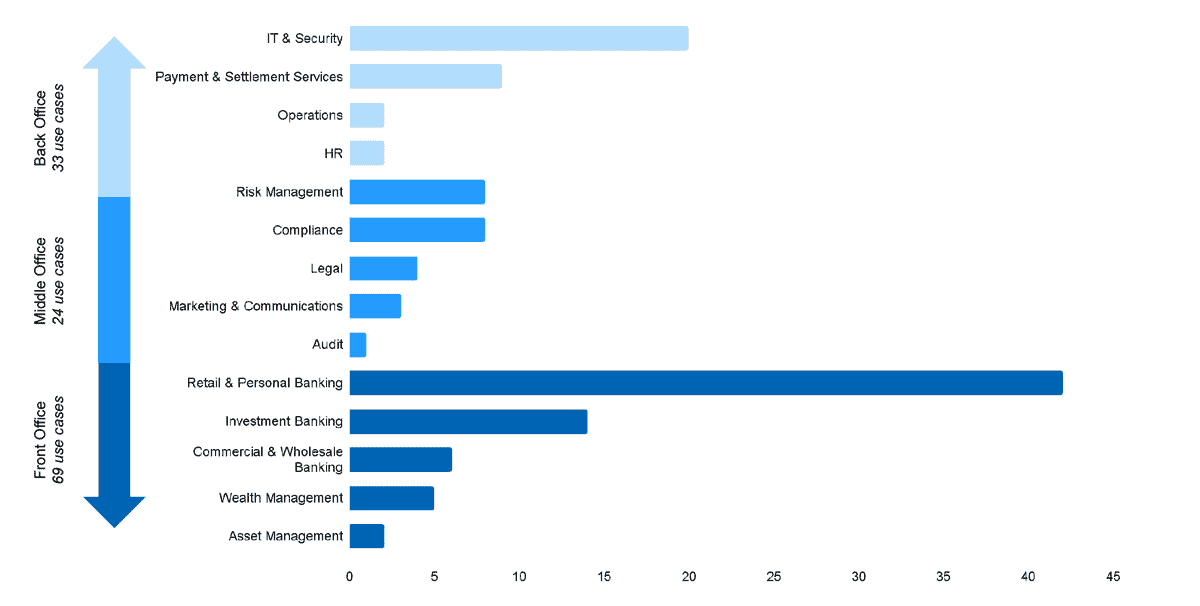

#1: AI EVERYWHERE

Banks are pushing AI use cases into every corner of the business, from the bowels of the organization to the trading and retail floors.

Here, There and Everywhere

Bank use cases are proliferating and getting more complex in the process

Let’s dig into a few of these.

The most AI use cases were deployed in retail and personal banking – mainly chatbots. That may not sound cutting edge, but there’s lots of innovation here. ING and NatWest worked generative AI into their chatbots. BBVA recently did the same, allowing customers to complete more complex tasks – like cancelling a card – conversationally.

In another hot area – IT & security – use cases mostly help developers write code. Some other applications caught our eye, though: ANZ uses generative AI to simulate phishing attacks; CommBank lets ChatIT handle employee tech questions.

A handful of the investment banking use cases let bankers query internal documents colloquially (see: Goldman Sachs’ Legend AI Query or UBS’s Red Platform). Some help give traders and investors an edge (see: Morgan Stanley’s MNLPFEDS that interprets sentiment inside the Federal Reserve and RBC’s VWAP).

Finally, in compliance, banks lean on generative AI to adapt to new regulations and enhance AML controls. Santander's tool analyzes spending patterns to flag potential human trafficking cases. A Citi tool determines which regulations might impact a project and summarizes them.

- Bottom Line: AI is not a mystery. It’s a puzzle that businesses are solving one piece at a time.

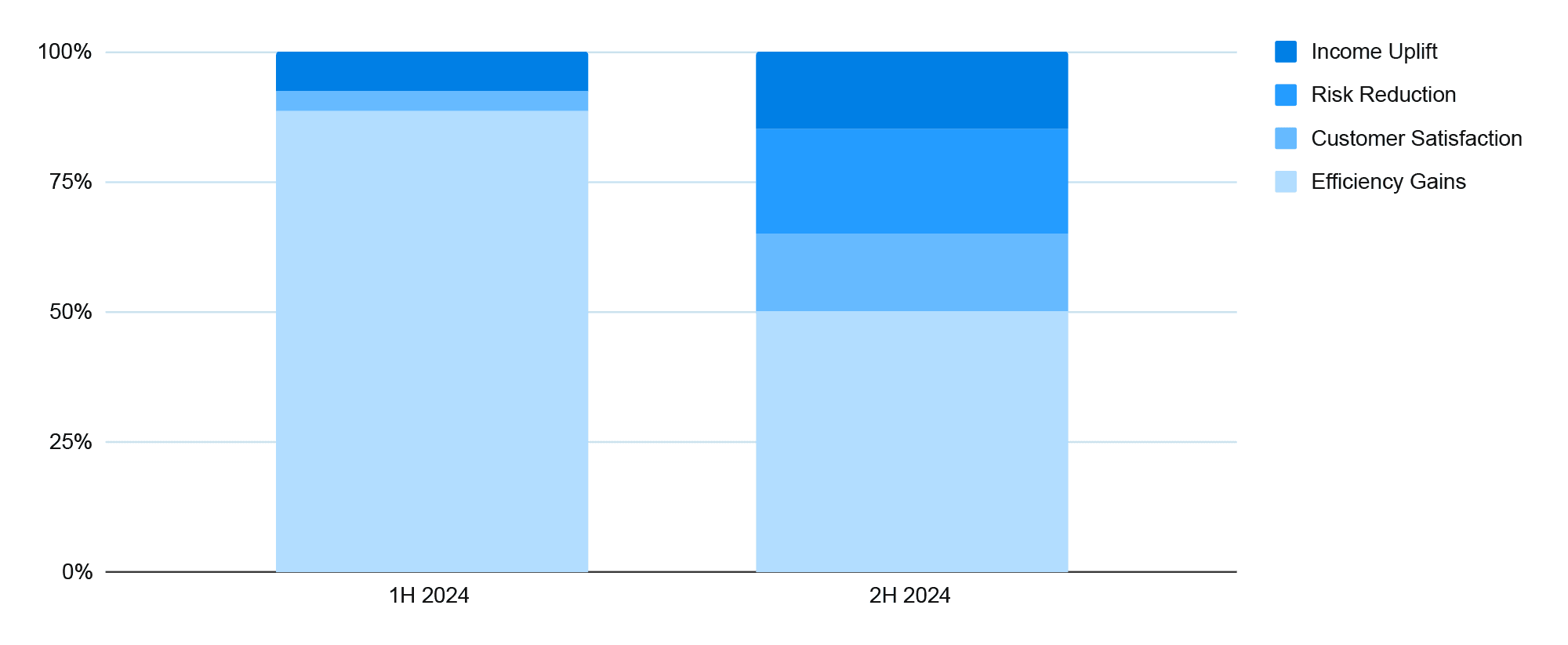

#2: BEYOND PRODUCTIVITY

AI, we know, makes you more productive. The most recent batch of use cases tells a richer story. Banks are getting more out of AI. Nearly half of the use cases in the second half of last year reported benefits to the business beyond more efficiency.

Cashing In

The share of AI use cases reporting income uplift nearly doubled in the second half of the year

- Bottom Line: Improving efficiency and cutting costs will always be important, but leading banks are using AI to improve customer experiences and unlock entirely new revenue streams.

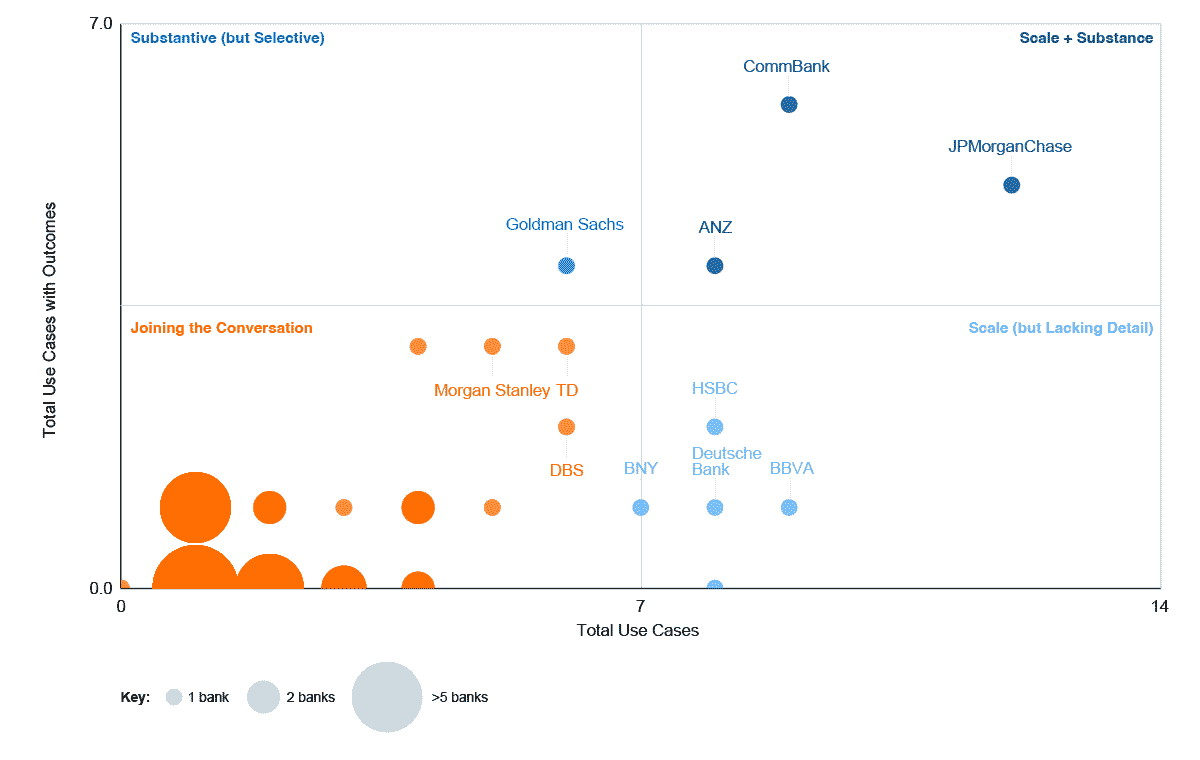

#3: DETAILS, PLEASE

Most banks talk the talk, only a few walk it as well.

CommBank, JPMorganChase and ANZ are in our “scale + substance” sweet zone (see below), sharing details about the outcomes from more than half of their announced use cases.

Goldman Sachs is joining them, holding the “substantive (but selective)” fort. The rest of the banks are for now just joining the conversation.

Sound and Fury

How many AI use cases banks are disclosing vs. how many include tangible outcomes

- Bottom Line: When banks can communicate specifically about how they use AI and the returns they see, it shows they have a good framework to measure ROI.

What’s public only scratches the surface of a bank’s full AI portfolio. JPMC says they have 400 use cases in production. Wells Fargo, highly selective about the use cases they share, says “a huge number” are operational.

Many cybersecurity and anti-money laundering use cases stay under wraps to keep them away from bad actors. For the same reason, banks don’t share details about their fraud use cases. Even though many banks patent a lot of their AI work on trading, they tend to hold details of those use cases close to their chests for competitive reasons.

Coming soon: The Evident AI Outcomes Benchmark. See how your organization’s AI use cases, spend, and ROI stack up vs the rest of the financial services sector by participating in our new survey-based benchmark. To find out more, email Alexandra at [email protected].

USE CASE CORNER

HOW THEY BUILT THEM

We gathered three AI leaders to explain a recent use case they deployed at their bank:

- Prem Natarajan: EVP, Chief Scientist and Head of Enterprise Data & AI at Capital One

- Dan Jermyn, Chief Decision Scientist at CommBank

- Foteini Agrafioti, Chief Science Officer at RBC

Each brings a unique perspective. Capital One and CommBank are the only banks that have gone public with agentic AI use cases, while RBC’s tie-up with Cohere saw them break with the recent focus on open-source models.

Evident members can read the full interview with Prem Natarajan and explore our case studies about RBC and CommBank in the Member Hub.

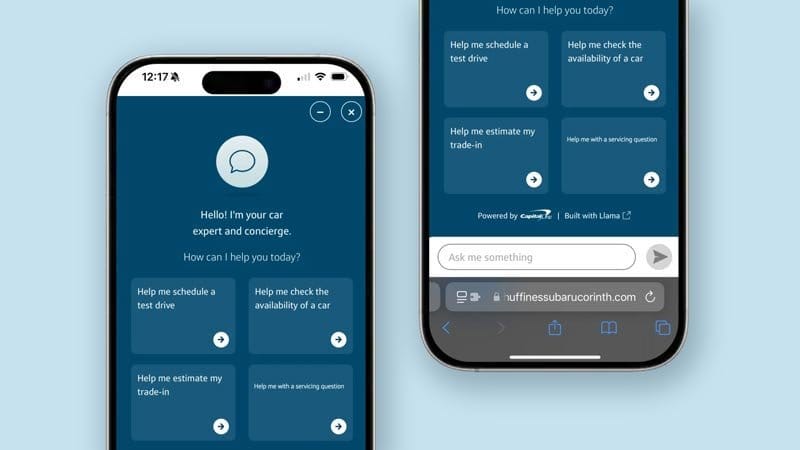

AGENTIC IN THE WILD

Chat Concierge – Capital One’s new agentic AI tool for car-buying – moves beyond what a typical chatbot can do by “breaking down a complex, overarching task into component parts with multiple AI agents,” Prem Natarajan said. Instead of just pointing a customer in the right direction when they ask a question, the tool (see below) can schedule appointments with salespeople or estimate the trade-in value of a user’s car.

CommBank is employing agentic AI to address some of the 15,000 payment disputes the bank processes each day. “When a customer is reaching out to us in an AI-assisted channel, it’s important for us to be able to understand their intent,” Dan Jermyn said. Customers who didn’t receive the stuff they ordered with their CommBank credit or debit card can explain the situation to the tool and get their dispute lodged automatically upon satisfaction of the right criteria.

What made these use cases the right fit for agentic AI?

- JERMYN: “In some ways, this is a relatively simple use case for us, but one that also encompasses a huge range of components and possible outcomes: from getting information from the customer and verifying details about the transaction, to the process of rectifying the transaction upon validation.”

- NATARAJAN: “Three things. First, buying a car can actually be a high stress, high friction task – and the second largest purchase decision many people make outside buying a home. Second, from a technical perspective, it’s a complex task – so it’s very conducive to an agentic workflow framework. So this use case allows us to test the ability of agentic AI systems to deliver a smooth user experience even in the face of complexity. Third, it’s relatively low risk – which is how we want to build AI systems. We want to start somewhere lower on the overall risk spectrum with clear guardrails and responsibly slope our way up as we learn and refine our approach.”

OPEN VS. CLOSED

Banks have largely steered clear of bringing LLMs hosted on the public cloud close to their most sensitive data. RBC and Capital One take different approaches to layering generative AI capabilities onto that data. Both are working to balance the risks with the costs.

RBC and Cohere are now building models together using the North platform. Because they’ll be hosted on-prem, the models can be deeply customized and trained with that sensitive data, allowing teams to “securely access and query critical information,” RBC’s Foteini Agrafioti said. It’s part of the bank’s strategy to bring autonomous agents to core banking. She added the next steps include solving “for a wide range of risks around what an agent might do” with that sensitive data before ultimately having agents “executing tasks for clients automatically.”

Capital One on the other hand is looking to customize open source models on top of its vast trove of data – which is structured well thanks to the bank’s early cloud adoption. This approach is in tune with the recent upswing in the popularity of open-source models.

What makes the approach right for you?

- AGRAFIOTI: “Moving forward, the choice was either to continue to just buy from any one of these companies or work directly to co-develop solutions that are more fit for our market. And frankly, we see that as an enabler. This is not just about speed. The reason why Gen AI hasn't really taken off as much in banking is because of the risks that come with AI – data loss, and hallucination, which we are looking to tackle.”

- NATARAJAN: “I think the future is customized models. For most enterprises, their data advantage is their AI advantage. Proprietary data enables enterprises to add unique value – whereas a lot of stuff around pre-training is becoming a commodity. While Capital One maintains the optionality of building versus leveraging open source models, training is expensive and doesn’t always necessarily add more value.”

PARTING SHOTS

So what’s the key to getting AI right for your business?

- AGRAFIOTI: “Our approach will be focused and deliberate, carefully managing risks along the way – and we’re prepared to take as much time as needed to get it right."

- JERMYN: “The practice of product management will itself need to be adapted as the technology develops, from more traditionally structured approaches to a broader, dynamic ecosystem view.”

- NATARAJAN: “I think the focus on short-term ROI is why many companies never make the technology transformation that unlocks long-term ROI. You’re either going to transform the future or you’re not.”

Visit the Member Hub to read the full interview with Prem Natarajan and explore our case studies about RBC and CommBank.

SPEED READS

EVERYONE’S TALKING ABOUT USE CASES

“While 2024 was the year of generative AI pilots, 2025 will be the year of LLMs and LRMs (large reasoning models) transcending narrow use cases,” per IBM’s 2025 banking outlook. Only 8% of banks are currently developing Gen AI “systematically” by implementing use cases across different parts of the business, the survey of 600 banking executives found.

“Data analytics remains the predominant AI workload, with companies leveraging this technology to harness vast amounts of data to better detect fraud, personalize services, predict market trends, and manage investment risk,” according to NVIDIA’s “State of AI in Financial Services” 2025 report.

The Anthropic Economic Index found that AI use cases favor augmentation of existing human capabilities (57%) over wholesale automation (43%).

TALENT MATTERS

SETTING STRATEGY

Société Générale opened a new business unit “dedicated to AI deployment on a large scale.” SocGen AI will be headed by Nicolas Meric, who joins from LineData. Bank veteran Etienne Guibout will step in as Group Chief AI Officer.

BBVA named Antonio Bravo as the bank’s new Global Head of Data, a role which includes oversight of the company’s AI Factories in Spain, Mexico and Turkey.

BNP Paribas appointed Philippe Maillard to be its Chief Operating Officer. He’ll oversee the IT group and the Group Data Office, among other units.

WHAT'S ON

COMING UP

Fri 21 Feb:

MIT Fintech, Cambridge MA

Tue 25 - Wed 26 Feb:

Finovate Europe, London

Mon 24 - Tue 25 Feb:

Future Digital Finance Connect, New Orleans

Wed 26 - Thu 27 Feb:

CDAO Financial Services, New York

Mon 28 Apr:

Financing the AI Revolution, New York

Tues 29 Apr:

LlamaCon, TBD

Correction

The Use Case Trends section was updated to reflect that CommBank's ChatIT tool handles employee tech questions. Our apologies.

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]