DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Banks' AI Bets

4 April 2024

TODAYS BRIEF

Welcome back to The Brief, our new publication that brings you the latest of Evident’s data-driven insights as well as our take on the most recent AI news and announcements across the banking sector.

Today we dive into recent patent activity and answer the question you hear asked most about business and AI—how is it being used to drive the bottom line. Plus, the latest talent moves. The Brief is 1,674 words, a 5-6 minute read.

If this newsletter was forwarded to you, subscribe here. We want to hear from you: [email protected].

A programming note: Join us virtually at next week’s Innovation Roundtable with Chintan Mehta, Group CIO at Wells Fargo, and EJ Achtner, who heads up the Office of Applied AI at HSBC. Sign-up here.

LATEST FROM THE EVIDENT AI INDEX

PATENTLY USEFUL

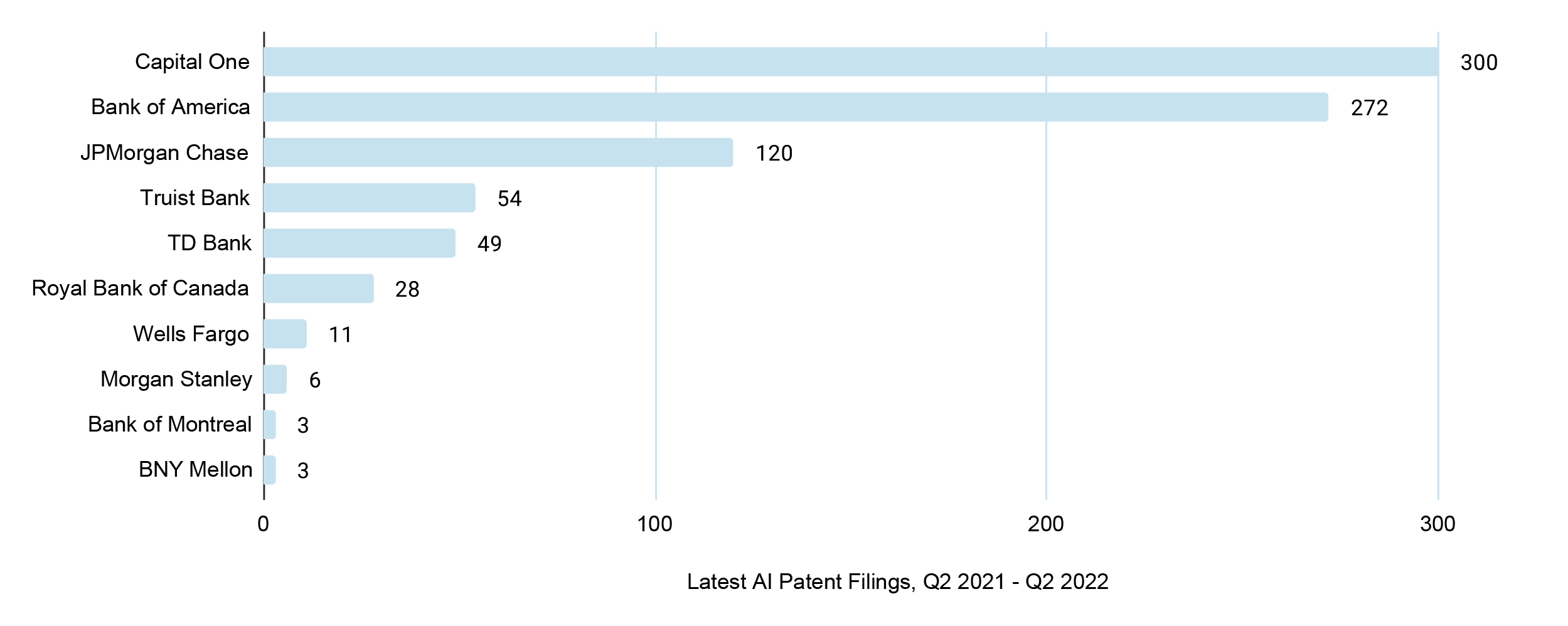

We looked at over 2,000 AI patents filed by the 50 banks in the Evident AI Index to see where research dollars are going.

Leading the way: Capital One and Bank of America account for 72% of AI patent activity over the past five years of available data. But in recent years, new banks have entered the fray. Truist Bank filed nearly 60 patents in the first half of 2022 alone, in anticipation of launching an AI-powered financial assistant.

Top 10 Banks, by Number of AI Patents Filed

12-Month Period, Ending Q2 2022

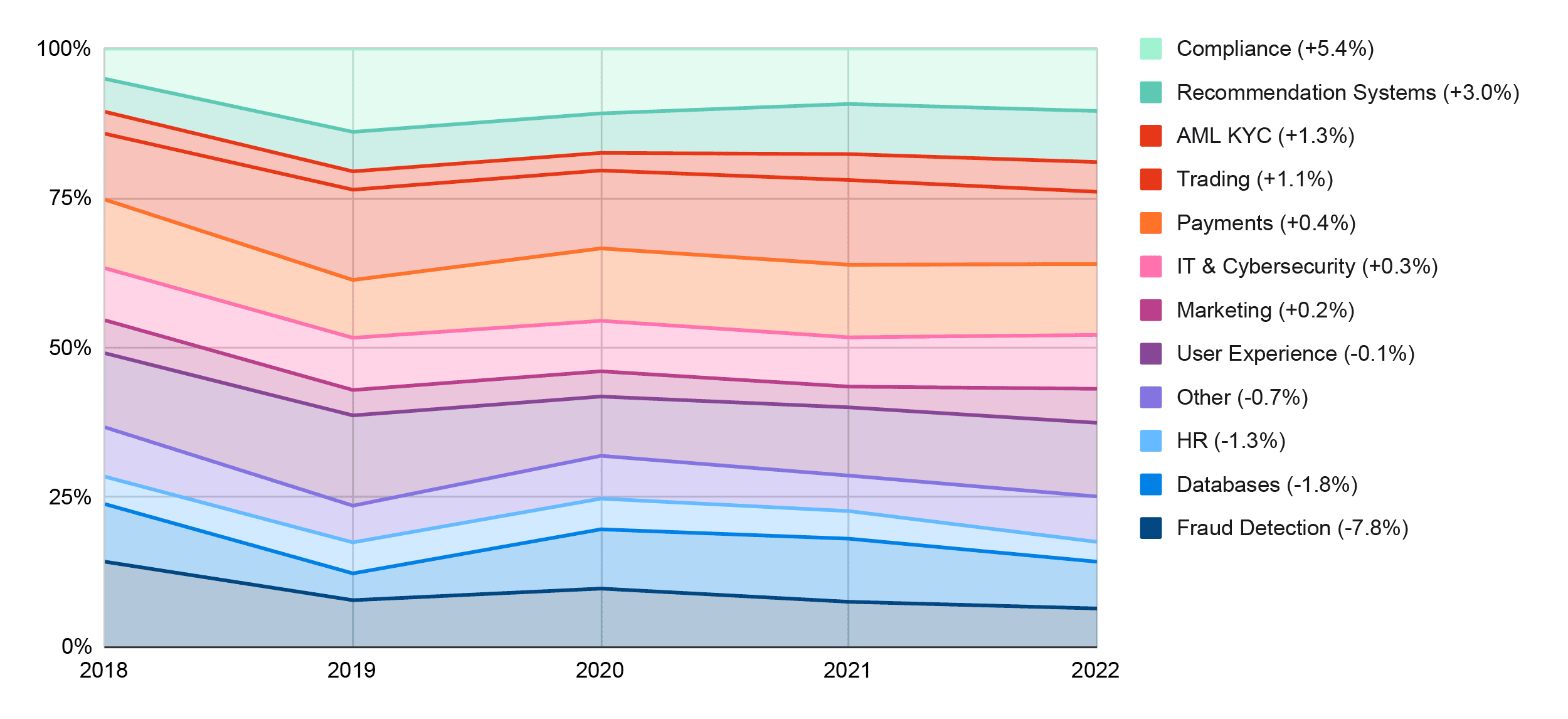

More banks, more use cases: We’ve also seen a shift beyond fraud detection to a wider range of use cases. Specifically, banks are now fast increasing their focus on compliance, anti-money laundering efforts and personalized product recommendations for consumers.

Share of AI Patent Filing, by Use Case

2018 - 2022 (% change)

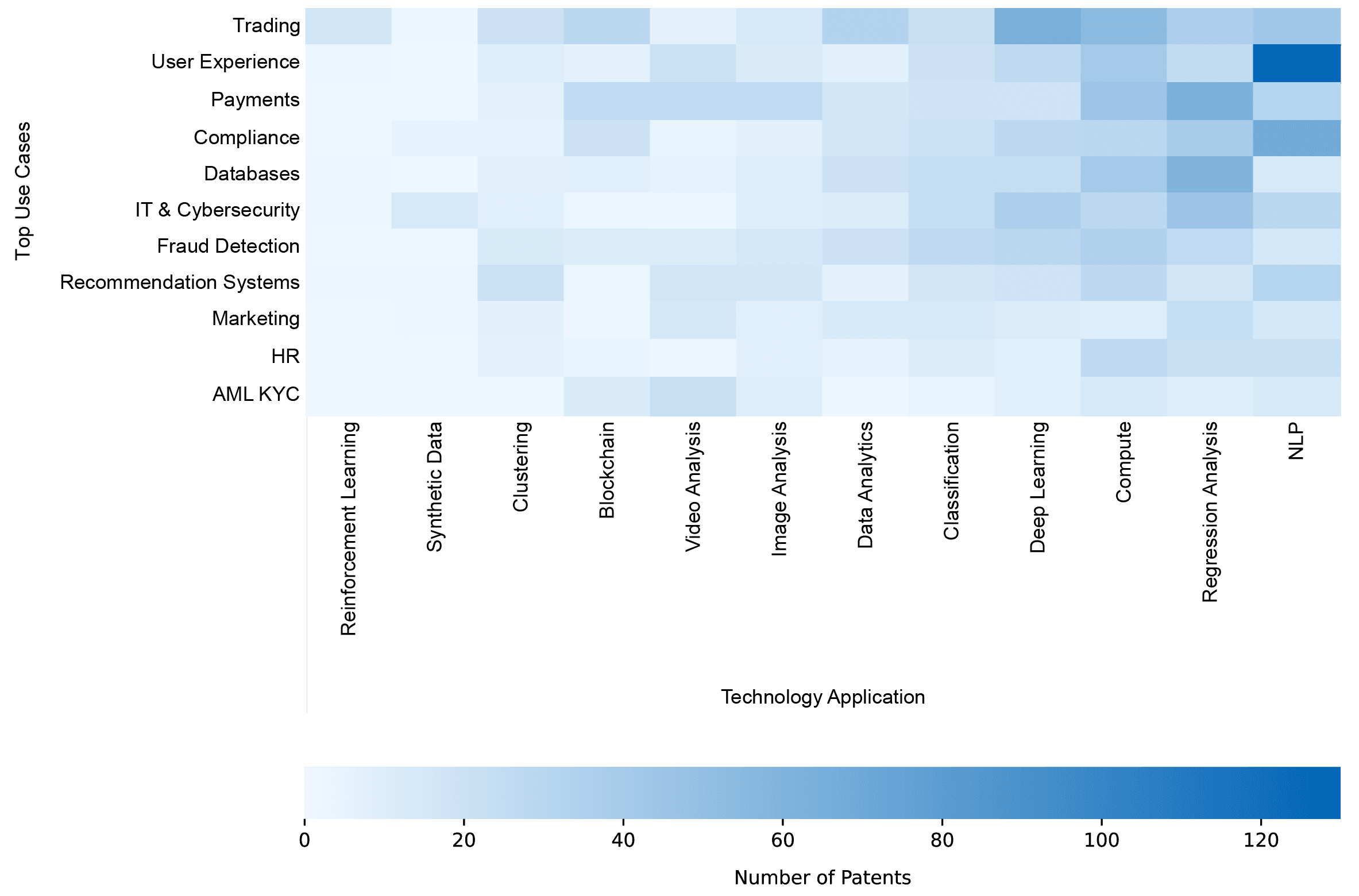

Big bets on generative AI: Nearly a third of all AI-related patents now focus on applications of NLP and deep learning, as the heat map below shows, signaling a shift from predictive AI to generative AI over the last five years.

AI Patents by Focus Area

2018 - 2022

Power in the hands of a few: While more banks have filed patents than ever before, 90% of all patents related to generative AI were filed by just five banks: Capital One, Bank of America, JPMorgan Chase, Royal Bank of Canada, and Wells Fargo.

So what? Generative AI is now a top priority at all major banks, but the banks that had developed—and protected—IP in this space were arguably better positioned to capitalize on the latest generative AI advancements. But despite the head start, it remains to be seen how quickly such IP translates to ROI in the long-term.

Read more in Evident’s AI Patent Dispatch. Get in touch to find out more about membership.

USE CASE CORNER

SHOW ME THE ROAI

Banks are increasingly sharing how they deploy AI and hinting at the ROI of their investments—call it ROAI, return on AI. We’ll regularly scour the announcements and reality check the claims. These three use cases stood out in the past month:

#1: User Experience

Tool for improving administrative efficiency for small businesses

Bank: NAB

Use Case: Bookkeeper

Vendor: Thriday

Why it’s interesting: Thriday developed the Machine Learning tool to help small traders automate administration tasks. NAB Ventures backed the start-up, and the Australian parent bank has since made the product available to its small business customers—showing the benefits of having a strong ventures arm.

Potential ROI → increased customer satisfaction

Reported ROI → reduced admin time by up to 5 hours per week

#2: Recommender Systems

Insight generator for wealth management advisors to detect significant “life events”

Bank: RBC

Use Case: TIFIN AG

Vendor: TIFIN

Why it’s interesting: This new program gives wealth managers the ability to better track clients’ financial behavior. The program is integrated into RBC’s CRM and marketing stack to support the 2,100+ investment advisors at RBC in deepening customer relations, and has been rolled out company wide since the initial pilot in August 2023.

Potential ROI → increased recurring revenue

Reported ROI → N/A

#3: Fraud Detection

Tailored prompting questions to protect customers against fraud

Bank: WESTPAC

Use Case: SaferPay

Vendor: N/A

Why it’s interesting: Westpac have used NLP to tailor specific prompting questions for customers throughout the payment flow process. It’ll be rolled out to customers in coming months. NAB launched a similar prompting capability last year, and reported that losses from scams fell 24%, saving customers $80 million (AUD).

Potential ROI → increased customer satisfaction, reduced fraud, reduced risk

Reported ROI → N/A

More News on AI Use

Wells Fargo: Its use case pipeline includes 191 AI Machine Learning and NLP projects, with nearly half already in production, Wells Fargo’s Chief Information Officer of Consumer Technology, Steve Hagerman, announced March 18th.

BNY Mellon: Buried in its announcement last month of the first major partnership with Nvidia’s AI Supercomputer, BNY claimed that its AI Hub has more than 20 AI-enabled “solutions” in production and has identified more than 600 opportunities in AI, with “dozens” already in development.

Goldman Sachs: In a recent interview, Global Chief Operating Officer of Engineering Gunjan Samtani said that “more than 100 ideas” for generative AI have been identified across the firm, with a “dozen proofs of concept”.

More background here: The Evident AI Outcomes Report looked at how banks organize themselves on AI, and defined 27 key KPIs they should track to deliver value on their AI investments.

WHAT’S ON AT EVIDENT

Book your place at Evident's first virtual roundtable of the year, as we will dive into the latest findings from our updated Innovation Report (releasing April 2024) to consider:

- How are major banks driving AI innovation?

- How are they thinking about the choices and trade-offs?

- And how are banks’ innovation strategies driving outcomes from AI?

We are delighted to be joined by AI leaders driving the innovation agenda at two of the world's largest banks to find out more about their innovation strategies and how they are driving outcomes from AI today. The roundtable is open to all.

NOTABLY QUOTABLE

"In a presentation [in March], the venture-capital firm Sequoia estimated that the AI industry spent $50 billion on the Nvidia chips used to train advanced AI models last year, but brought in only $3 billion in revenue."

EVIDENT SPEED READS (AND A LISTEN)

FIVE ITEMS THAT CAUGHT OUR ATTENTION

U.S. Treasury says small banks are vulnerable to fraud in the AI era. Based on over 40 interviews, the Treasury report points out a widening capabilities gap between large and small financial institutions on being able to defend against attacks using generative AI. (OpenAI’s new voice-cloning tool gives a sense of what fraudsters might now be able to use)

Capital One announces partnership with Columbia University to accelerate Responsible AI research. The bank put up $3 million for a new Center for AI and Responsible Financial Innovation (CAIRFI) to support research projects and hold events.

Podcast: How NVIDIA is accelerating financial services into the AI age. Malcom deMayo, Global Head of Financial Services Industry at NVIDIA, talks to Lex Sokolin at Fintech Blueprint. Nvidia helped banks report credit losses five times faster, he said.

Australian stock picker backs CBA to lead the way on AI adoption in the country. Commonwealth Bank of Australia is well placed to “gain the most from integrating AI into its operations,” said Anthony Aboud of Perpetual Investment Management.

Worst Taiwanese earthquake in a quarter century highlights a threat to global AI supply chains from the high concentration of semi-conductor chip production on the island, reports Bloomberg, even though production, including at giant TSMC, was mostly unaffected.

TALENT MATTERS

SEEKING GEN-AI GENERATION

Banks push senior generative AI roles: Capital One wants a new Director of Generative AI to build out its platform. The job ad emphasizes the need for experience in running “training clusters,” which suggests the bank wants to design, train and develop its own large ML models, including LLMs. Raiffeisen has open roles for a Generative AI Solution Architect and Senior Data Scientist with Generative AI focus. Just shows that not only the big players are hunting for elite generative AI talent.

JPMC looks to strengthen it's Applied AI/ML team in London: The bank has at least five open roles for Applied AI/ML Lead (see here) at different levels of seniority including Director, VP and Senior Engineer. Most sit in the Applied Innovation of AI team within a strategic unit of the CTO’s Office.

Payment Providers take leaf out of Big Tech book with PhD internships: Visa is offering three internships for PhD and Masters level candidates across data analytics, ML and cybersecurity. That’s how Meta and Google developed their talent funnels.

Deutsche Bank hires new Head of Group Technology Infrastructure: Tony Kerrison was previously CTO at Bank of America

Santander U.S.’s new digital push: Spanish bank named Swati Bhatia, who previously ran Marcus, Goldman Sachs’ digital banking platform, its U.S. Head of Retail Banking and Transformation.

CODA

AI “PRODUCTIVITY” REALITY CHECK

Is the AI economic boost for real? If so, at what cost? It’s sure boosting Big Tech stocks. But the debate over AI’s impact is unsettled at best, and it has gone mainstream.

The New York Times weighed in this week with a widely shared look at the early gains from generative AI. Some economic data provides support for the positive case, with the U.S. Bureau of Labor Statistics reporting three consecutive quarters of productivity gains for the first time since the pandemic. It could be that AI leads to the kind of sustained productivity gains we saw from 1995-05 … or … aggressive layoffs provide only a fleeting productivity bump. Jon Stewart, with biting humor, skewered the productivity claims on the Daily Show this week on America’s Comedy Central.

Banks illustrate the problem with showing the impact. While they’re very public about reductions in headcount, they’re quiet about how investment in AI boosts business. In the latest Evident AI Index, only four of the 50 banks (JPMC, DBS, SocGen, and BNP) were able to quantify both the number of AI use cases and quantify their benefit.

It’s not hard to understand the banks’ “Goldilocks” predicament. If they talk about it too soon, they risk underwhelming (and oversharing). If they don’t talk about it at all, they must not have the goods to back it up (obviously).

No wonder that’s leading to AI skepticism, including from some important corners of the financial industry. As the New York Fed chief John Williams said in February: “I am not counting on the AI narrative. The one thing we all agree on is that AI is very important. It’s a big deal. It could very well be one of the drivers of strong productivity growth in the future. But we don’t know. It’s really too early…”