DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

AI efficiency revolution comes to banking

Source: OpenAI

3 April 2025

TODAYS BRIEF

Welcome back to The Brief! It’s been a year since we launched this newsletter. Thank you for reading. We’d like your help to make The Brief better. Please take our short reader survey. Let us know what you like, dislike and wish for more from our coverage of the intersection of AI and the banking business.

In this edition: Exclusive talent data from Evident shows that banks are hiring fast in AI, even as they’re cutting across the board. And that was in the flush times. Expect the trend to accelerate as the economic and market waters get choppy. The upshot: A long-promised AI-driven efficiency revolution is here.

We also dig into the 45 new use cases now live in our Use Case Tracker to highlight three standouts.

Finally, quantum computing. Last time in The Brief we went deep on this emerging technology and asked for your feedback. We share the results of our survey and a selection of the smartest thoughts on how (and how soon) it might be adopted by business.

Companies featured in this edition: JPMorganChase, Goldman Sachs, RBC, DBS, Capital One, CommBank, Lloyds, ING, BBVA, ABN AMRO, HSBC, UBS, Morgan Stanley, NatWest and BNP Paribas.

The Brief is 2,272 words, a 6 minute read. You can read this Brief online and subscribe here.

– Alexandra Mousavizadeh & Annabel Ayles

FROM THE EVIDENT AI INDEX

AI REMAKES THE WORKFORCE

THE ONE SAFE JOB

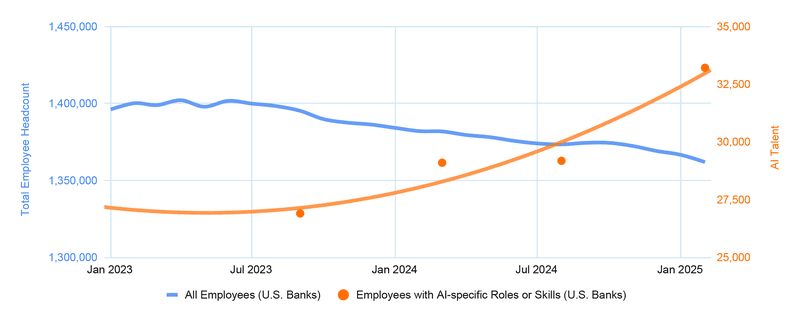

Headcount at U.S. banks has dropped 3% since June 2023, but AI hiring is up 24%

The AI efficiency boon is coming clearly through the latest jobs numbers at banks.

Since June 2023, the number of AI roles at the 50 banks we track has grown nearly 24%, according to exclusive new data from Evident, while the sector’s overall U.S. headcount has shrunk by nearly 3% over that same stretch.

In recent quarters, banks poured money into tech investments and touted all kinds of new efficiencies from AI. Goldman Sachs, for example, says its new AI tool generates an IPO filing document in minutes, something that took a six-person team two weeks. Despite posting record profits, banks also made the type of staff cuts that tend to happen after a slowdown starts. During the Great Recession, they shed 69,000 jobs over two years. We’re 60% of the way to that total already thanks to papercuts.

As an economic downturn looms – JPMorganChase puts the chances of a U.S. recession at 40% and bank stocks are getting hammered – the push toward AI-driven efficiency is only going to accelerate.

Given the huge investment in tech hardware and talent, banks are under pressure to scale Gen and Agentic AI across their businesses, and to show the benefit to the bottom line of this shift. They’re feeling it and trying to respond. RBC last week projected AI would add up to $700 million of enterprise value by 2027, while DBS said around $750 million by 2028. That number was $2 billion in 2024 at JPMC.

Look out for the 2025 Talent Report out on April 28th. We explore how leading banks have organized their AI teams to grow use cases across their business, where the biggest growth areas are and who is winning the AI talent race. Sign up for our Talent Roundtable on April 29th here.

TALENT MATTERS

FOUND IN TRANSLATION

As banks use AI to squeeze out human inefficiencies (see above), they’re focused on hiring people to implement this evolving tech strategy, our latest analysis shows.

Most in demand are AI product managers – people who can translate engineering into business opportunities. The number of people in those roles at the 50 Evident AI Index banks has grown by 61% in the last year alone, the biggest increase we’ve seen among the job categories we track. That’s notably where Index leaders JPMorganChase and Capital One are pushing. More than 35% of the AI product managers at the world’s top banks are employed by those two, according to Evident data.

Who they hire gives a great glimpse into where the AI adoption story is going:

- Product Ownership: At Capital One, one AI product manager oversees a Gen AI-based agentic application that helps associates retrieve and analyze documents. He says it’s projected to save the bank $55 million.

- Lifecycle Management: JPMC is looking for someone to drive the product roadmap and define key KPIs for LLM Search capabilities across its Global Banking division.

- User Research: The “Agentic AI Experiences” team at Capital One posted a job last month for a product manager that “deeply sympathises with customer needs.”

N.B.: In Coursera’s 2025 Job Skills Report, enrollment in Gen AI courses was up more than 700% in the financial services sector this past year. And many of the AI skills users were most interested in learning this year – like Applied Machine Learning and MLOps – show up over and over in AI product manager roles.

MEMBERSHIP MESSAGE

ABOUT EVIDENT

Evident is the intelligence platform for AI adoption in financial services. We help leaders stay ahead of change with trusted insights, benchmarking, and real-time data through our flagship Index, Insights across Talent, Innovation, Leadership, Transparency and Responsible AI pillars, a real-time Use Case Tracker, community and events. Get in touch to hear more about how Evident can help your business adopt AI faster.

BEST PRACTICES

HOW TO TRAIN YOUR AI DRAGONS

Staying on the theme of implementing and scaling AI, there are a couple fresh approaches to training that stood out for us recently.

FOLLOW THE TALENT: CommBank opened a “dedicated tech hub” in Seattle to “fast-track adoption of Agentic AI and Gen AI.” The Australian bank’s AI team has already grown over 40% during the last two years – the largest increase of any APAC bank – and the tech hub opening follows February’s news that CommBank inked a five-year partnership with Seattle-based AWS. The Australian outfit may not have a big U.S. footprint, but like JPMC, which also operates a “Seattle Tech Center,” it decided to plant a flag in the heart of tech America.

PARTNER WITH EXPERTS: Lloyds is sending 300 executives to the University of Cambridge for an 80-hour AI bootcamp that covers Gen AI, Agentic AI and the latest on AI regulations and ethics. The bank wants to have “the most AI-capable leadership team in banking,” COO Ron van Kemenade said. Part of a reorganization of the bank’s tech team announced in February included creating 1,200 new tech roles. Clearly the bank wants to do that at least in part by training its existing workforce.

MAKE IT MANDATORY: ING launched a “mandatory Gen AI e-learning” course in 2024, and 92% of the company’s workforce completed it, the bank said in its annual report. ING, which is in the top-10 for talent in the Evident AI Index, is doubling down on training to establish a “healthy pipeline of future AI leaders” and help workers “AI pivot.”

USE CASE CORNER

GENERAL AI VALUE

This week, we updated the Use Case Tracker – our inventory of all the AI use cases announced by the world’s largest banks, which is available to Evident members – with 45 new ones since February. These three below unveiled recently show how banks are focusing on Gen AI and immediate value creation.

#1 Conversational Buying

Use Case: Gen-AI update for BBVA Blue

Vendor: n/a

Bank: BBVA

Why it’s interesting: BBVA customers can now speak to or message Blue, the bank’s five-year-old virtual assistant, and get the chatbot to provide information about their accounts or complete transactions. With Gen AI, the chatbot will help customers take 150 different actions – like deactivating a card or showing their balance. Impact: Blue’s upgrade was only recently announced, but when ING brought Gen AI to its chatbot, the bank reported a 20% increase in the number of customer problems it solved.

How they did it: BBVA leaned on its AI Factory team (which is now 400-strong) to develop the “technical aspects” of Blue’s new Gen AI capabilities. The factories are part of the bank’s effort to push AI into production faster. They have a code library so AI developers can reuse the “Lego pieces,” said Ignacio Teulón, global head of BBVA AI Factory.

#2 High-Roller ID

Use Case: Affluent customer classifier model

Vendor: n/a

Bank: ING

Why it’s interesting: Banks that use AI/ML transaction models in retail and personal banking often focus on use cases that prevent fraud (like SocGen's Mosaic model) or give broader insight into customer behavior (like Citi’s customer analytic record or HSBC’s customer profiles). ING is using AI to sell new products to richer customers, which the model identifies by looking at customer transactions.

Impact: In the time it has used this model, the bank has grown the number of term deposit accounts it has opened by 40%, grown the average deposit amount in those accounts by 40% and cross-sold 20% more products to those account holders.

3 Agentic Orchestration

Use Case: Customer service agents for personalized interactions

Vendor: Microsoft

Bank: ABN AMRO

Why it’s interesting: ABN AMRO teamed up with Microsoft Copilot Studio to give its customer-facing chatbot (Anna) and its employee-facing chatbot (Abby) an agentic upgrade. The bank says its chatbots are now better at understanding the intent behind customer or employee questions – and can provide more tailored solutions.

Impact: The chatbots handle over two million text and 1.5 million voice conversations annually, and Anna helps with tasks like unblocking a debit card or changing the withdrawal limit at an ATM. Since the Microsoft partnership, the bank says customer satisfaction is up and the chatbots are 7% more accurate in determining what a user actually wanted from an interaction.

How they did it: The bank moved its chatbots to Microsoft’s platform in six months. It now uses Azure AI Conversational Language Understanding (CLU) – a tool Microsoft designed to predict a user’s intention based on what they type – to determine what action a customer wants to take while they communicate with a chatbot. The chatbot can then either direct a customer to the right call center based on their specific question or determine that the problem can be solved without human interaction, which the bank says has improved efficiency.

As you see above, we want to include more information on how these cases get into production. Tell us how you overcame a technical hurdle to launch a use case at [email protected]

EXPERT VOICES

QUANTUM PREDICTIONS

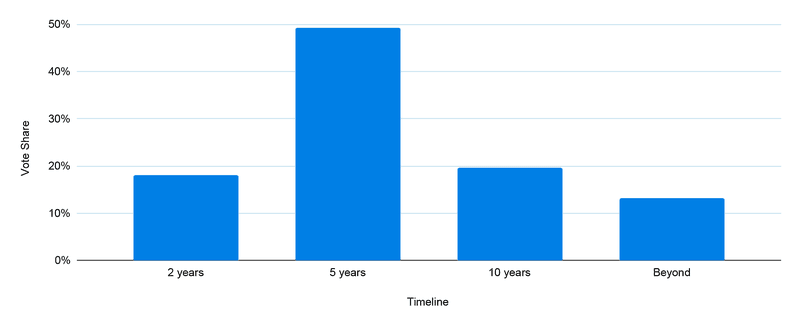

In the Quantum Computing Special Edition, we asked you when this emerging technology might be practically useful for the financial industry. The consensus of more than 50 Evident readers: not before the decade’s out.

QUANTUM IS COMING – MAYBE BY 2030

When quantum capabilities will be used in banks, according to our poll

Discussions about the timeline for useful quantum applications gained traction last week when JPMC’s team generated “truly random numbers" with a quantum computer – what the bank calls “breakthrough result” and something it can eventually use in cryptography and trading.

Below, we share a few of the views we heard about quantum utility, from bullish to the most hawkish.

- The bull: "What makes [JPMC’s] experiment particularly remarkable is that it provides a rigorous proof that a practical problem (the generation of certified random numbers) can be efficiently tackled by a quantum computer in a way that is probably beyond the reach of classical machines. A rare and valuable achievement in today’s quantum computing narrative." –– Oswaldo Zapata, theoretical physicist and quantum computing consultant

- A hedge: “It's important to clarify that while we are making significant strides in quantum hardware, much further research is still needed. Hybrid systems that combine quantum and classical computing are emerging, especially in Quantum Machine Learning. While quantum resources are beginning to add value, they have not yet reached the point where they independently outperform classical systems.” –– Jan Mikolon, CTO at QuantumBasel and former Principal Data Scientist at IBM

- And the bear: “Quantum computers are intrinsically noisy systems. For intermediate-scale quantum systems, neither a convincing demonstration of ‘quantum computational supremacy’ nor the implementation of high-quality quantum error-correcting codes is achievable. Consequently, this also implies that large-scale quantum computers based on quantum error correction are fundamentally unattainable. My argument is not definitive. It certainly requires experimental testing, and ongoing research efforts provide valuable opportunities to evaluate its validity.” – Gil Kalai, Henry and Manya Noskwith Professor Emeritus of Mathematics at Hebrew University of Jerusalem

SPEED READS

FIVE THINGS THAT CAUGHT OUR EYE

The banker of the future will need to be able to manage AI agents as well as they manage colleagues, Goldman Sachs CIO Marco Argenti said on a podcast last week. Argenti went on to describe the future banking workforce as “elastic,” meaning the number of agents working at any one time will change based on how busy the bank is – similar to how cloud computing now works.

NatWest partnered with OpenAI to deploy Gen AI applications across its business, the first U.K. bank to partner with the ChatGPT maker. The bank’s digital assistant will be a key focus area, and retail banking CEO Angela Byrne notes that the partnership will also help NatWest “offer even better protection like fraud and financial crime.”

UBS used its AI-powered M&A co-pilot tool in more than 1,000 pitches in 2024, a new report from Euromoney said. The report also highlighted that roughly half of Morgan Stanley’s staff are using an AI solution and HSBC has seen efficiency gains between 15% and 30% for developers using its GitHub copilot.

C-Suite musical chairs continued at European banks, as CIO Bernard Gavgani left BNP Paribas and HSBC hired a new CTO – former JPMorgan head of CIB markets technology Mario Shamtani. Standard Chartered also hired David R. Hardoon to be the bank’s AI global head.

Want to know how an LLM thinks? A new research paper from Anthropic digs into how Claude formulates answers to your questions as well as why these models can sometimes hallucinate. If you’re a visual learner, the company put the main takeaways from the paper in a video.

WHAT'S ON

COMING UP

Weds 9 April - Fri 11 April:

Google Cloud Next, Las Vegas

Tues 15 - Weds 16 April:

NexGen Banking Summit, New York

Tues 15 - Weds 16 April:

AI in Finance Summit New York

Mon 28 April

Financing the AI Revolution, New York

Tues 29 April

Evident AI Talent Roundtable, Virtual

Thurs 1 May

FS Technology Summit, Edinburgh

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]