DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

Banks go agentic

Source: OpenAI

17 April 2025

TODAYS BRIEF

Welcome back!

We need your help to make The Brief better. Please take our three-minute reader survey. Let us know what you like, dislike and wish for more of in our coverage of AI and banking.

In today’s edition, a deep dive into agentic AI. Banks can’t stop talking about it, and new Evident data and interviews show how they’re forging ahead here, including with new use cases, investments in startups and cutting-edge research.

Plus the latest from the quarterly results on AI adoption inside banks and our usual Speed Reads.

People mentioned in this edition: David Griffiths, Chintan Mehta, Prem Natarajan, Dan Jermyn, Sarthak Pattanaik and others.

Plus these banks: Citigroup, Wells Fargo, Capital One, BNY, JPMorganChase, BBVA, HSBC, CIBC, Bank of America, Goldman Sachs, UBS, CommBank, Lloyds and NatWest.

The Brief is 2,099 words, a 6 minute read. You can read this Brief online and subscribe here. As always, write us at [email protected].

– Alexandra Mousavizadeh & Annabel Ayles

TABLE STAKES

IF YOU BUILD IT, AGENTS WILL COME

The early days of agentic AI are a lot like the early days – oh back at least a dozen months or so ago – of the generative AI boom. No one quite knows where it’ll go or how. And leading players have decided it’s too risky not to lean into it.

As you’ll see below, specialists are getting hired, mostly at five of our 50 Evident AI Index banks. Tools are being built, though only a few have rolled out agentic AI use cases publicly.

Citigroup CTO David Griffiths insists “the agentic model is becoming much more viable.” Capital One, which owns one of the only public agentic use cases in Chat Concierge, plans to use its same agentic framework to build other tools around the bank.

Certainly the promise is undeniable. New agentic tools, leveraging the generative AI models developed in recent years, can make decisions and act without human oversight in ways that will unlock transformative productivity and revenue gains – so far, a lot more in theory than reality.

There are no obvious shortcuts. Companies will have to manage talent smartly, of course, and build out the tech. They’ll have to figure out their larger “agentic strategy” and get their organization’s buy-in. But in banking, the early adopters are already hiring, investing and building out use cases.

MEMBERSHIP MESSAGE

ABOUT EVIDENT

Evident is the intelligence platform for AI adoption in financial services. We help leaders stay ahead of change with trusted insights, benchmarking, and real-time data through our flagship Index, Insights across Talent, Innovation, Leadership, Transparency and Responsible AI pillars, a real-time Use Case Tracker, community and events. Get in touch to hear more about how Evident can help your business adopt AI faster.

FROM THE EVIDENT AI INDEX

AGENTS OF CHANGE

HELP WANTED

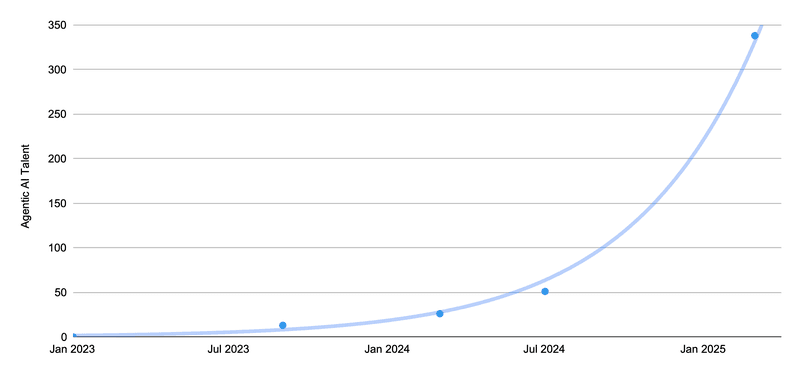

The number of employees with agentic AI-related roles at the 50 Evident AI Index banks since Jan. 2023

People who can make and implement AI agents are in great demand. In the last year, the number of employees at the 50 banks we track working on agentic AI grew 13 times over.

They’re still a smidgen of all AI talent – about 340 in total – but this recent increase reflects the eagerness of some banks to get agentic use cases into production. Five in particular stand out: JPMorganChase, Wells Fargo, Citigroup, Capital One and UBS employ nearly half of them.

Who are these agentic specialists?

JPMC is leaning into research, where a fast-growing team is using “AI agents and multi-agent” systems to improve personalization, automated code generation and visualization use cases at the bank. Wells Fargo has product directors building strategies for how to scale agentic AI into different parts of the bank’s business, including customer touchpoints like call centers. At Capital One, software engineers are actively exploring how to use agentic AI to “improve developers' experience and productivity.” UBS’s data engineers and data scientists describe using agentic AI for data analysis and reporting.

Their skills overlap with anyone working on Gen AI. But good agentic tools – which execute multi-step plans in service of a broader goal – need to touch more parts of the business than many generative AI tools. The engineers who create and run agentic tools will have to think bigger, in a sense, and work more across teams.

USE CASE CORNER

AGENTIC IN ACTION

Agentic applications still only make up a small portion of the Use Case Tracker – our inventory of all the AI use cases announced by the world’s largest banks, available to Evident members. But they’re getting more popular in banking and beyond.

In February, Capital One’s Prem Natarajan told you about Chat Concierge, the bank’s agentic car-buying tool, and Dan Jermyn discussed CommBank’s agentic tool to handle payment disputes. Other banks are coming out with details on how they’re adding (or planning to add) agency, so to speak, to their use cases.

#1 Agentic Loan Underwriting

Use Case: Loan underwriting agents Vendor: LangChain Bank: Wells Fargo

Why it’s interesting: The bank built an agentic tool capable of re-underwriting loans. It retrieves archived documents, pulls out relevant information, matches the data to internal systems and performs the calculations that ultimately determine the loan.

How they did it: The bank used LangGraph (an open source framework) to design how the individual agents tasked with each step of the process above would interact with each other. CIO Chintan Mehta noted that the bank is focused on building “compound systems,” meaning they’ll match different tasks to different models to make sure they’re not tapping expensive ones for simple jobs.

Impact: Each task handled by the tool is typically done by a human, and while a human still reviews the final output in this case, the agentic approach can improve efficiency.

#2 Agents That Upsell

Use Case: Multi-agent platform for salesVendor: MicrosoftBank: BNY

Why it’s interesting: The bank’s AI tool Eliza uses agentic AI to help its sales teams recommend financial products to clients. Thirteen agents work together to determine the right product based on the specific question a client has and who that client is. For now, this tool still has a human in the loop and doesn’t yet “automatically generate a PowerPoint we can give to the client,” said Sarthak Pattanaik, the bank’s head of AI.

How they did it: The bank used Autogen (Microsoft’s open-source framework) to build guardrails for the agents’ responses and determine how each of the agents would interact with one another. Some of those agents gather information from the client while others search the bank’s full portfolio of products and services in order to determine the best way to answer the question, Pattanaik said. He also noted the bank is having AI engineers work directly with full-stack engineers to "componentize" parts of the tool that will make it easier to scale in the future.

Impact: The tool can save client-facing employees time by cutting down the number of people they need to speak to before answering a question, the bank says.

#3 Agentic Lawyers

Use Case: Legal Agentic Workflow (LAW)Vendor: AWS, OpenAI, SnowflakeBank: JPMorganChase

Why it’s interesting: The bank’s research team published a paper about a suite of agentic tools aimed to aid legal teams with tasks like extracting dates, determining a contract’s lifecycle and comparing clauses of legal documents. LLMs tend to struggle with complex legal documents because of the amount of reasoning it takes to pull out the right information – such as the termination date of a contract instead of the effective date.

How they did it: The bank designed legal-specific tools that work together to pull out information from “financial-legal contracts.” The bank’s proposed agentic workflow takes user questions – relating to contract lifecycle or the parties involved in a particular agreement, for example – and turns them into code which it runs to retrieve the relevant information or summarize the relevant parts of a document.

Impact: The bank says it was able to accurately determine the termination date of a contract more than 95% of the time using its workflow. Doing the same task, OpenAI’s GPT-3.5-Turbo was accurate less than 3% of the time.

One more thing: At NVIDIA GTC, Capital One’s Milind Naphade gave a presentation on how the bank built Chat Concierge. It uses four agents to guide buyers through the process. An ‘understanding’ agent gets information from the customer to see what they want to do. A ‘planner’ agent puts together a set of actions to achieve those goals using the customer input and its knowledge of Capital One’s policies. An ‘evaluator’ agent simulates the plan and flags any potential issues. If it passes the evaluation, the plan gets communicated back to the customer by an ‘explainer’ agent for approval.

WE'RE HIRING

Evident is growing and we’re looking for Senior Consultants to join our team. You'll work with C-suite decision makers at the world’s largest banks to benchmark AI maturity and provide cutting-edge insights. Interested or know someone great? Apply here.

VENTURES CORNER

AGENTIC INVESTMENTS

Beyond use cases, banks’ growing interest in agentic AI comes through in the startups they invest in.

- HSBC and JPMC invested in Prophecy in 2025 and 2023 respectively. The startup automates the creation and maintenance of data pipelines, making it easier for data engineers to spin up new models and build agentic tools by preparing the data powering them faster.

- BBVA invested in Parcha via Propel ventures in 2023. Parcha builds enterprise-grade AI agents that automate manual compliance and operations tasks, like reviewing documents, extracting data and making decisions on onboarding, compliance and risk management.

- CIBC invested in Landbase in 2024. The company is building a cohort of specialized AI agents that address the needs of go-to-market teams.

- Citi Ventures invested in Norm AI in 2024. The company builds “Regulatory AI Agents” that perform real-time compliance checks, handle complex workflows, and deliver actionable feedback.

TALENT MATTERS

WHO’S USING AI?

As earnings season continues, banks are sharing more about firmwide AI usage – often highlighting one of two metrics, adoption or availability.

Adoption: Bank of America last week said more than 90% of its employees were using Erica, the bank’s AI assistant. BNY said during its earnings call that 8,000 employees are already experimenting with personal AI agents and 80% of the bank’s employees had completed the training required to use its AI platform Eliza.Access: NatWest says it rolled two Gen AI tools out to 99% of its workforce. JPMC rolled its LLM Suite to 200,000 employees, about two-thirds of its workforce. Standard Chartered rolled SC GPT, its Gen AI tool, to 70,000 employees worldwide.

SPEED READS

SIX THINGS THAT CAUGHT OUR EYE

Bank of America is spending $4 billion on AI and “new technology initiatives” in 2025, which accounts for nearly one-third of its $13 billion tech cost line. The bank said it had AI projects in progress that help write code and capture client feedback, among other areas.

Lloyds Banking Group is now using Google Cloud's Vertex AI platform, which the bank says has allowed the bank to spin out more than 80 machine learning use cases, including an AI tool that cuts the processing time for income verification in mortgage applications from days to seconds.

OpenAI released five new models this week: GPT-4.1, GPT-4.1 mini, GPT-4.1 nano and two reasoning models. The 4.1 family of models is designed for building “sophisticated agentic applications” thanks to longer memory and lower latency. The company’s new reasoning models are trained to dynamically use tools like web search and code execution.

Meta released its new flagship open source model, Llama 4. The new model borrows a ‘mixture-of-experts’ architecture from DeepSeek, which means it only uses part of its power to answer any given question, and is cheaper to run as a result. It boasts strong performance in a number of reasoning tasks – though some have accused Meta of gaming the rankings. The model isn’t fully open though; Llama 4’s license prohibits access for businesses based in the EU.

Huawei announced a new LLM trained entirely on Chinese chips. The new model, Pangu Ultra, is competitive with midsize models like Llama 3 and Deepseek v3. However, while virtually all AI labs use Nvidia GPUs, Huawei trained Pangu on their proprietary Ascend NPUs, which are manufactured in mainland China.

Stanford's AI Index shows the U.S.’s model lead over China shrinking. Though the U.S. still boasted more “notable AI models” than China in 2024, the Chinese have substantially narrowed the quality gap, getting to “near parity” on major model performance benchmarks.

WHAT'S ON

COMING UP

Sun 1 - Weds 4 June

Digital Banking, Boca Raton, FL

Tues 3 - Thurs 5 June

Money 20/20 Europe, Amsterdam

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]