DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

4 use case trends for 2025

Source: Adobe Firefly 3

9 January 2025

TODAYS BRIEF

Happy New Year. Welcome back to The Brief!

In the spirit of automating repetitive tasks, we won’t ask you how your holiday was; that was covered in the first few minutes of every call you’ve had this week.

In this special 2025 lookahead, we give banks their four biggest KPIs for how to get AI right. We tell you why certain AI adoption data is so last year and what ought to replace it. And we call on the experts in Evident’s community to share their quick-hit AI predictions. But to start us off, we analyzed the 138 AI use cases banks publicly launched in the past year to figure out what trends are here to stay.

The Brief is 2,575 words, an 8 minute read. If it was forwarded to you, please subscribe. You can read this Brief online here. Find out more about our membership offers here.

We always want to hear from you: [email protected].

– Alexandra Mousavizadeh & Annabel Ayles

USE CASE CORNER

HERE’S WHAT’S TRENDING

The 50 Evident AI Index banks publicly launched 138 AI use cases in the last year. We looked at them closely and found four noteworthy trends.

- Banks used Gen AI in more than half of the use cases. But nearly all were internal.

- Of those that leverage Gen AI, the vast majority (86%) were rolled out to employees only (e.g. BBVA’s custom GPTs library).

- Client-facing tools (e.g. State Street’s Alpha Platform) remain in the strict minority (14%) – for now…

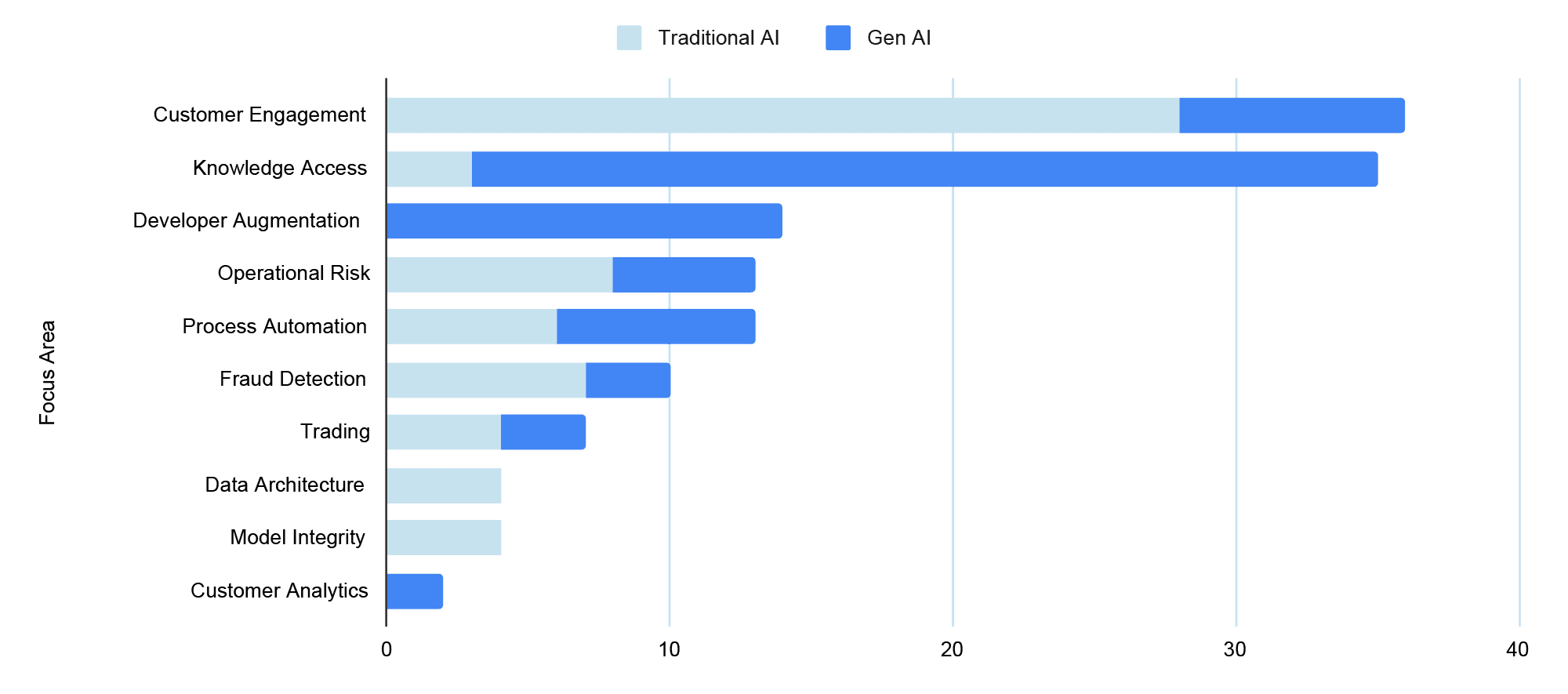

- Half of all AI use cases are concentrated in two areas.

- Customer engagement tools (think: chatbots that enhance user experience through personalized communication) are an AI hotbed, but less than a quarter of them use Gen AI.

- Within knowledge access (think: rapid discovery and document summarization tools for financial analysts) there’s a similar concentration, but the vast majority of those use cases (91%) rely heavily on Gen AI to unlock productivity gains.

- Only developer augmentation announcements (think: tools that generate code snippets or suggest solutions to automate repetitive tasks) leveraged Gen AI in all of the cases analyzed.

Gen AI Penetration

The areas where banks utilized AI and Gen AI most in 2024

- Success is still what you make it: Just 23% of use cases were connected to a measurable outcome.

- Of these, the vast majority (75%) contributed to efficiency gains, while just two of those reported concrete metrics on revenue gains:

- Morgan Stanley’s AI assistant to wealth managers doubled human referrals to financial advisors.

- HSBC’s credit card optimization system in partnership with FICO provided a 15% uplift in monthly credit card spend.

- OpenAI is winning the vendor race.

- Of the 138 reported use cases, 23 involve OpenAI, which includes banks implementing OpenAI-enabled services via Microsoft.

- Google came in second, with nine use cases being enabled by both Gemini and the Google Cloud Suite.

LATEST FROM THE EVIDENT AI INDEX

YOUR 2025 KPIS ARE HERE

Bonus season has arrived, and personal key performance indicators are top of mind across the banking sector. We track 90 KPIs across the four pillars of the Evident AI Index, but to kick off 2025 here are four we think banks should pay particular attention to.

TALENT KPI: Round out the AI talent stack, giving “builders” new coworkers that can quickly move projects into production.

- Our expectation: Banks will shift hiring focus from data scientists and AI researchers towards AI product managers and AI engineers, as leading organizations focus on implementing and scaling promising use cases that demonstrate clear ROI.

- Metric to watch: Ratio of AI development talent to AI-focused implementation talent.

INNOVATION KPI: After an extended decline in venture capital dealflow, show a rebound in early stage investment that focuses on applications.

- Our expectation: Following the mega rounds centered on foundation AI models, AI dealflow ought to double in 2025 as the venture arms of banks place bets on industry-specific AI disruptors.

- Metric to watch: YoY change in number of investments into AI-focused companies.

LEADERSHIP KPI: Show how AI use cases are helping overall business performance.

- Our expectation: The number of banks talking about the ROI of individual AI use cases will increase, and more banks will follow the lead of JPMC and DBS in publicizing the overall return of their group-wide AI activities.

- Metric to watch: Number of banks communicating total ROI of AI activities.

TRANSPARENCY KPI: Give Responsible AI talent brought on board in last year’s hiring surge the organizational backing to implement firmwide RAI frameworks.

- Our expectation: RAI leaders will have more responsibility to manage and implement AI risk frameworks that touch multiple teams, empowered by closer relationships with existing controls functions.

- Metric to watch: Number of senior RAI roles.

TOP OF THE YEAR

THE MEASURE OF AI

Many had a view last year on how to track AI adoption by business. And a number, sometimes vastly different ones, depending on who they ask or what they’re looking for. Goldman Sachs says a mere 6% of businesses use AI. The National Bureau of Economic Research: 28% of workers use Gen AI. MIT Sloan and McKinsey, far more bullish than either of the first two, claim over 60% of large firms use AI.

They’re not looking in the right places. The measure of adoption isn’t whether employees or companies say they’re using it or not – much as our Index has shown that companies that embrace AI tend to be forward-leaning and more successful.

The way to know whether you’re adopting AI is to understand – and quantify – how it’s helping your business. Broadly speaking, that’s ROI: the return on the billions that businesses have spent building and running AI teams and infrastructure. In the coming year we’ll all have to clarify how best to measure this return.

It’s not as straightforward as traditional capex or investment. AI’s benefits are often delayed and even indirect. Take developer coding copilots, one of the most common Gen AI use cases. It’s not enough to know whether developers are using AI. Banks also need to ask whether they’re more productive, whether AI reduces – or increases – the number of bugs in the codebase, and how much time it saves during code review cycles.

Bank leaders will also have to recognize and factor in that return on AI investment compounds over time as teams develop new ways to integrate the technology. The most successful organizations will treat AI implementation as an ongoing journey of measurement, refinement and optimization. In 2025 and beyond, the conversation needs to shift from “Who's using AI?” to “Who's using AI effectively?”

So how do you measure that? The metrics are everywhere, but knowing how to look for them will separate the leaders from the laggards. In customer service, firms will have to assess their AI solutions against Net Promoter Scores (a benchmark for customer satisfaction), customer retention and resolution times as well as harder financial metrics. Or, for example, with document processing, you have to ask how many documents are you processing, what’s the error rate, and how much time has it really saved.

These things often can’t be easily observed from the outside-in. It will have to be work that businesses carry out for themselves. We’re currently creating a private benchmark to enable banks to compare (on an anonymized basis) where they’re extracting value and how they’re quantifying that value. Stay tuned for more on that in the coming weeks.

2025 PREDICTIONS

What’s the next year going to bring? We asked our community to offer up their best, non-obvious predictions on AI & business and boiled them down into these quick hits.

Want everyone’s full thoughts? Send us a note at [email protected] and we’ll share them with you.

Chris Lehane, Chief Global Affairs Officer at OpenAI: AI agents will help scale digital asset payment systems (responsibly).

“...Digital asset payment systems will help support the prospective need for AI agents to transact, transmit and settle payments instantaneously at scale (and they can build in KYC capabilities).”

Vibhor Rastogi, Head of AI/ML Investments at Citi Ventures: The next Gen AI wave shifts focus from LLM-based copilots to specialized SLMs and AI agents.

“...We predict that enterprises will begin experimenting with the next wave of Gen AI innovations, including fit-for-purpose small language models (e.g. Galileo, Writer)...as well as automated prompt optimization and autonomous AI agents (e.g. Glean, Norm Ai)…”

Rumman Chowdhury, U.S. Science Envoy, Artificial Intelligence at the U.S. Department of State: Gen AI will hit an adoption speedbump as companies struggle to overcome consumer privacy concerns.

“…Companies are pushing to find [Gen AI] product market fit, but given that data privacy, concerns about bias and surveillance, and concerns about the future are paramount with the average person, consumers won't be eager to introduce this technology into their lives.”

Jared Cohen, President of Global Affairs at Goldman Sachs: Transformational changes to models that justify the cost won't come, nor will clarity on infrastructure.

“...I also doubt we’ll get answers to the only question that matters: when will the infrastructure get built to meet this demand? That said, I don’t think AI is a fleeting trend….”

Alexandra Mousavizadeh, Co-Founder and CEO at Evident Insights

“...Realised results are going to be needed to justify ongoing investments. Equity analysts will be asking for clear evidence of the value AI is delivering: whether that’s efficiency gains, revenue growth, staff productivity or customer satisfaction….”

Brian Chau, Partner at Norton Rose Fulbright: Patents will get more complex as foundational AI research evolves into direct use cases.

“…As financial institutions become more sophisticated in their approach to intellectual property and AI, there will be more patent applications directed to applied use cases – especially as research and innovation units move beyond foundational research.”

Scott Zoldi, Chief Analytics Officer at FICO: LLM risk scoring will help companies balance the gravity of business decisions they’re making using AI with its potential for error.

“...Businesses that want to operationalize Gen AI will accept that LLMs' hallucinations, bias, and low statistical coverage are best managed not by more complex LLM constructs or user guardrails, but through risk scoring…”

Paul Dongha, Head of Responsible AI & AI Strategy at NatWest: Interoperability and business process change management will still be limiting factors for Gen AI adoption and could hinder impactful use cases.

“...For Gen AI, complex use cases will impact business processes profoundly and this impact needs to be carefully navigated to ensure colleagues are able to adapt adequately… it requires more focussed attention.”

Kevin Delaney, CEO and Editor-in-Chief at Charter: Companies will go all in on Gen AI training and help close the gender gap in the process.

“...When training is hands-on and encourages experimentation, workers feel like they’re part of the AI adoption process and empowered to experiment and identify new use cases…”

Tobias Rees, Senior Visiting Fellow, Technology and Society + Research at Google: A decoupling of the concepts of AI and machinery will lead to more elevated AI uses and potential.

“...2025 is the year we begin to understand that we have to differentiate AI from machines…what comes after machines is an AI-human co-cogitation: These human-AI units will be able to identify problems, think things, make superior decisions on scales and with speed impossible before.”

Auren Hoffman, CEO, NQB8. Chairman, SafeGraph. Host, World of DaaS podcast: Don’t bank on another banner year for the Mag7.

“AI spend was pulled forward in 2024 so the combined Market Cap of the Magnificent 7 (Apple, Microsoft, Alphabet, Meta, Nvidia, Amazon, Tesla) will be lower on Dec 31, 2025 than it was on Jan 1, 2025.”

NOTABLY QUOTABLE

"“If you said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30, it's probably on the late side. But if you picked 20, I think a whole bunch of us would believe it”"

— – Jensen Huang, at an Nvidia analyst Q&A event on Jan. 7

SPEED READS

SEVEN THINGS THAT CAUGHT OUR EYE

As many as 200,000 banking jobs could be on the chopping block in the next three to five years thanks to AI advancements, a new Bloomberg Intelligence report says. CIOs and CTOs surveyed expected 3% of their workforce to be cut over the time period, with back office, middle office and operations roles taking the biggest hit.

Eurasia Group called the impending AI deregulation wave promised by incoming President Donald Trump a leading global risk for 2025, warning that guardrails around safety and transparency will fall. In particular that will hurt already tense US-China relations by sowing further distrust inside “painfully slow” AI safety talks aimed at preventing the spread of dangerous capabilities.

“We believe that, in 2025, we may see the first AI agents ‘join the workforce’ and materially change the output of companies,” wrote Sam Altman on his blog Monday. “We are beginning to turn our aim beyond that, to superintelligence in the true sense of the word.”

“I’m very excited, and I’m also making sure I understand what the risks are that I’m introducing into our system when I use it,” said U.S. Bank CPO Rob Seidman, of integrating AI use cases into core bank functions, like underwriting, presentation layers, and financial advice. “We have to be extremely careful how we deploy it.”

Vladimir Putin ordered his country’s top bank, Sberbank, to coordinate AI development with China, circumventing Western sanctions blocking microchip producers from exporting to Russia.

The Texas Responsible AI Governance Act, introduced in December, “remains a Lovecraftian regulatory nightmare,” per Mercatus Center researcher Dean W. Ball. The bill requires compliance documents for AI use cases when AI is a “substantial factor” in “consequential decisions,” (e.g., hiring, education, insurance) and ups financial penalties.

The U.S. Office of the Comptroller of the Currency (OCC) wrapped up its call for paper submissions on AI and banking in mid-December, and will host a conference reviewing accepted papers on June 6, 2025.

TALENT MATTERS

NEW YEAR, NEW PEOPLE

Michael Barr is stepping down as the Fed’s top banking regulator, preempting what many saw as a looming political fight with the Trump administration. One name to keep an eye on: Michelle Bowman, one of Trump’s Fed picks in 2018, who said “we need not rush to regulate” AI in banking in a November address.

JPMorganChase is staffing up a Gen AI Enablement team with roles from the executive director level down to associate focused on strategy, use case identification and product roll-out for generative AI.

Financial AI vendor Kasisto appointed Joshua Schecter chief product and innovation officer.

Any noteworthy people moves you know about? Share them with us at [email protected].

COMING UP

Weds 8 Jan - Fri 10 Jan

2025 Bank Presidents Seminar (featuring Michelle Bowman), California

Thu 16 Jan - Sat 18 Jan

DLD Conference, Munich

Mon 20 Jan - Fri 24 Jan

World Economic Forum Annual Meeting, Davos

Thu 23 Jan

When AI Moves the Needle, Davos

Mon 27 Jan

The AI Regulation Summit 2025, London

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]