DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

How AI talent pays off

Source: Source: Adobe Firefly

1 May 2025

TODAYS BRIEF

Welcome back!

In today’s edition, three takeaways from our newly-released 2025 Talent Report. We check in on this week’s ICLR conference in Singapore and find banks leaning into AI research. With earnings season in full swing, CEOs tout investments in technology to calm market nerves. Plus, the latest update to our Use Case Tracker.

One last ask: Take the three-minute reader survey to let us know what you make of the Brief. You can always write to us directly.

People mentioned in this edition: Jamie Dimon, Richard Fairbank, David Solomon, Noelle Eder, Mira Pijselman, Patrick Opet and others.

Plus these banks: JPMorganChase, Capital One, TD Bank, RBC, Goldman Sachs, Santander, CaixaBank, BMO, Standard Chartered and others.

The Brief is 2,236 words, a 7 minute read. You can read this Brief online and subscribe here.

– Alexandra Mousavizadeh & Annabel Ayles

FROM THE EVIDENT AI INDEX

TALENT-RICH BANKS GET RICHER

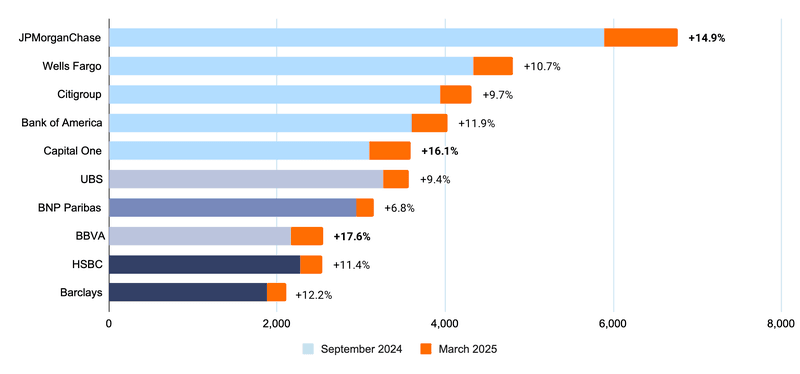

Evident AI Index banks ranked by size of their AI talent staff, including percentage change in the last six months.

Talent is a great enabler of use cases and ROI, new data from our 2025 Talent Report shows, and the banks with the largest AI talent pools are pulling away. The 10 banks above account for half of the AI talent pool at the 50 banks we track and illustrate three of our main takeaways on talent for the industry today:

- MORE IS MORE: Banks with the largest pools of AI talent are twice as likely to disclose AI use cases publicly. The 10 banks with the largest AI headcount have an average of six public use cases, while the other 40 banks in the Evident AI Index average three.

- DEEPER IMPACT: Top banks are 1.5-times more likely to include ROI figures in their use case disclosures, highlighting a direct link between investment in the workforce and a bank’s ability to quantify returns (no mean feat).

- BALANCING ACT: Top banks aren’t only getting more people in the door, they’re bringing in the right mix of talent – in this case with a focus on the doers. AI software implementation makes up a greater part of the AI headcount at the top-10 banks compared with the Index at large, according to our analysis. At JPMorganChase and Capital One, for example, there’s one AI software implementation specialist for every three data engineers. Index-wide, that ratio is 1-to-8.

Join us: In our next virtual roundtable, we'll dive into the latest data from Evident's newly-released 2025 Talent Report. We'll explore how the AI talent stack is changing across the 50 banks tracked in the Evident AI Index and unpack emerging trends, identify critical new roles, and explore which capability areas leading banks are prioritizing moving forward.

RESEARCH CORNER

EGGHEADS RISING

In the not-so-distant past, AI leaders at many banks questioned the value of centralized AI research teams. Now research is red hot.

According to our 2025 Talent Report, top banks are doubling down on hiring researchers, using their work to expand their patent portfolios, applying it to wider parts of the bank and, in turn, generating ROI.

It’s playing out in real time: At ICLR – a premier AI research conference in Singapore this past week – the number of papers banks published doubled compared to last year. The star of the show at the conference was alignment, the process of ensuring AI models are accurate, fair and follow instructions without going rogue.

TD Bank (which has the second-largest group of researchers at any of the 50 banks we track) presented a new way for models to handle uncertainty after finding that a common way of addressing bias in machine learning could unintentionally lead users to select less fair outcomes. The bank also developed a way to prevent LLMs from memorizing personal data, reducing the risk that data leaks contain identifying information. The bank also recently announced the opening of a new office in New York specifically to grow its in-house research team, Layer6.

Meanwhile, JPMC – by far the leading bank on AI research – showed how swapping out different agents (specialized for different tasks) on-the-fly could generate better responses and ensure the right models get tapped for the right tasks. Another paper from the bank suggests screening LLM outputs one word at a time – avoiding the need to generate full responses before determining if there are any potential issues, making them cheaper and faster to run.

RBC’s Borealis AI, another AI research leader, contributed open-source work on enabling LLMs to process large amounts of data efficiently.

NOTABLY QUOTABLE

"If everyone has these superhuman tools to create a ton of different stuff…I would guess the world is going to get a lot funnier, weirder, and quirkier, the way that memes on the internet have gotten over the last 10 years."

— Mark Zuckerberg, Meta CEO, on a podcast, April 29

QUARTERLY RESULTS SEASON

‘REALLY HELPS WHEN ECONOMY TURNS’

Bank CEOs had a clear message for investors in this latest earnings round: We’re doubling down on AI, especially in tough economic times.

In Q1 of last year, one-third of the U.S. banks in the Evident AI Index discussed AI on earnings calls, according to our analysis. This quarter, that number is up to 60%. And as investors white-knuckled their way through April and bank stocks took a hammering despite strong results, even familiar AI messaging took on a new meaning as CEOs pitched the technology as a way to weather the storm.

Take Capital One: CEO Richard Fairbank said its AI investment makes the bank more “diagnostic” – something that “can really help when the economy turns.” In other words, the data transformation that makes Capital One an AI standout (#2 in the Evident AI Index) also helps it monitor closely its business and make quick adjustments as needed.

At Goldman Sachs, CEO David Solomon talked up, not for the first time, how the bank’s making engineers more productive with AI. He’s been hesitant to put a specific number on AI returns at the firm, but wasn’t shy about saying that the “productivity gains [from AI] for the economy will be significant” even while warning that growth in the U.S. has “fallen meaningfully.”

Bottom line: It’s not immediately clear where we are in this downturn cycle, but bank CEOs are trying to convince investors that AI investments are part of the solution, not the problem. AI investment will continue “regardless of the environment,” said JPMC’s Jamie Dimon.

USE CASE CORNER

KING CUSTOMER

Our monthly update of the Use Case Tracker – the inventory of all the AI use cases announced by the world’s largest banks available to Evident members – includes 46 new AI applications. The three we highlight here take differing approaches to handling (sometimes unsatisfied) customers:

#1 AI Complaint Analysis

Use Case: Viva Voz

Vendor: N/A

Bank: Santander

Why it’s interesting: Santander Brasil’s “Viva Voz” tool analyzes and categorizes customer complaints to help the bank respond to them.

How they did it: Working with the Consumer Protection team and the Models and Data team, Santander Brasil first identified customer service as an area where AI use cases could have the greatest impact. To build the tool the bank leaned on its unified data architecture, a way the bank organizes all of its data sources in one place to standardize how global teams build new applications and, in turn, speed up development.

Impact: Before the tool came online in 2024, the bank could only examine 3% of customer complaints in two days time. Now, 60% of complaints can be analyzed in a single day, and the bank says it's aiming to hit 100%.

#2 Omniscient Wealth Management

Use case: Sales Assist

Vendor: N/A

Bank: JPMorganChase

Why it’s interesting: JPMC’s tool for its wealth and asset management division transcribes and summarizes calls, presents relevant product info and organizes client data in real time. The tool is a product of the bank’s efforts to get rid of ‘no joy’ work.

How they did it: Sales Assist is part of a broader suite of LLMs at the bank, which is built on AWS Sagemaker for model development and AWS Bedrock for generative AI capabilities. The bank began a phased rollout of Gen AI capabilities in 2023 and incorporated prompt engineering training as part of the onboarding process for incoming talent in its wealth and asset management division to speed up the uptake of the tools.

Impact: The bank says relationship managers are now ~95% quicker locating relevant content, and credits the tool with supporting ~20% higher gross sales within the line of business compared to the previous year.

#3 AI Sales Agents

Use Case: AgentforceVendor: SalesforceBank: CaixaBank

Why it’s interesting: CaixaBank implemented a generative AI-driven assistant to guide customers through the process of buying new products from the bank. Once a customer activates the “Need Help?” feature, the assistant connects them to a human manager within two minutes. In that time, the tool feeds the customer support manager specific information about the customer and tailored insights about the types of products that might be most appealing to help close the deal. During the interaction, the tool also remains on hand for real-time questions.

How they did it: Developed by CaixaBank Tech (with AI tools from Salesforce), the assistant supports over 300 CaixaBank employees. All customer data transmitted to the system is encrypted, and is not used to train the model, the bank says. The project fits into the GalaxIA program, an initiative launched last year to bring Gen AI tools into contact centers and customer service touch points, as well as improve productivity.

Impact: The bank says the assistant reduces wait times, speeds up interactions and is a boon to new product sales. In time, the assistant will become more proactive – identifying sales opportunities, suggesting complementary products and offers and scheduling follow-up calls independently.

MEMBERSHIP MESSAGE

ABOUT EVIDENT

Evident is the intelligence platform for AI adoption in financial services. We help leaders stay ahead of change with trusted insights, benchmarking, and real-time data through our flagship Index, Insights across Talent, Innovation, Leadership, Transparency and Responsible AI pillars, a real-time Use Case Tracker, community and events. Get in touch to hear more about how Evident can help your business adopt AI faster.

SPEED READS

FOUR QUICK THINGS THAT CAUGHT OUR EYE

Here come the Chinese models: Alibaba released Qwen3, a set of open-source models with “a hybrid approach to problem solving,” meaning they can handle “thinking” and “non-thinking” problems. Also open source, DeepSeek’s much-anticipated next model release may be right around the corner.

An open letter from JPMC’s Chief Information Security Officer Patrick Opet calls for third-party software suppliers to get their act together. Software (and AI) companies, he argues, prioritized speed over security, leaving the organizations that buy their products vulnerable to cyber attacks.

Mastercard launched “Agent Pay,” a tool that lets AI agents complete purchases on the payment provider’s network. It comes in the same week OpenAI rolled out new shopping features.

“Agent Bosses” are the future of the workforce, according to Microsoft’s Work Trend Index Annual Report. Microsoft says the “human-agent ratio” will be a new KPI for leaders to track as AI agents get more popular.

TALENT MATTERS

COMINGS AND GOINGS

Standard Chartered appointed Noelle Eder as group head, technology and operations. Most recently, Eder was CIO at Cigna. She also served as chief card customer experience at Capital One from 2016 to 2018.

EJ Achtner joined BMO as VP, head of applied AI. He was previously the head of generative AI capabilities at HSBC. The bank also recently appointed Mira Pijselman, most recently a digital ethics lead at EY, as head of responsible AI.

Deutsche Bank is hiring for a new VP-level role to look after “projected operational efficiency, cost reduction and revenue growth targets” as the go-between for CIOs and the central AI team. At the same time, the bank is looking for someone to help the bank with “change and adoption strategies” for AI.

In both London and New York, JPMC is hiring Gen AI specialists within its commercial and investment bank. The roles are centered on Gen AI enablement, helping to deploy new products around the unit.

State Street CIO Brian Franz joined Estée Lauder, where he’ll serve as chief technology, data and analytics officer.

MARKET CODA

AI-LPHA NO MORE?

For bank stocks, the world looks to be upside-down.

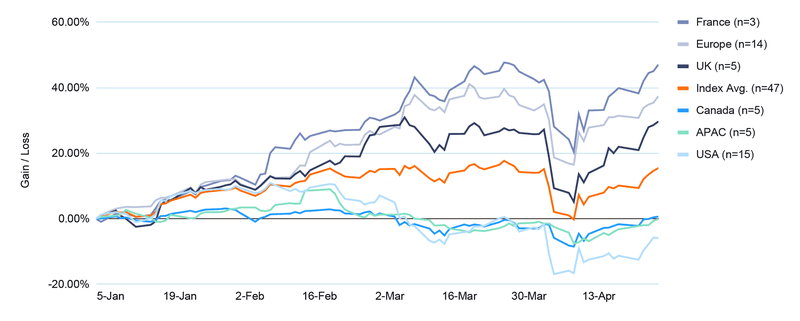

A year ago, we found that the shares of banks that leaned most into AI – which tends to correlate closely with how forward-leaning and financially successful those businesses are – handily outperformed their competitors who weren’t as AI mature, per our rankings. Half in jest, we coined it the “Evident ETF” to track bank stocks versus AI maturity. In October our pretend ETF fared even better.

Then came Donald Trump and “Liberation Day”. With half of the top-10 banks’ shares in the Evident AI Index in the red, the ETF would have applied AI-like efficiency to losing money. And those who bet on the banks at the bottom of the ranking are laughing all the way to the bank.

Have investors fallen out of love with AI? Is our ETF kaput? We don’t think so. This current performance reflects bigger disruptive trends in America that have affected banks in other parts of the world but not as directly. Heavily represented atop our Index, American bank stocks are down 6% on the year as tariffs, bond market volatility and recession prospects have spooked the market. Canadian and APAC banks are flat, and European banks, which tend to lag behind on AI, are riding high (see chart below).

How long this will last and when the Evident ETF will be back in the black perhaps only Trump can tell.

LOCATION, LOCATION, LOCATION

European banks are soaring while U.S., Canadian and APAC banks struggle to move past market turmoil

WHAT'S ON

COMING UP

Weds 7 May

Evident AI Talent Roundtable, Virtual

Fri 16 May

AI Rush, London

Thurs 23 - Fri 24 May

AI in Finance Summit, London

Sun 1 - Weds 4 June

Digital Banking, Boca Raton, FL

Tues 3 - Thurs 5 June

Money 20/20 Europe, Amsterdam

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Gabriel Perez-Jaen|Research Manager|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]