DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

What AI talent makes

30 May 2024

TODAYS BRIEF

Hello! The upheavals at Sam Altman’s shop over safety have put the focus on responsible AI. A year ago, few banks had teams or even dedicated roles. That’s all changed now. We show how.

Also, our new data reveals the premium that banks put on AI talent. We test drive some new Copilots, and explain why the very-data-rich BNY Mellon’s AI conversion turned heads. The Brief is 2176 words, a 7 minute read.

Was this newsletter forwarded to you? Sign up here. Send tips and feedback to [email protected].

LATEST FROM THE EVIDENT AI INDEX

AI THE WORLD TURNS…

The newsfeed continues to dish out the latest from everyone’s favorite AI soap opera at OpenAI. Two weeks ago, co-founder Ilya Sutskever and safety lead Jan Leike announced their departures, effectively shuttering the company’s “super-alignment” team. Then earlier this week, OpenAI did a kind of 180, creating a new Safety and Security committee.

This tussle between innovation and safety isn’t unique to BigTech. The banking sector, too, has been grappling with this issue of how to adopt generative AI—at scale—while ensuring the right governance procedures are in place to mitigate risk.

The accelerations in generative AI over the last 18 months have raised many new questions for the banks: What are the primary risks associated with generative AI? How should we adapt our existing governance frameworks to manage these risks? Do we embed these into our existing processes and teams, or does this require different expertise and processes? And how do we go beyond thinking about risk mitigation to responsibility and ethics as a whole?

It’s still early days, but over the last year we have seen many banks creating dedicated responsible AI (RAI) roles and centralized teams to define RAI principles and ways to evaluate new AI models and tools. Just like OpenAI used to have and (who knows) might have again.

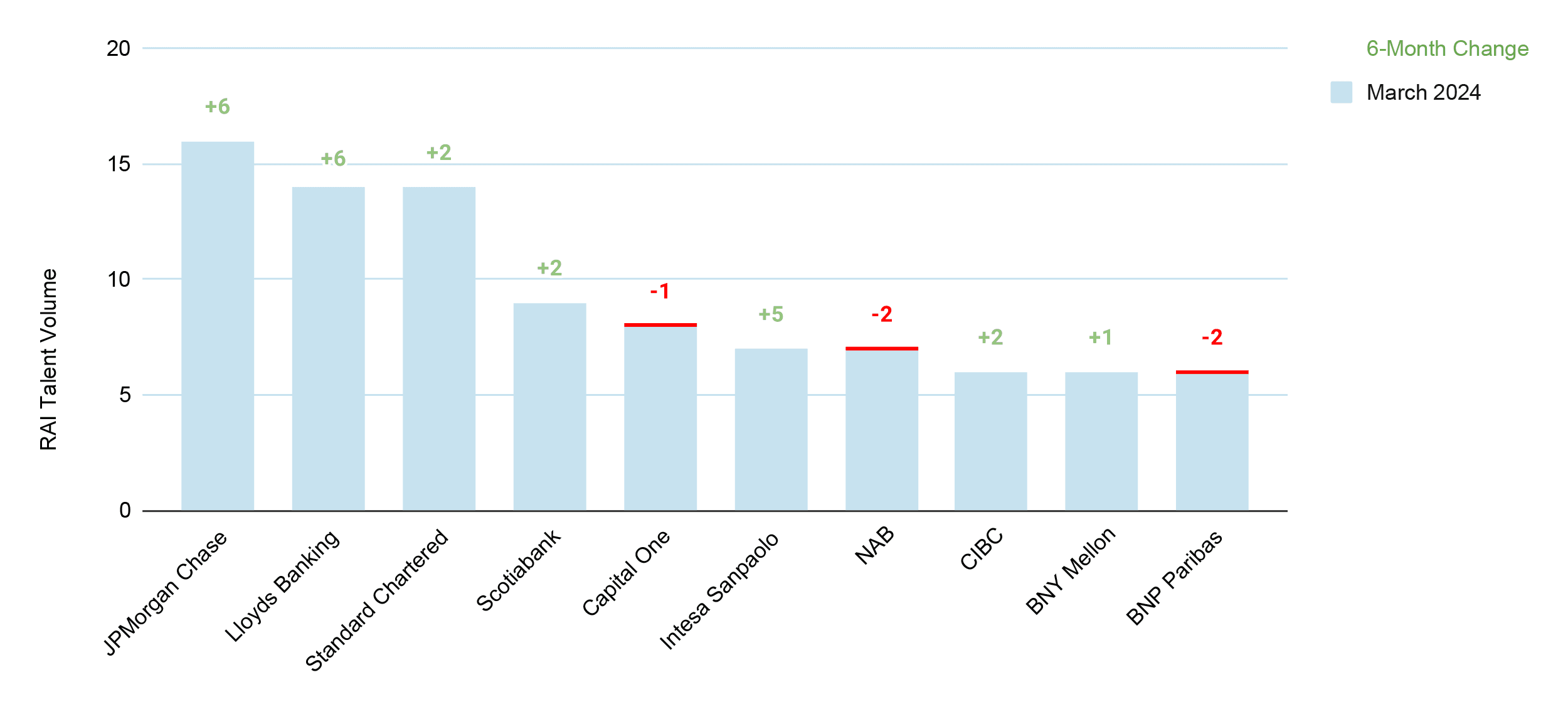

In the latest Talent data from the Evident AI Index, we find 138 individuals working in dedicated RAI positions at 30 of the 50 Index banks. Moreover, the total number of these positions has grown by 21% over the past six months.

Top 10 Banks: RAI Talent Volume

March 2024, n=138 roles

Who’s growing? Half of the new RAI positions have been found at JPMorgan Chase, Lloyds Banking Group, and Intesa Sanpaolo. Some recent moves at these three highlight different approaches:

- JPMorgan Chase bid adieu in April to two senior RAI team members, including Head of RAI Kristof Horompoly. But the net increase in RAI talent doesn’t suggest this is an OpenAI style exodus. The bank recently hired several RAI leaders from BigTech (including Apple and Amazon) for its strategy, product, and research teams, showing how the bank’s looking to embed RAI across the organization.

- Lloyds Banking Group added more junior roles to the RAI ranks under Paul Dongha, who took on the role of Group Head of Data & AI Ethics in 2022. It’s interesting to note the bank bringing in backgrounds in research and policy to oversee the ethics of generative AI deployment.

- Italy’s Intesa Sanpaolo has shored up both legal and governance expertise to support ethical AI and data efforts—possibly in anticipation of enhanced scrutiny from Italy’s Data Protection Authority (DPA) on whether ChatGPT violates data privacy provisions.

So what? The more quickly banks can establish their approach to generative AI governance, risk and responsibility, the more quickly they can get their use cases into production. The banks that don’t get this right soon run the risk of being left behind

Read more about the latest talent trends across banks in The Dispatch: Talent Capability. Evident members have exclusive access to the full report. Find out more about membership here.

TALENT MATTERS

WHAT AI COMMANDS

Call it the AI premium—and the GenAI superpremium. We’ve heard anecdotally that AI-related jobs fetch a higher salary, and now have the numbers to prove it. We looked at job descriptions posted by the 15 U.S. banks in the Evident AI Index—35,000 with salary information out of 250,000 in all. Comparing similar roles, a clear pattern emerges. AI skills command up to an extra 20% in base salary, GenAI up to 30%. (We can’t factor in bonuses—usually a big chunk of pay packages—since that data is elusive.)

Analyst (3,649)

No AI Mention$101,800

JD Mentions AI$115,000

JD Mentions GenAI$132,700

Associate (2,058)

No AI Mention$105,000

JD Mentions AI$123,900

JD Mentions GenAI$122,800

Data Engineer (363)

No AI Mention$122,00

JD Mentions AI$135.300

JD Mentions GenAI$151,800

Data Scientist (186)

No AI Mention$143,300

JD Mentions AI$165,400

JD Mentions GenAI$179,900

VP (3,651)

No AI Mention$151,700

JD Mentions AI$154,100

JD Mentions GenAI$152,800

Director (118)

No AI Mention$218,700

JD Mentions AI$268,700

JD Mentions GenAIn/a

But also… When looking at the AI job openings as a whole, the hiring push is for the most experienced talent, reflecting banks’ focus to build specialized AI teams from the top down. Half of the job descriptions that mentioned GenAI were for senior roles, compared to a fifth in our sample overall.

NOTABLE MOVES AND OPENINGS

Harveer Singh joined Truist as Chief Data Officer, in the Retail, Digital and Business Bank. Singh, who was the global Head of Data Architecture at Western Union, will work to improve customer experiences and enhance operational efficiency using data.

JPMorgan Chase is also hiring an AI Policy Director, reporting to the Head of AI Policy. The job is to engage with policy makers, monitor regulatory developments and advise business teams within the bank.

PNC is hiring for a senior strategy and planning role in its Center of Excellence to scan the business for opportunities and provide justification for generative AI applications

NOTABLY QUOTABLE

"Building smarter-than-human machines is an inherently dangerous endeavor."

— Jan Leike, former OpenAI Head of Superalignment, recently quit OpenAI to join rival lab Anthropic, citing safety concerns.

SPEED READS

FIVE NEWS ITEMS THAT CAUGHT OUR EYE

OpenAI’s GPT4 beat human analysts on stock and earnings forecasts, according to a paper from researchers at the University of Chicago. While numbers were previously an Achilles heel for generative AI, the LLM outdid professionals as well as state of the art stock prediction models. The model used company earnings statements to see how well it could process financial information and make predictions on future earnings trends.

Goldman Sachs’ co-head of applied innovation, George Lee, heralds the “revenge of the liberal arts”. Critical thinking, logic and rhetoric will be key non-technical skills to make the most of AI capabilities, says Lee.

Over half of 500 European financial services C-suite and senior executives oppose strict regulations on AI, according to a Bainbridge study.

BBVA strikes the first partnership by a European bank with OpenAI, rolling out 3,000 ChatGPT Enterprises licenses to its staff in Spain.

There’s growing talk of “shadow AI”: employees who use AI at work without the knowledge or understanding of their bosses.

WHAT’S ON AT EVIDENT

EVIDENT AI SYMPOSIUM

Join us at the Evident AI Symposium in London, where we will bring senior AI leaders from across the banking sector together to cut through the hype and drive forward a global conversation around the realities of AI adoption.

At our first European gathering, we’re zeroing in on the theme of: Accelerating Outcomes: How are banks delivering value from AI now?

Speakers include: David Schwimmer, CEO, LSEG; Clare Barclay, CEO, Microsoft, UK; Manuela Veloso, Head of AI Research, JPMorgan Chase; and Sameer Gupta, Chief Analytics Officer, DBS.

USE CASE CORNER

THIS IS YOUR CO-PILOT SPEAKING

Microsoft last week unveiled several updates to their Copilot suite of products, including new Copilot AI assistants for Microsoft PCs that stole the spotlight. For this week’s Use Case Corner, we looked more closely at two Copilots from Microsoft and one in-house tool being piloted by JPMorgan Chase.

#1 Coding

Use Case: Github Copilot for Engineers

Vendor: Microsoft/Github

Banks: At least nine Evident AI Index banks are experimenting with the tool or have put it into production, according to media reports and company press-releases

How it works. Code generators like Github Copilot are a ChatGPT-like assistant that can be prompted to create new lines of code for a particular programming task. Here’s a demo.

Promise: Improved coder productivity, accelerated learning for early career coders, reduced error rate, more efficiency (with more code written in less time).

Reality: There are issues around data security, inaccuracy and licensing concerns (although being addressed), which may explain why we hear anecdotally that uptake is low on the tool. Microsoft is rolling out updates that may convince engineers otherwise.

What the Execs are saying: TD Bank CEO Bharat Masrani, said at last week’s earnings call that “TD is testing GitHub CoPilot…accelerating the pace of software development and empowering TD engineers to focus on more complex work.”

Potential ROI → coding efficiency, speed to market

Reported ROI → engineers “feel” more productive, produce more lines of code

#2 General Productivity

Use Case: Microsoft Copilot

Vendor: Microsoft

Banks: At least five Evident AI Index banks are piloting the tool, according to media reports and company press releases

How it works: Another ChatGPT-like interface, providing LLM powered support in Microsofts’ 365 office software to improve efficiency on everyday tasks such as market research and summarizing documents.

Promise: It’s still being tested. Most banks are in the pilot phase of this Copilot, but Goldman Sachs and HSBC, among others, have shown optimism for how it can be used by sales teams to extract information quicker, or associate level staff to whip up a PowerPoint in minutes.

Reality: The feedback is promising. At CommBank, 86% of early testers at said they wouldn’t go back to working without it…

Potential ROI → efficiency, productivity boost

Reported ROI → n/a

#3 Private Banking Advisor

Use Case: GenAI Copilot for Advisors

Vendor: n/a

Bank: JPMorgan Chase

How it works: The tool is still in early stages, but will provide advisors support on manual tasks around client meetings: prepping material beforehand, sending emails afterwards and even making investment recommendations based on interactions with the customer.

What else we know: At the end of last year, JPMorgan Chase posted a job opening for a Copilot Product Director in its New York office. And now, since March advisors in JPMorgan Chase’s private bank have been piloting a generative AI “Copilot,” building out the bank’s growing generative AI offerings.

How it could help: Anecdotally, advisors have claimed that the piloted tool has saved them a couple of hours a day.

Potential ROI → efficiency, productivity boost

Reported ROI → anecdotally, two hours saved per day

EVIDENT TRIVIA

AND THE QUESTION IS…

Which recent blockbuster features Jennifer Lopez as a Data Analyst?

Last time, we asked “What was the first video game to incorporate artificial intelligence?” There were some close guesses, but the answer to Rhett Edward’s question is Spacewar! (sorry Space Invaders fans). Developed in 1962 by Steve Russell, the game predates the wave of 70s arcade games like Pong.

Email us your answer to this week’s question (no Googling please): [email protected]. The winner gets to run the next trivia round.

CODA

VINCENE CONVERSION

Speaking of responsible AI and banks (see Latest From Evident AI Index section above), few players on the street have as much reason to err on the side of caution than BNY Mellon, the nation’s oldest and the leading custodian bank.

So ears pricked up when CEO Robin Vince recently touted the efficiency gains from AI. He had also been vocal in Davos this January. This counts as a strong vote of confidence from BNY Mellon in AI.

Vince’s AI conversion is important as well because BNY Mellon happens to have what’s AI gold: Tons and tons of data. It’s good to be a clearinghouse, in a data sense. Vince and his predecessor Todd Gibbons laid the foundations with big data infrastructure investments in 2018 and earlier.

Fast-forward to 2024 and the bank is working with Nvidia in a unique partnership that gives them access to a lot of (super) compute power and platforms to expand and scale up use cases from their data treasure trove. Having Nvidia on board will also attract GPU hungry talent to fill the AI Hub they announced last year—a central unit that applies the technology to solve specific problems for different business teams, but also makes the rest of the organization able to tap into its capabilities.

In short, BNY Mellon’s main play here is to generate value from its “world class” financial dataset (in Vince’s words). But we wouldn’t want anyone to think Vince is irrationally exuberant. He dishes out AI realism, saying the bank will be careful to put in strong guardrails. He isn’t promising returns soon either: On their last earnings call, he warned analysts not to expect the investment in AI to pay off before 2026.

COMING UP

Thurs 30 May

RBC Q2 Earnings Call

Thurs 30 May

CIBC Q2 Earnings Call

Tues 4 June - Thurs 6 June

Money20/20 Europe, Amsterdam

Weds 5 June - Thurs 6 June

Commercialising Quantum Global 2024, London

Thurs 6 June

WSJ Tech Live, Cybersecurity, New York

Mon 10 June - Weds 12 June

London Tech Week, London

Mon 10 June - Thurs 13 June

Databricks Data + AI Summit, San Francisco

Mon 10 June - Fri 14 June

Apple WWDC, San Francisco

Mon 10 June - Fri 14 June

London Fintech Week, London

Tuesday 11 June

FTLive: The Impact of GenAI on the Legal Sector, Virtual

Weds 12 June

Morgan Stanley US Financials, Payments and CRE Conference, New York

Weds 19 June

Evident AI Symposium, London

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]