DATA-DRIVEN INSIGHTS AND NEWS

ON HOW BANKS ARE ADOPTING AI

What Trump means for AI and banks

Source: Adobe Firefly

23 January 2025

What a week. A disruptive president returned to Washington. Now let us introduce you to the regulators and policymakers who’ll set Trump’s agenda on banking and AI. Lots of great conversations took place in Davos. Alexandra is there to share her insights. There’s tons to discuss from bank earnings season (here’s looking at you, David Solomon).

Before we get to those main events, a toast. Two years ago – Jan. 26, 2023 to be precise – we launched the Evident AI Index. In that time, much has changed. The Index grew from 23 to 50 banks. AI staff at the banks we track doubled. They’ve produced over a thousand AI-specific research papers and filed twice as many patents. All of them talk about AI now in their press releases and annual reports. So, tchin tchin.

The Brief is 2,615 words, an 8 minute read. If it was forwarded to you, please subscribe. You can read this Brief online here. Find out more about our membership offers here.

We always want to hear from you: [email protected].

— Alexandra Mousavizadeh & Annabel Ayles

TOP OF THE NEWS

TRUST ME, THE AI SPEND IS WORTH IT

TODAYS BRIEF

A week into their buffo results season (see chart below), the big banks haven’t revealed a lot about their AI plans. JPMorganChase, usually among the most AI loquacious, didn’t mention AI or machine learning even once in their earnings call. Robin Vince did so only in the context of BNY’s $3.8 billion overall tech budget. Citi’s Jane Fraser cited the deployment of some Gen AI tools.

But there was a moment involving Goldman Sachs’s David Solomon that may suggest why banks are reticent.

Asked by RBC Capital Markets’s Gerard Cassidy if and when Goldman Sachs would be able to report an exact percentage of earnings that were favorably impacted by ongoing AI implementation, Solomon shot back: “Can we get to a point where you can say it's affected by this percent? I don't necessarily think that's the way to think about it. We're going to continue to use technology to make the firm more productive. We're going to continue to scale and create automation of platforms that allow us to deploy resources to other places that will allow us to serve our clients better and grow our franchise.”

The emphasis is ours, and to us that sounded like: let our results speak for themselves, and don’t press us for details on ROI on AI.

Having spent the past two years looking closely at bank AI strategies, we think Solomon is both right and wrong. Yes, financial results are ultimately what matter. Yes, AI – at some point – will be so pervasive that it will become business as usual. And yes, you shouldn’t not invest in emerging technologies because you can’t yet quantify the benefits to the business.

But as AI spend ramps up, measuring ROI is going to be critical. Both to assess progress and justify the business case internally, but also to answer the ever-intensifying questions from equity research analysts.

Banks can measure it. Over half we track report ROI in some way and six put a specific number on it. Whether bank chiefs chose to follow JPMC, DBS, Intesa Sanpaolo, SocGen and BNP Paribas in disclosing these figures remains to be seen.

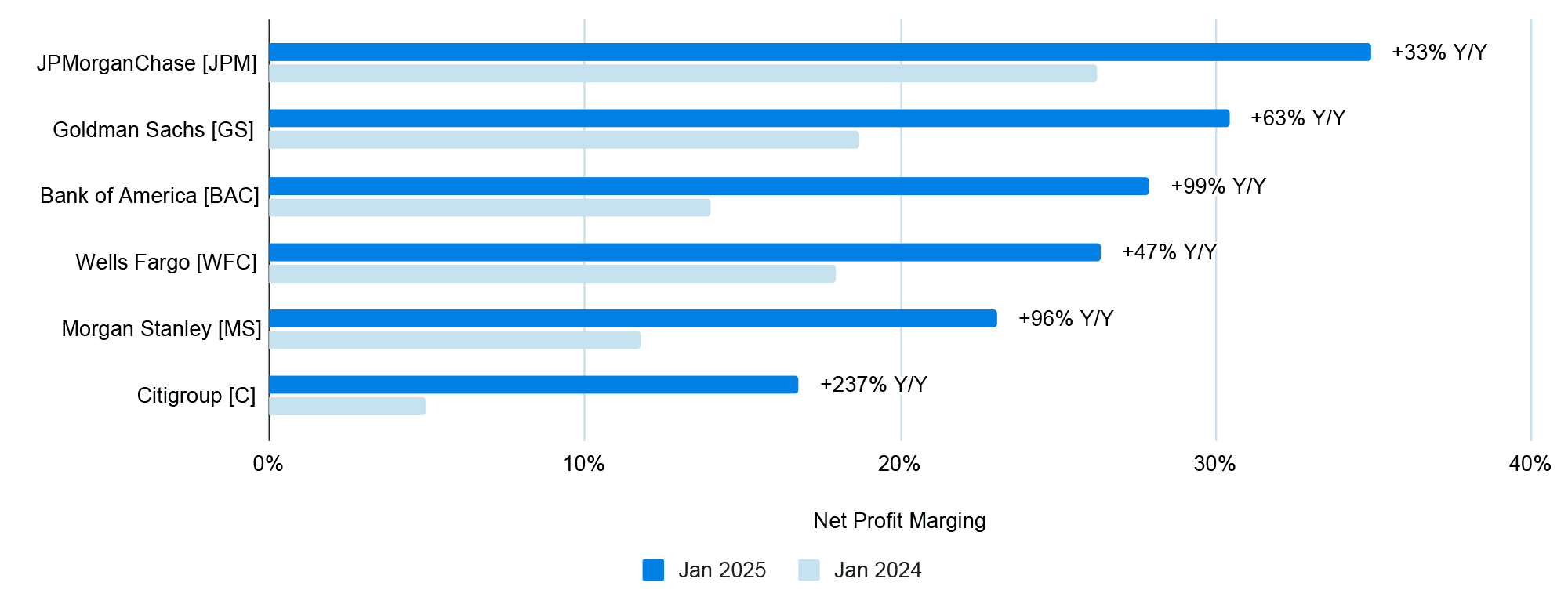

Fat and Happy

Net profit margins for select banks, Q4 in 2024 compared to Q4 2023

DAVOS DIARY

WAITING FOR DONALD

Our own Alexandra Mousavizadeh braved the icy sidewalks, Glögg hangovers and seemingly infinite number of AI-related panels to share a daily dispatch from 1,560 meters up at the World Economic Forum this week in Davos.

MONDAY

What drove the news?

Following on the heels of WEF’s Future of Jobs Report, Accenture’s provocative C-suite survey said that 60% of execs expect Gen AI solutions to be adopted at scale within their organizations in 2025, up from 36% in 2024. Potential stumbling blocks include: “lack of clarity on ROI.” #shocker #not

What left the biggest impression?

As the advertising takeovers on Davos Promenade show, AI carries a lot less political baggage than before. Is it good? Is it bad? For people? For society? For the planet? No one here cares. AI is just a fact of life now. Everyone is hunkered down figuring out the most efficient path forward, if still debating where AI generates ROI sooner rather than later.

TUESDAY

What drove the news?

Chinese Vice-Premier Ding Xuexiang, pleading for responsible global governance of AI, called the competition between world powers over AI a “grey rhino” – a high probability, high impact event.

What left the biggest impression?

Those warnings from the Chinese notwithstanding, the general pessimism and outright doomerism around AI that felt so omnipresent last year has lifted. Ironically, greater familiarity with where LLMs demonstrate promise – and more importantly, where they utterly fail – has given people some reassurance that they have time to figure out how to identify, prioritize, and defend against future risks.

WEDNESDAY

What drove the news?

A rock-star panel of AI experts convened to discuss the “Dawn of AGI.” Definitely worth a watch. Ultimately, the only consensus was a lack of consensus. Precisely when we hit this watershed moment depends on our competing definitions of AGI.

What left the biggest impression?

Meta and NYU’s AI guru Yann LeCun thinks we’re at least five years out from “true” AGI. It’s not about where machines match performance with humans. It’s about how machines can solve problems in a vacuum.

THURSDAY

What’ll drive the news?

President Trump’s virtual address is this afternoon. Expect a victory lap on the size and scale of Project Stargate. Look for signals on what MAGA might mean for AI innovation, investment, and infrastructure. (More on who’s who in Trump’s AI and banking world, see next item below.)

What leaves the biggest impression?

For the first 48 hours here, Trump was conspicuously absent from the AI agenda. Then came Tuesday’s huge “Stargate” initiative from OpenAI, Oracle and SoftBank. Davosmen and Davoswomen took notice of the push but remain pessimistic the U.S. can make up for years of stalled investment in energy infrastructure to support energy-guzzling data farms.

NOTABLY QUOTABLE

“A very strong version of [agentic] capabilities will come this year, possibly in the first half of the year”

– Dario Amodei, CEO of Anthropic, speaking to Joanna Stern on Jan 21

PERSONNEL IS POLICY

BANKERS, MEET YOUR NEW REGULATORS

President Trump came out of the gates fast on AI, repealing Joe Biden’s executive order and announcing that $500 billion infrastructure funding push. But for banks and their AI strategies, the most important moves from the new president are the personnel that will make the policies and rules that govern their lives.

Here’s our guide to the people in the White House and across Washington in the most important jobs (Key: 🔴 is rumored, 🟡 acting or proposed, 🟢 confirmed or in place.)

The AI Advisors🟢 White House AI and Crypto Czar: Venture capitalist, PayPal Mafia fixture and China hawk David Sacks

Quick take: A “pro-innovation, pro-startup approach” with respect to regulation and “support for open-source AI projects,” speaks loudly and often, seen more as an investor than big thinker.

Expectation: To align with Elon Musk, push AI innovation with fewer restraints and press fight with China over tech.

🟡 Office of Science and Technology Policy: Trump’s former CTO Michael Kratsios

Quick take: Measured, cerebral, instrumental in drafting Trump’s AI executive order in December 2020, which formalized how federal agencies now inventory and report their AI use cases.

Expectation: To focus on the technology policy side of his role, following through on his calls to have science agencies play a role in evaluating LLMs and in securing global AI leadership.

🟢 Senior Policy Advisor for AI: Andreessen Horowitz VC Sriram Krishnan

Quick take: Crafty and confident, was close to Elon Musk during Twitter takeover. Wants a decentralized internet.

Expectation: To collaborate with Sacks on developing AI policy and be strong voice in favor of legal immigration to keep AI talent coming to America.

🟢 President’s Council of Advisors on Science and Technology: former deputy CTO Lynne Parker

Quick take: Serious, academic, with strong tech background. Pushed for improving AI use case inventories while leading AI initiatives during Trump’s first term. Criticized Biden administration over implementation of regulatory principles she and Kratsios worked on.

Expectation: To coordinate with Kratsios and Sacks on beefing up use case inventories and to push for for industry voices to be at the table in AI regulation talks.

The Regulators🟡 Federal Deposit Insurance Corporation: FDIC veteran since 2018 Travis Hill

Quick take: Wants the FDIC to stay out banks’ business where it doesn’t affect risk or solvency, thinks regulators make it too difficult for banks to adopt new technology.

Expectation: To put out more and clearer guidance on AI and bank-fintech partnerships that will allow banks to “evolve with the times.”

🟡 Commodity Futures Trading Commission (CFTC): Citigroup alum and CFTC junior commissioner Caroline Pham

Quick take: Worked on AI governance and risk controls at Citi, made AI a focus at the CFTC. Says risks of using AI for trading and markets are “very similar to the use of algorithmic trading.”

Expectation: To double down on “regulatory sandboxes” to allow companies to quickly test new products under close supervision. As acting head, she may be made permanent, but fellow CFTC commissioner Summer Mersinger and a16z’s Brian Quintenz are still being floated.

🔴 Consumer Financial Protection Bureau: Biden-appointed FTC commissioner Melissa Holyoak

Quick take: Pushed FTC to look at data privacy issues arising from AI products that interact with children, but characterized some Biden-era enforcement as overreach.

Expectation: To navigate calls by Musk and others to “delete” the agency altogether. To bring a softer touch on Big Tech.

🟡 National Credit Union Administration (NCUA): Former Lehman bond trader, GOP political operative, and NCUA vice chair Kyle Hauptman

Quick take: Championed AI adoption at the agency for fraud detection, discussion boards, a customer service chatbot, and scanning Call Reports. Bemoaned agency’s “technophobic” tendencies. Pushed back on concerns about bias in lending models, saying the test of AI is its ability to outperform human bias.

Expectation: To press for more AI use cases in lending assistance and back office automation.

🟡 U.S. Securities and Exchange Commission: Crypto lobbyist and former SEC commissioner Paul Atkins

Quick take: Anointed “the anti-Gary Gensler” by the Wall Street Journal, in reference to Biden’s chief.

Expectation: Crypto will be front and center, but Atkins’ approach to AI oversight (and climate, ESG, etc.) will, by extension, also be more laissez faire and industry-friendly.

🟢 Federal Trade Commission: Biden-appointed commissioner Andrew Ferguson

Quick take: “Pro-regulation side of the AI debate raging across academia, industry, and government,” he says, is “the wrong one.”

Expectation: To roll back AI regulations which “only squelch innovation, further entrench Big Tech incumbents, and ensure that AI innovators move to jurisdictions friendlier to them — but perhaps hostile to the United States."

USE CASE CORNER

BYE-BYE (SOME) GRUNT WORK

In this week’s Use Case Corner, we look at the three most interesting tools banks released in the new year.

#1 AI-Powered Paralegals

Use Case: Legal Advisory GPT

Vendor: OpenAI

Bank: BBVA

Why it’s interesting: BBVA’s nine-person legal advisory team uses a customized GPT to answer more than 40,000 customer questions annually. The GPT searches all of the firm's consultation documents to improve the quality of the first response and cut response times to within 24 hours.

Potential ROI → Faster legal query response times and enhanced operational efficiency.

Reported ROI → Specific figures are not disclosed, but BBVA reports significant improvements in productivity and efficiency across departments utilizing ChatGPT.

#2 Double AI Whammy for Employee Productivity

Use Case: Citi Stylus + Citi Assist

Vendor: n/a

Bank: Citigroup

Why it’s interesting: Citi Assist copilot helps employees navigate internal policies and procedures across HR, risk, compliance and finance departments, among others. Citi Stylus summarizes documents and offers search across multiple documents simultaneously, making it easier to compare what's inside.

Potential ROI → Enhanced employee efficiency, improved document management.

Reported ROI → n/a

#3 Gen AI-Supported IPO Prospectuses

Use Case: SEC Document Generator

Vendor: N/A

Bank: Goldman Sachs

Why it’s interesting: The bank can now leverage Gen AI to write 95% of an IPO prospectus, a task that CEO David Solomon said previously took a team of six bankers two weeks to complete. The tool frees front office bankers up to spend more time engaging clients.

Potential ROI → Faster turnaround on IPO filings; efficiency gains from manual task cost reduction, increased revenue from advisory services

Reported ROI → Goldman Sachs did not disclose specific metrics; however, we expect that the tool will likely translate into efficiency gains for the bank as it reduces the costs of manual tasks performed by highly paid staff.

Have feedback on or ideas about use cases? Let us know at [email protected].

SPEED READS

FIVE THINGS THAT CAUGHT OUR EYE

Chinese AI lab Deepseek’s new R1 model matches OpenAI’s o1, but is 30x cheaper and freely downloadable. Deepseek also released an R1-tuned version of Meta’s Llama, which outperforms the original. Taken with other releases by Alibaba and Tencent, Chinese labs are now arguably leading on open-source AI. Why? American restrictions on chip transfers seem to have forced Chinese labs to innovate with limited compute, leading to more efficient models than Western counterparts.

Google Titans can give the next generation of models long-term memory that functions like the human brain. The new architecture uses the concept of surprise to determine what should and shouldn’t feed into the historical context it retains, offering an improvement on the limited context windows transformer models can suffer from.

A new agentic AI report from Citi lays out an array of use cases. Among them: Agentic contracts that execute the terms of a deal in the post-signature phase or monitor the regulatory environment in an ongoing fashion and flag compliance issues and AI agents focused on hyper-personalization of customer interactions.

US Bank scoured the Consumer Electronics Show for agentic AI solutions, CIO Don Relyea said. APAC banks, like Industrial Bank of Korea and “some Chinese banks” seemed to be demoing the most interesting applications – from agents that did predictive analysis on your venture portfolio to virtual bank tellers.

Goldman Sachs says about 10,000 workers now have access to GS AI assistant, a tool built on the back of ChatGPT, Gemini and Llama to complete tasks like summarizing and proofreading emails or translating code to another language. CIO Marco Argenti hinted at “agentic behavior” being the next phase of its development, where it can act like a Goldman employee instead of just thinking like one.

TALENT MATTERS

BNP TAPS NOMADS

CommBank wants people to lead the company’s AI audits. It’s a trend: leading banks are staffing or skilling up to develop group-wide assurance and oversight initiatives that monitor how AI risk is managed.

BNP advertised multiple AI roles in Lisbon, the Portuguese capital so beloved by global nomads, continuing to grow out its 200-strong AI talent base in the country. Roles include Senior LLM Developer and Quant Research AI.

Any noteworthy people moves you know about? Share them with us at [email protected].

WHAT’S ON

COMING UP

Mon 27 Jan

AI Regulation Summit, London

Tue 28 - Wed 29 Jan

Data & Analytics Live, Online

Mon 5 - Tues 6 Feb

TechEx Global, London

Mon 20 Feb

Japan Banking Innovation Conference, Tokyo

Wed 26 Feb

Middle East Banking AI & Analytics Summit, Dubai

Wed 26 - Thu 27 Feb

CDAO Financial Services, New York

THE BRIEF TEAM

- Alexandra Mousavizadeh|Co-founder & CEO|[email protected]

- Annabel Ayles|Co-founder & co-CEO|[email protected]

- Colin Gilbert|VP, Intelligence|[email protected]

- Andrew Haynes|VP, Innovation|[email protected]

- Alex Inch|Data Scientist|[email protected]

- Matthew Kaminski|Senior Advisor|[email protected]

- Kevin McAllister|Senior Editor|[email protected]

- Sam Meeson|AI Research Analyst|[email protected]